U.S. Treasury Bills, Can you hear the Bond Market POP!?

Interest-Rates / US Bonds Jan 08, 2009 - 09:19 AM GMTBy: Daniel_Smolski

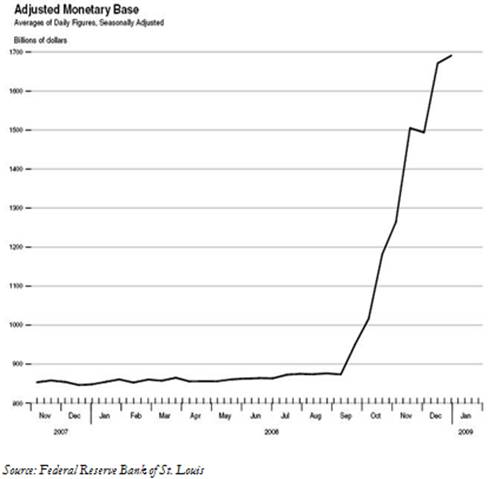

Keynesian capitalism continues to bring with it a saga of never ending bubbles. In just the past decade, we have been faced with the internet bubble bursting of 2000 and a massive real estate bubble that has brought the American economy to its knees. All are examples of a gross misallocation of resources caused by an excess money supply searching for home. The recent credit crunch has provided us with an opportunity to deflate and wipe away all unnecessary liquidity but the Federal Reserve, along with their posy of world bankers, have chosen instead to attempt to reflate a balloon that has already burst. Turning on all the world's liquidity taps has thus far proven to be working. We have beaten down the “evil” that is deflation and we look forward to an era of continued inflation. Inflation that will, undoubtedly, spiral out of control and potentially lead to a period of hyper-inflation.

Keynesian capitalism continues to bring with it a saga of never ending bubbles. In just the past decade, we have been faced with the internet bubble bursting of 2000 and a massive real estate bubble that has brought the American economy to its knees. All are examples of a gross misallocation of resources caused by an excess money supply searching for home. The recent credit crunch has provided us with an opportunity to deflate and wipe away all unnecessary liquidity but the Federal Reserve, along with their posy of world bankers, have chosen instead to attempt to reflate a balloon that has already burst. Turning on all the world's liquidity taps has thus far proven to be working. We have beaten down the “evil” that is deflation and we look forward to an era of continued inflation. Inflation that will, undoubtedly, spiral out of control and potentially lead to a period of hyper-inflation.

With the Ben Bernanke's staunch determination to employ his Helicopter Ben policies, we are forced to adjust our investment practices to reflect presumed future government interventionist policies. Never has there been an era when listening to and studying the words of central bankers has been so crucial to investing. This past year, daily stock movements were directly correlated to whether it was believed the government would or would not bail out some company. Whenever Paulson spoke, the market would tank, investors stopped believing the rhetoric that came out of the man's mouth. So we are put in a position that we must accept that the government will use its full arsenal to squelch the fires of deflation. With acceptance of continued inflation, several investment adjustments must be made to ensure success.

This leads us to US treasury bills. It is the final bubble that has already popped and the air is quickly escaping. It is of great significance to the US economy as the US bond market far exceeds US equity markets. Other than gold, treasury bills and corporate bonds are the only asset classes to gain in 2008. It is an understandable outcome, given the general perception that T-Bills are a safe haven in times of uncertainty. But now the time has come for caution.

Yields have dropped to levels not seen since the all-time-lows in the 1940s. A 30-year bill yields a return of under 3%, 10-year just over 2% and short-term yields have periodically even dropped into the negatives. Yes, investors were paying for the privilege of owning US denominated debt. It boggles the mind who would accept such ludicrous returns when the money supply growth is quite literally, off-the-charts. The inevitable day of reckoning, when foreign investors fail to show up to a bill auction, is coming unless prices fall and yields tick up.

Treasury Bills have had an impressive run into the later months of 2008 but their heydays are quickly drawing to a close. We will see a continued movement out of T-Bills as investors refuse the low yields and move into asset classes offering greater opportunities. The recent resilience of T-Bills, in the face of a sharp dollar decline, can only be attributed to the Federal Reserve's intervention to prevent the collapse of US debt. The Federal Reserve has as great a chance, of keeping prices at these levels, as are you or I do seeing pigs fly. Market forces always win and they will force down values and increase yields. Watch for UST to continue its decline towards the 200-day MVA.

Treasury Bills will, at a minimum, revert to their mean for the following fundamental reasons:

• Heavy government intervention appears to be easing the credit crunch and liquidity is flowing. Once deflation fears are squelched, treasury bills will collapse.

• Deflation fears will quickly transform into inflation fears as the impact of the Fed's ultra accommodative monetary policy is felt.

• Deficits of over $2 trillion are predicted over the next two years, the US government will be issuing debt at levels never before seen. Near zero yields on bonds will sooner, rather than later, attract near zero interest.

• The dollar's continued decline will pressure foreign investors to abandon their enormous holdings of US debt. If the Chinese government chooses to dump or merely stop buying new T-Bills, it will create an unstoppable downward spiral with detrimental consequences.

• The United States does not have a God-given birth right to triple A debt rating. With continued debt growth and a GDP-debt ratio soon to be in excess of 100%, the pristine rating will be further questioned and inevitably, lowered.

• The world-wide recession is forcing nations to spend domestically, with stimulus packages popping up in every nation. “Friends” like China may not be as we willing to throw more money down the I.O.U. black hole to support the US dollar.

What does it all mean to the common investor?

As investors come to their senses and refuse near zero yields, they will begin to move into other investment classes. We believe gold will be one of the largest benefactors as the desire to hold something of inherent value intensifies. All investors holding T-Bills as a trade, rather holding to maturity, should be out of their positions.

We will continue to maintain our positions in TBT, established the past few weeks. TBT has been performing as expected and will continue to outperform going forward. A move back up to over $50 is expected in the coming months.

By Daniel Smolski

smolski@gmail.com - Smolski Investment Newsletter

For a limited time , we are opening our services to new subscribers and are currently offering a FREE trial to the Smolski Investment Newsletter. We had an extremely profitable year in 2008 but we strongly believe 2009 will be one of the best in a long time; those correctly positioned will reap the biggest rewards. In the next few weeks, we will continue to monitor the markets and specify which sectors are poised to provide the greatest returns. Do not hesitate to send us an email with “SIGN UP” as the subject line at smolski@gmail.com .

© 2009 Copyright Daniel Smolski - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daniel Smolski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.