You Should Never Trade Options If You Don’t Know This…

InvestorEducation / Options & Warrants May 31, 2021 - 11:35 AM GMTBy: Chris_Vermeulen

Have you ever heard someone say “90% of people that trade options lose money.”? I certainly have. Looking at an options chain can be a dizzying exercise for the uninformed. Delta, Gamma, Theta, Rho, Vega – and let’s not forget – implied volatility? Single, spread, butterfly, condor. What does it all mean?

So what is an option from a high level view?

At the end of the day, an options contract is just a derivative like any other stock, bond, ETF, or other tradable security based on an underlying asset. Most people will look at these other forms of derivatives and have an understanding of why the price fluctuates. For example, if a company posts a strong earnings report and the price of the stock goes up, it is easy to understand what is going on. In the case of options contracts, however, things do get a bit more complicated. Let’s break things down a little bit to start to get an idea of why many investors are afraid to trade options.

Simple and Straight Forward Options Basics

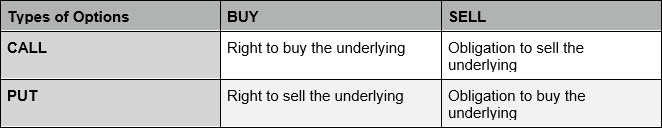

There are two forms of options contracts, Puts and Calls, and two things you can do with each type. For each of these, I can either buy or sell them. Buying a call option gives me the right to buy the underlying security at an agreed price or “strike” price. Selling a call option gives me the obligation to sell the underlying security at the strike price. On the other hand, buying a put option gives me the right to sell a stock at the strike price, while selling a put option obligates me to buy a stock at the strike price. Here is a diagram:

Seems simple enough right? In fact, if you think about it, it might seem similar to your car insurance. You give your insurance company premiums every month, and they are obligated to cover you in the event of damage to your car. So in many ways, you are correct, it is like insurance. The price of an option is even called the “premium!” As you can imagine, the price of the premium would have a big impact on whether or not you decided to trade it. Taking insurance as an example, why would you want to pay $500 dollars per month to your insurance company if they only cover you up to $1000 in damage? Many beginners don’t understand what is really being exchanged in the options market and how the prices are calculated.

How are options premiums calculated? This is where things get much more complicated and one of the most overlooked factors in options pricing is the current market volatility.

The Price of an Option Explained

In simple terms, options prices are generally broken out into two different components: intrinsic and time value. These two values combined make up the option premium. The intrinsic value of a call option is calculated as the difference in the current price of the underlying security and the strike price of the option.

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

For example, if I buy a call option with a strike price of 100 when the underlying is 100, the difference between the two numbers is 0, thus the call option has no intrinsic value. If the price of the underlying goes up to 105 dollars, my call option now has 5 dollars of intrinsic value. Put options are reversed – their intrinsic value is the difference between the price of the put option minus the price of the underlying security.

Time value is calculated by taking the price of the option and subtracting the intrinsic value. This will tell you how much the option writer is compensated for taking on the obligation to buy or sell the underlying for the pre-determined amount of time.

The price of an option is typically calculated using a few industry standard models. These models use historical data and many variables to calculate the price of an option including the current stock price, the strike price of the option, the risk-free rate and the option expiration. All of these variables are plugged into the mathematical models such as the Black-Scholes and ultimately a price is calculated. This is typically where people get bogged down by the complexity. Each of these variables can make a big difference in the price of an option, and when looking at an options chain, most people simply don’t have the knowledge to make an educated decision about what sort of trade they should make.

In reality, options can be used in so many different ways. They can be used to hedge, speculate, or make a profit all on their own. Having a basic understanding of the options market can help you enhance your existing positions and allow you to reduce your risk. Or you can trade options as their own individual positions which is what we teach and provide at Options Trading Signals. Once you have a complete understanding of options, the possibilities are endless.

If you are just starting out on trading options and want to learn more about the different strategies, follow me on https://www.thetechnicaltraders.com/ots/ and look out for more articles where we’ll take you step by step through real live options trades with members.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.