Silver Price Rockets to Multi-Year Highs, Targets $169

Commodities / Gold & Silver 2020 Aug 19, 2020 - 03:40 PM GMTBy: Jason_Hamlin

After nearly 7 years of consolidation and mostly sideways trading, the silver price is finally experiencing a powerful breakout. It did not take long after breaking above the psychologically-important $20 level for silver to climb another nearly 50% toward $30 per ounce.

The silver price has since corrected by 11% to the current price of $26.40, but remains up more than 45% in three weeks. Remarkably, silver is now up more than 125% from the March lows and we see significantly more upside ahead.

How High Can the Silver Price Climb?

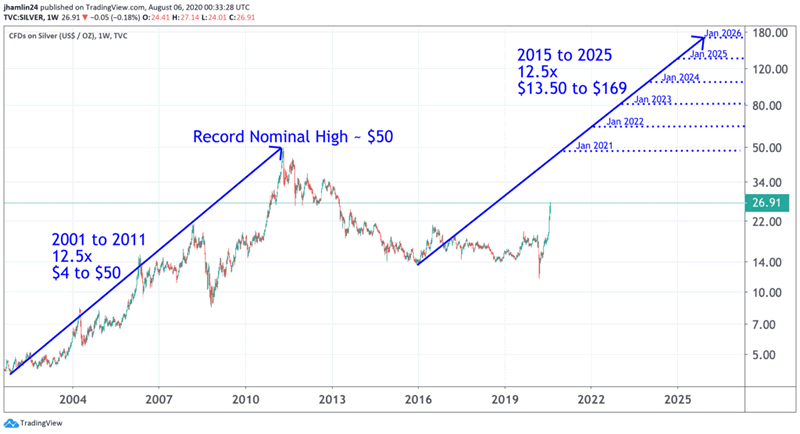

The last major bull cycle propelled the silver price 12.5x higher from lows around $4 to roughly $50 per ounce. If we use the late 2015 bottom as a starting point and project the same magnitude of gain, silver is forecast to hit $169 by the end of 2025.

We forecast the silver price will climb toward $50 by the start of 2021, $80 by the start of 2023 and climb above $100 by January of 2024 en route to a new inflation-adjusted high above $169 by the start of 2026.

This is based on an analysis of past silver bull markets. But these estimates may prove too conservative. Silver is liked a coiled spring that has been held down for nearly a decade and is finally set free to rise. Some analysts believe JP Morgan, historically one of the largest paper shorts in the silver market, may have finally exited this trade and stepped aside.

But the larger driver of silver’s gains is no doubt the trillions in new money (debt) created by central banks in the past four months. Globally the estimated stimulus thrown at keeping markets afloat during the pandemic is approaching $10 trillion. This is an unprecedented amount that is multiples of the stimulus efforts put in place following the financial crisis of 2008/09.

The staggering thing is that our central bank saviors are just getting started, with a second multi-trillion stimulus effort underway in the United States and EU leaders striking a $2 trillion deal to rebuild Europe’s economy.

Here is an incredible statistic to put the magnitude of current debasement in perspective: The United States printed more money in June than in the first two centuries after its founding. Let that sink in.

And yet an estimated 27% of adults in the U.S. missed their rent or mortgage payment for July. This number will only get worse in August and the FED has committed to doing ‘whatever it takes’ to avoid a deflationary tailspin.

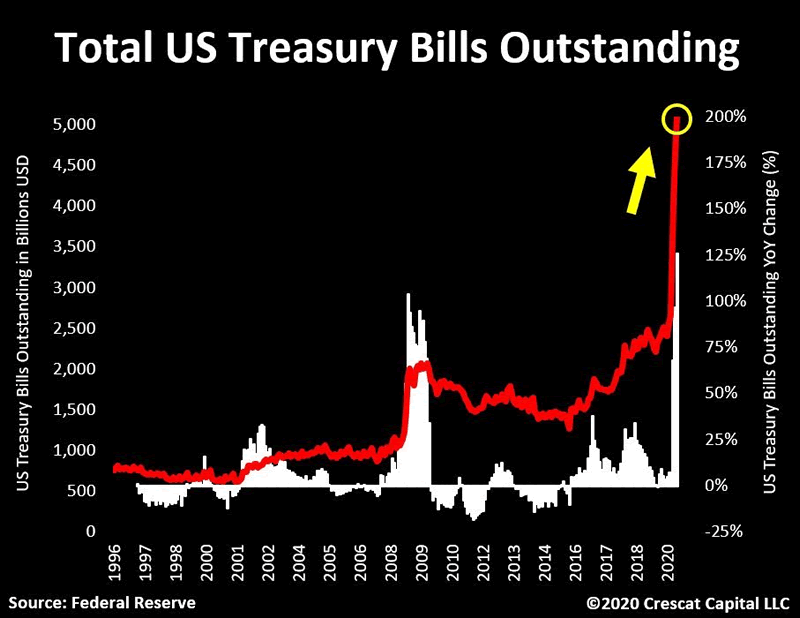

So, there is no end in sight for the currency debasement that is taking place. Compounding matters, 71% of the government debt issued this past year matures in less than 12 months and the amount of Treasury Bills outstanding shot up to $5 trillion recently.

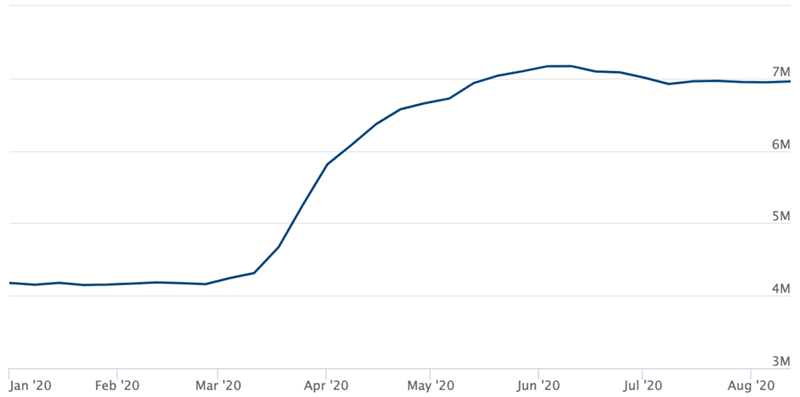

The FED balance sheet is exploding higher and has nearly doubled from around $4 trillion prior to the pandemic to over $7 trillion today. It has taken a breather after the huge move in April/May, but is set for another leg higher over the next few months.

Even if the scientific community were to find a miracle cure for Covid-19 that allows economies to re-open fully, the damage (to fiat currencies) will have already been done.

It is therefore no surprise that Fitch Ratings revised the United States Credit Outlook To “Negative.” And we’ve seen that U.S. consumer prices rose more than expected in July, with a measure of underlying inflation increasing by the most in 29-1/2 years amid broad gains in the costs of goods and services.

Yes, velocity of money has declined, but we believe central banks will have a harder time keeping inflation in check this time around. More of the new money created is directed at small businesses and consumers to maintain jobs, as opposed to financial crisis funds going directly to banks that used the money to shore up their balance sheets.

At any rate, we believe that a new bull cycle in precious metals has just begun. We recently predicted that gold would climb above $6,000 per ounce during this same bull cycle that takes silver toward $169/ounce. This would give us a gold-to-silver ratio of 36, more in-line with historical numbers and closer to the actual ratio of metals in the earth’s crust.

What is Next for Silver?

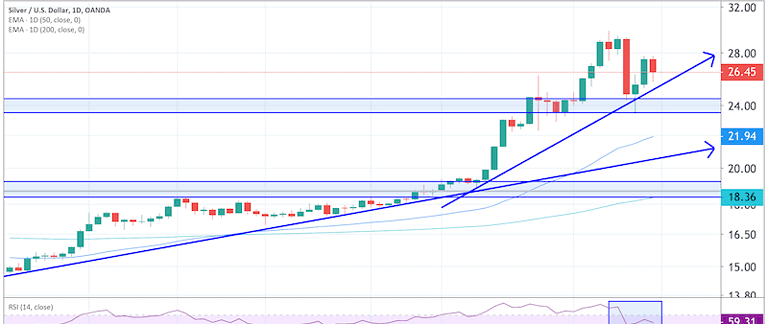

The short-term chart shows the recent pullback to support around $24 and a small bounce. We think there are decent odds of this support holding. But if it fails, the next key support zone is between the trend line at $21 and the 50-day EMA around $22. This $21-$22 zone is stronger technical support for silver with a high likelihood of holding.

It is also worth noting that the RSI momentum indicator has dropped from overbought levels around 88 to neutral levels around 59 currently. This resets the bull cycle for another potential leg up before becoming overbought again. Of course, there is the potential for a deeper drop in the RSI to oversold levels at or below 30. But during breakout bull cycles fueled by record levels of money printing, we can expect short corrections with the RSI never hitting oversold levels.

Silver Miners – Where is the Leverage?

Silver is up 47% YTD, outperforming the Global X Silver Miners ETF (SIL), which is up 42%. So, where is the leverage?

A handful of junior silver explorers have generated incredible leverage to the price advance in silver in 2020. We hold three silver stocks in the GSB portfolio that are up 226%, 202% and 157% year to date!

But not all junior silver explorers have generated triple-digit returns this year or have managed to outpace silver. Several of these companies that we track have been trending alongside silver without offering leveraged returns yet. But they have near-term catalysts that we believe will propel them to powerfully-leveraged returns over the next 6 to 12 months. Among them are two of the highest-grade silver mines in the world about to move into production.

Researching and identifying undervalued junior mining stocks is a key area of focus for the Gold Stock Bull newsletter. If you would like to receive our investment research, model portfolio, trade alerts and more, you can get started by clicking here.

We also offer a new chat room with daily news, charts, trade ideas and discussions as part of our all-access Mastermind Membership.

By Jason Hamlin

Jason Hamlin is the founder of Gold Stock Bull and publishes a monthly contrarian newsletter that contains in-depth research into the markets with a focus on finding undervalued gold and silver mining companies. The Premium Membership includes the newsletter, real-time access to the model portfolio and email trade alerts whenever Jason is buying or selling.

Copyright © 2020 Gold Stock Bull - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.