Trump or Biden - USA is Still Going Bananas

Stock-Markets / Financial Markets 2020 Nov 06, 2020 - 04:42 PM GMTBy: Gary_Tanashian

You see, it’s not a Trump thing. It’s an ‘America is so hopelessly indebted (as are other developed economies) that they have no choice now’ thing.

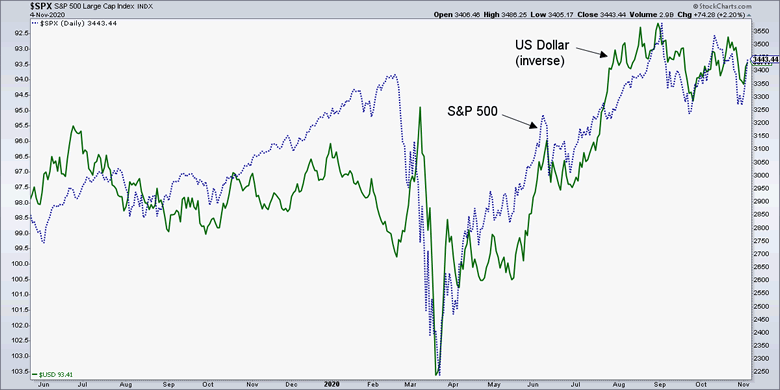

However the election shakes out – most likely Democrat president and congress, Republican senate – the stock market is cheering two things in my opinion. It is cheering US dollar compromising fiscal stimulus (Fed prints, politicians spend) and the coming of more US dollar compromising monetary policy (Fed prints, Fed monetizes bonds AKA debt, Fed screws with any other esoteric tool it can get its hands on in the age of MMT TMM, AKA Total Market Manipulation).

I have a still profitable position against the Euro that is about to tick un-profitable this morning. That was my hedge against a firming US dollar, which is the anti-market to the US stock market especially, but also to many global markets, because I am long US and global stocks. I may have to pull back to hedging stocks (including gold stocks) with high cash levels. So says the ongoing inflationary operation.

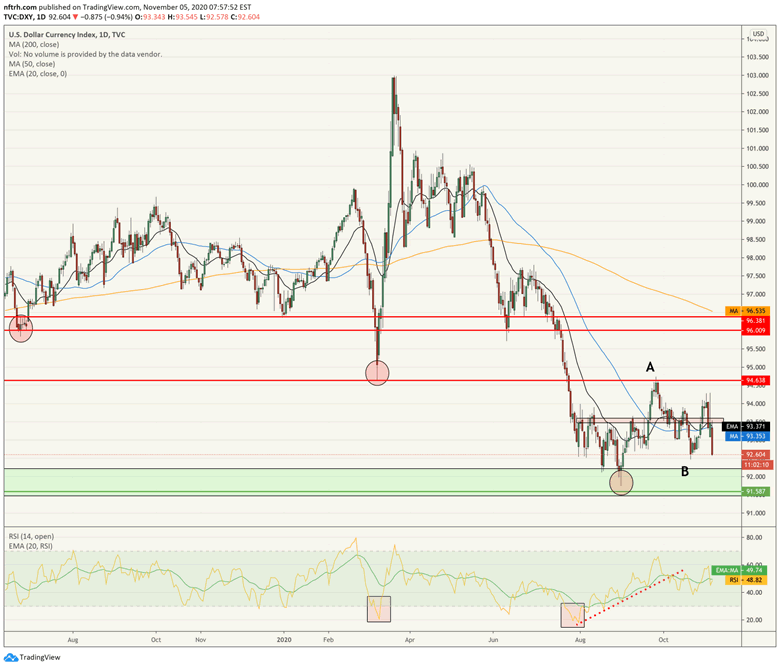

I had projected an A-B-C bear market bounce in Uncle Buck, just to keep the macro honest and put a spook into market bulls. But it appears – due to the joy breaking out everywhere – that I will have been wrong about ‘C’. That’s what this breakdown below support (now short-term resistance) says, anyway.

We are going bananas not because Trump is/was just another politician when it comes to the modern American tradition of debt-leveraged inflation to disenfranchise the middle and poor and enrich the already spectacularly wealthy. We are going bananas because that’s the only path out of this mess that people in power who want to stay in power will choose. Always.

They will choose inflation by currency devaluation because it is a neat macro parlor trick that will boost certain desirable asset prices to the degree that the average person will think they are doing the right thing. After all, running a true savings/investment-based economy featuring Larry Kudlow’s mythical “King Dollar” would crash the S&P 500, for one.

Now, the Republican senate will probably stand in the way of some of the Democrats’ plans, like the Green New Deal when that pork wagon tries to roll into town. But they will not stand in the way of the ongoing and massive bailout stimulus aimed straight at the US dollar going one way and enriched asset owners going the other.

There may be some volatility here in the next few weeks and a market correction could still come about (unfortunately, the unpredictability of Trump’s tantrums will probably drive that, not some guy’s charts) but when it all shakes out and if it shakes out as currently indicated politically, America will still be going bananas because it’s the same tired old game plan Trump was using (even before the Pandemic, as the economy was slowly decelerating and the yield curve steepening in mid-late 2019).

Sit back, relax, have a banana (smoothy, daiquiri, with your corn flakes or straight up). There are only two ways this story can ultimately end. Either a deflationary whirlpool or ole’ von Mises’ Crack-up-Boom.

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas, all archived/posted at the site and delivered to your inbox.

You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar and get even more by joining our free eLetter. Or follow via Twitter ;@BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2020 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.