How Will Gold Perform This Winter?

Commodities / Gold & Silver 2020 Dec 15, 2020 - 05:25 PM GMTBy: Arkadiusz_Sieron

Brace yourselves, winter is coming! It may be a harsh period for the United States, but much better for gold.

Brace yourselves, winter is coming! It may be a harsh period for the United States, but much better for gold.

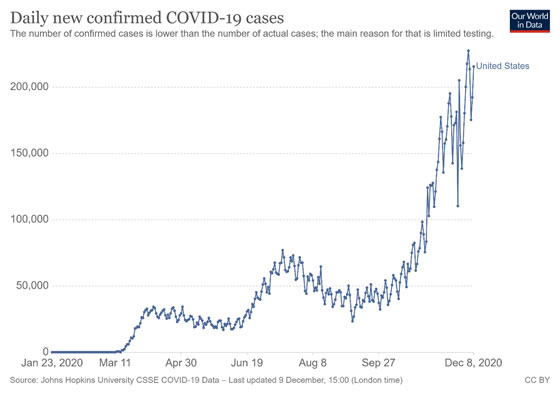

Some of you may have seen snow this year already, but the astronomical winter is still ahead of us. Unfortunately, it could be a really dark winter. Instead of joyful snowball battles and making snowmen, we will have to contend with the coronavirus . The vaccines will definitely help (the first doses of Pfizer’s vaccine were administered this week), but their widespread distribution will begin only next year. So, we still have to deal with the pandemic taking its toll here and now – as the chart below shows, the number of daily COVID-19 cases is still above 200,000 in the U.S.

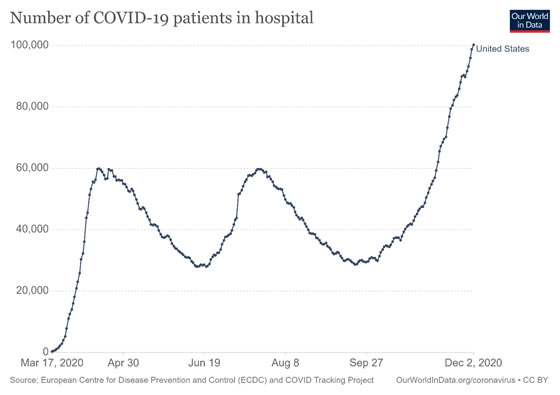

The increasing cases are one thing, but the soaring numbers of COVID-19-related hospitalizations is another, even more terrifying, issue. As one can see in the chart below, the number of patients in U.S. hospitals has reached a record of 100,000, due to a surge in the aftermath of Thanksgiving.

Importantly, the situation may get even worse , as people spend more time indoors in winter, and large family gatherings during Christmas and Hanukkah are still ahead us…

I know that you are fed up with the date about the epidemic . And I don’t write about the pandemic because I’ve become an epidemiologist or want to scary you; for that all you need to do is read the press headlines or watch TV for a while. I cover the pandemic because it still impacts the global economy, and in particular, it explains why the U.S. economic growth is slowing down.

You see, in the summer and autumn of 2020, America’s economy roared back. But that might be a song of the past. As I wrote in Tuesday’s (Dec 8) edition of the Fundamental Gold Report , November’s employment situation report was disappointingly weak, and the high frequency data also point to a slowdown. For example, the number of diners and restaurants, as well as hotel and airline bookings, have declined in recent weeks.

So, the increased spread of the coronavirus slows the economy down. A growing share of Americans, even those who were previously skeptical about the epidemiological dangers, worry about catching the virus, thereby reducing their social activity.

However, there are also other factors behind the most recent economic slowdown. First, the previous recovery was caused by a low base and the end of the Great Lockdown . The deep economic crisis seen in the spring, with accompanying coronavirus restrictions, will not happen again. Therefore, the initial recovery was fast, but the pace of economic growth had to slow down. Second, the easy fiscal policy helped to increase the GDP , but Congress has so far failed to agree on another stimulus package.

Implications for Gold

What does it all mean for the yellow metal? Well, the economy could rise again when the vaccines become widely available. However, we will face a harsh winter first. It means that the coming weeks might be positive for gold – especially considering that in recent years, the shiny metal rallied in January (or sometimes even in the second half of December).

But what’s next for gold prices? Will they plunge in 2021 after the rollout of the vaccines? Well, the vaccines are in a sense, a real game changer for the world next year. As they revived the risk appetite, they hit the safe-haven demand for gold. So, yes, there is a downward risk, although it could already be priced in.

However, the vaccines are a game changer only in a sense . You see, the vaccines might protect us from the virus, but they will not solve all our economic problems , therefore, caution is still required. On Monday (Dec 7), the Bank of International Settlements warned the public that “we are moving from the liquidity to the solvency phase of the crisis”.

Actually, the post-winter, post-pandemic environment might be beneficial for gold. You see, gold is a portfolio-diversifier which serves as a safe haven asset during a period of turmoil, but it performs the best during the very early phase of an economic recovery – especially as the central banks will continue the policy of zero interest rates . Thus, the new stimulus package, low real interest rates , worries about the U.S. dollar strength and debt sustainability, and fears of inflation , which will accompany the economic revival in 2021, should support gold prices.

Thank you for reading today’s free analysis. We hope you enjoyed it. If so, we would like to invite you to sign up for our free gold newsletter. Once you sign up, you’ll also get 7-day no-obligation trial of all our premium gold services, including our Gold & Silver Trading Alerts. Sign up today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.