US Bond Market: "When Investors Should Worry"

Interest-Rates / US Bonds Nov 18, 2020 - 04:30 PM GMTBy: EWI

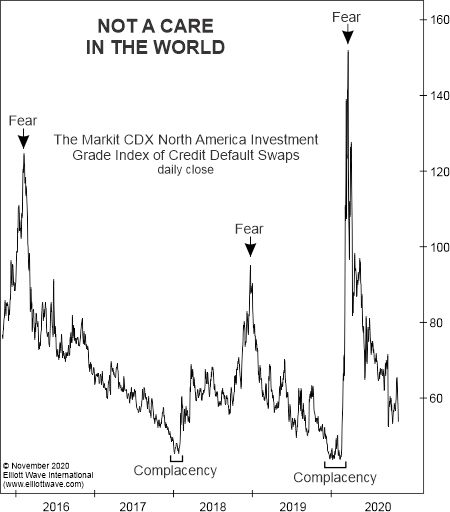

The cost of insuring against default has been declining – what this may suggest

You may recall hearing a lot about “credit default swaps” during the 2007-2009 financial crisis.

As a reminder, a CDS is similar to an insurance contract, providing a bond investor with protection against a default.

In the past several months, the cost of that protection has fallen dramatically.

The November Elliott Wave Financial Forecast, a monthly publication which provides analysis of major U.S. financial markets, showed this chart and said:

The Markit CDX North American Investment Grade Index comprises 125 equally weighted credit default swaps on investment grade debts. It shows the cost of insuring against default on high grade bonds issued by the most liquid companies. When the index is low, as it was in January 2018 and January and February 2020, the cost of insuring against default is low, because investors view the nonpayment of debt obligations as most improbable. Ironically, this is when investors should worry. Each time the stock market fell, the Markit index surged. The index has subsequently declined toward the lower end of its historic range, indicating complacency yet again.

This complacency toward default risk is occurring just as corporate bankruptcy filings are surging. As a matter of fact, the third quarter of 2020 was the worst quarter on record for U.S. bankruptcy filings.

Take a look at this Oct. 26 news item from Bloomberg:

Bond Defaults Deliver 99% Losses in New Era of U.S. Bankruptcies

Desperate to generate higher returns during a decade of rock-bottom rates, money managers bargained away legal protections, accepted ever-widening loopholes, and turned a blind eye to questionable earning projections. Corporations took full advantage and gorged on astronomical amounts of debt that many now cannot repay or refinance.

Now, keep in mind that all these bankruptcy proceedings – where many creditors are walking away with just pennies – are occurring during a time of historically low interest rates.

Imagine what will happen should rates begin to rise. It will become increasingly difficult for corporations to borrow at low rates AND service the huge amount of outstanding debt.

Let’s return to the November Elliott Wave Financial Forecast:

Increasing bankruptcies, debt restructurings and defaults are deflationary.

Are you prepared for a historic deflation?

Learn what you need to know to keep you and your family financially safe by reading the free report, “What You Need to Know Now About Protecting Yourself from Deflation.” Here’s a quote:

Many investment advisors speak as if making money by investing is easy. It's not. What's easy is losing money, which is exactly what most investors do. They might make money for a while, but they lose eventually. Just keeping what you have over a lifetime of investing can be an achievement. ...

Protecting your liquid wealth against a deflationary crash and depression is pretty easy once you know what to do.

Find out how to protect your wealth during a deflationary crash.

Get started by following this link: “"What You Need to Know Now About Protecting Yourself from Deflation.” – free access.

This article was syndicated by Elliott Wave International and was originally published under the headline Bond Market: "When Investors Should Worry". EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.