Gold Price Reaches 15-Month Flag Apex

Commodities / Gold and Silver 2021 Nov 14, 2021 - 04:00 PM GMTBy: Chris_Vermeulen

Since the start of the COVID-19 virus event, Gold has rallied more than +26% to reach highs near $2090 on August 7, 2020. Yet, over the past 15 months, Gold has been trailing downward in a sideways price pattern. This price rotation has set up a very broad Pennant/Flag formation in Gold that has recently reached the APEX of the Flag setup.

This is very important for two reasons. First, as the global central banks begin to plan and prepare for more normalized monetary policy, and address credit excesses and inflationary price concerns, the advantages of Gold as a hedging instrument become more valuable. Secondarily, after a massive rise in asset prices and an even bigger global attempt to stimulate the economy after the COVID-19 virus event, the world has never been in this scenario. Near-zero interest rates, excessive amounts of money and credit throughout the world, asset prices showing near hyper-inflation trends, and the global central banks taking very little action to address any future economic concerns.

The Luster Of Gold May Be Growing For Global Investors

The luster of Gold over the past 15 months has slightly diminished. Global central banks, corporations, and consumers jumped into the easy money rally and ignored ongoing risks. Now, China’s economic concerns and corporate debt issues continue to plague the global markets. Investors are suddenly waking up to the potential of rising global risks over the past 12+ months – not subsiding.

Recently, China’s economic and credit/debt issues have spilled over into more broad market concerns. What used to be more of a junk-rated debt issue has now transitioned into more of a global concern as China’s demand for cheap credit over the past 8+ years may have created the components of a perfect storm in the making (source: Yahoo! Finance).

I published research articles about this many months ago – which are still relevant.

- April 1, 2020: CONCERNED THAT ASIA COULD BLOW A HOLE IN FUTURE ECONOMIC RECOVERY

- January 24, 2020: THE WUHAN WIPEOUT – COULD IT HAPPEN?

- May 23, 2021: US DOLLAR BREAKS BELOW 90 – CONTINUE TO CONFIRM DEPRECIATION CYCLE PHASE

After reviewing some of my earlier research posts, I urge you to consider a unique situation that may be taking place in the global markets right now. I believe the US markets have transitioned into a new Depreciation Cycle Phase (started near the end of 2019). As the US Dollar continues to try and hold above the $90~$91 level, we may be entering a foreign market economic crisis prompted by US easy money policies over the past 12+ years. If this is the case, then the US stock market and the US Dollar may continue to show strength well into a foreign market collapse – also while Gold and Silver start to move higher.

What Could Happen Next

This type of event will eventually spread into the US markets as concerns mount related to the depth and cross-border economic issues if any economic contagion event continues. Yet my thinking is that initially US assets, and the US Dollar, may rise as global traders/investors move away from global/Asian market risks and pour capital into safer US stocks and the US Dollar. This may prompt a rally phase in the US stock market and push the US Dollar above $95~96 briefly before traders realize the full scale and scope of this potential global crisis in the making.

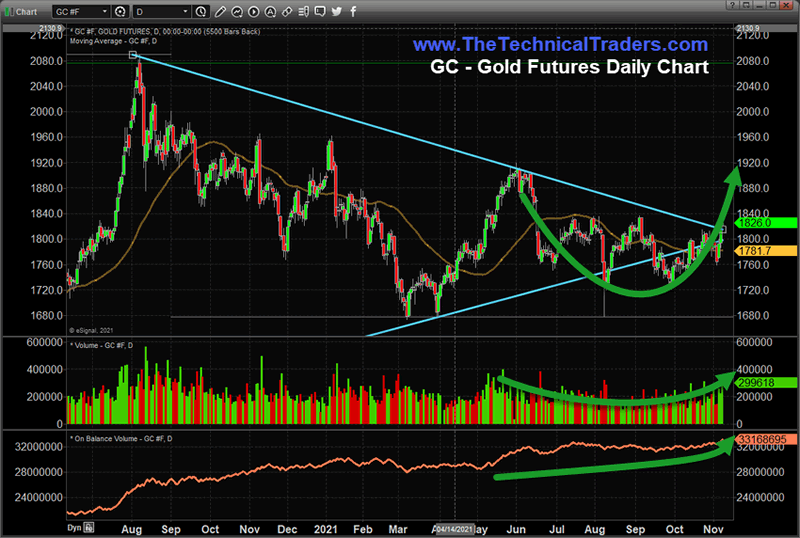

This Daily Gold chart highlights the extended Pennant/Flag price formation and how Gold has started to see increased trading volume in what appears to be an upward price breakout. Still, Gold must break above two key levels before considering this potential rally phase confirmed: $1845 and $1920.

Fibonacci Price Extensions Show $2600 As A Potential Price Target For Gold

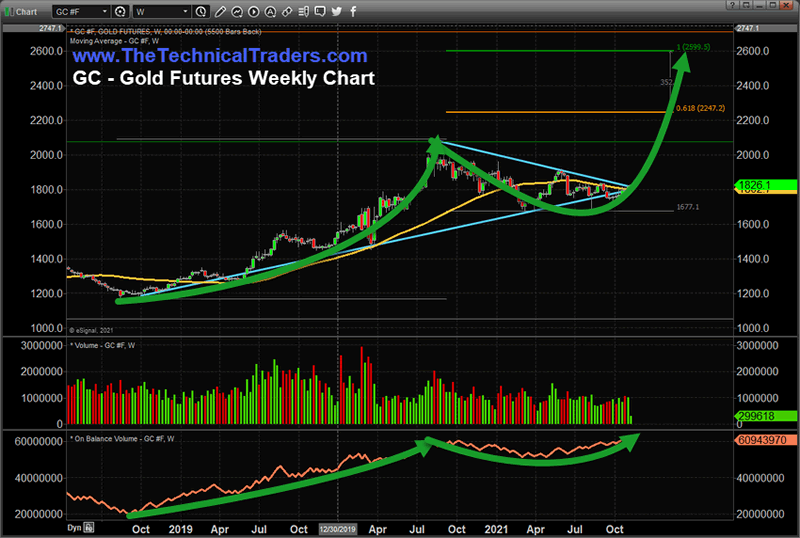

This Weekly Gold chart highlights a longer-term Fibonacci Price Extension pattern. It suggests that $2240 and $2600 are likely to be price targets for Gold if this rally continues. Many traders believe the last 15+ months of sideways trading in Gold has formed a “handle” for a bigger “cup-n-handle” price pattern. Ideally, I would like to see a Gold rally above $1925~1940 before attempting to confirm the “cup-n-handle” pattern.

My interpretation of the global markets and Gold is just as I stated above. Gold is starting to become more interesting for global investors as the China debt/economic crisis continues. Risks are mounting if the economic contraction in China/Asia continues. Global risks are already excessive after 24+ months of extended global central bank functions, easy credit, and increasing inflation. As a result of inflation, pricing pressures will eat away at profits for many firms. Slowing consumer demand could blow a big hole in demand for many assets.

Traders should prepare for a bout of price volatility headed into the end of 2021 as these issues continue to work themselves out. My technical analysis suggests this rally may continue into early January 2022. My cycle analysis indicates a change in price trend may initiate after January 18th or so. Yet, I also believe this potential rally in Gold may be just starting, and global concerns may be festering while the US stock market rallies. This is because global traders are piling into US assets/stocks while attempting to avoid economic/debt concerns in other world areas.

Gold will continue to react to this new concern and fear as it populates in traders’ minds. The luster of Gold will likely continue to grow – which may push Gold above $1950 before the end of 2021. Time will tell.

Want To Learn More?

Follow my research and learn how I use specific tools to help me understand price cycles, set-ups, and price target levels. Over the next 12 to 24+ months, I expect large price swings in the US stock market and other asset classes across the globe. I believe the markets are starting to transition away from the continued central bank support rally phase and may form a revaluation phase as global traders attempt to identify the next significant trends. Precious Metals will likely start to act as a proper hedge as caution and concern drive traders/investors into Metals.

Please take a minute to visit www.TheTechnicalTraders.com to learn about our Total ETF Portfolio (TEP) technology and it can help you identify and trade better sector setups. We’ve built this technology to help us identify the strongest and best trade setups in any market sector. Every day, we deliver these setups to our subscribers along with the TEP system trades. You owe it to yourself to see how simple it is to trade 30% to 40% of the time to generate incredible results.

Have a great day!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.