The State of the U.S. Consumer

Economics / Recession 2008 - 2010 May 01, 2009 - 05:42 PM GMTBy: Andy_Sutton

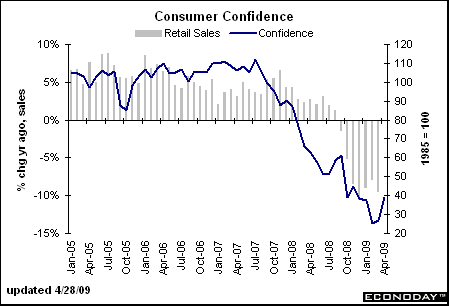

This week’s surprise Consumer Confidence report gives us yet another reason to take a step back and survey the landscape. Much of the recent focus has deservedly been on unemployment while little focus has been given to other aspects of the consumer and more importantly, the overall state of the consumer’s mind. Clearly there are several enigmas manifesting themselves in both confidence and spending patterns. This week we’ll take a closer look at some of these issues, and probably generate quite a bit of debate as well.

This week’s surprise Consumer Confidence report gives us yet another reason to take a step back and survey the landscape. Much of the recent focus has deservedly been on unemployment while little focus has been given to other aspects of the consumer and more importantly, the overall state of the consumer’s mind. Clearly there are several enigmas manifesting themselves in both confidence and spending patterns. This week we’ll take a closer look at some of these issues, and probably generate quite a bit of debate as well.

Desensitization

Increases in consumer confidence during the past two months are indicative of desensitization. Consumers are becoming acclimated to weak economic conditions, poor stock market returns, and the continued accumulation of job losses. This desensitization has been emphasized by the mainstream media; particularly in the past few months. The take-home message of articles and news reports has shifted to ‘be happy things aren’t getting worse’ and people are doing just that. Bargain hunters have been lured into many areas including housing, stocks, and even retail products. Meanwhile, important fundamentals like GDP, unemployment, foreclosures, and household net worth go largely unmentioned and underanalyzed.

Where are Consumers Spending Their Money?

What is telling, however, are the reports coming out of some individual sectors in the consumer landscape. Traditional economics breaks goods and services down into two major categories: staples and discretionary. This division follows the old-school definition of needs vs. wants. However, today, the lines have been blurred quite a bit and goods that would have easily been considered discretionary even 10 years ago are now regarded as staples.

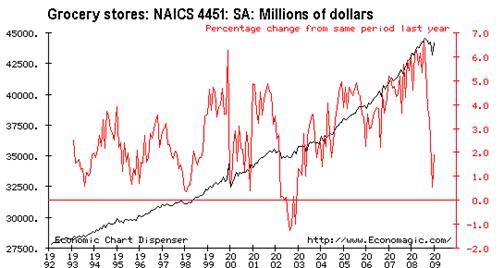

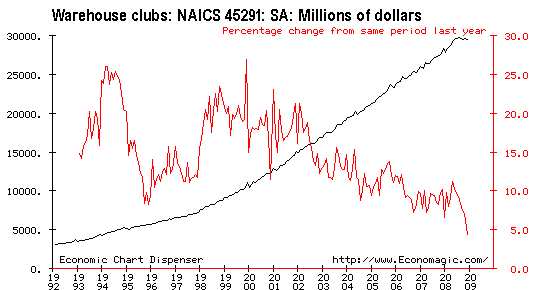

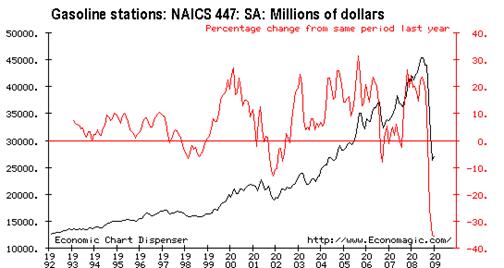

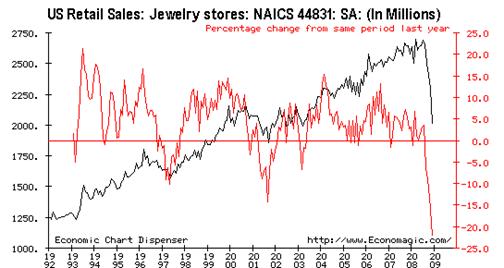

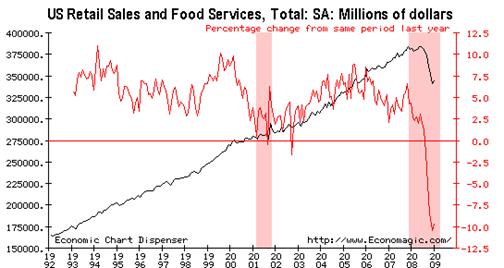

The following NAICS category charts were selected because they represent areas that are extreme examples in the staple—discretionary continuum. And for comparative purposes, the total US Retail Sales chart is included at the end of the series.

The situation with grocery stores is a primary example of how aggregate consumption numbers are reported, which will be explained in greater detail later in the article. Just reading the chart, Americans spent less at grocery stores from the middle of 2008 through the beginning of 2009, which is when we called the bottom in terms of consumer prices. Did people eat less or just spend less on what they purchased? In all likelihood it is the latter, given that grocery store shopping is one of the most basic of spending types. For the sake of thoroughness, included below is the same chart for big-box/warehouse type stores just in case everyone abandoned their local grocery store for lower prices at BJ’s and Sam’s Club.

You’ll notice quickly that the rate of growth in warehouse club spending has been declining steadily since the beginning of the decade. Spending has also flattened considerably in the past 6 months. Clearly Americans didn’t take their unspent grocery store dollars and run to the warehouse clubs, so our initial conclusion is intact.

Gasoline station spending fell off a cliff from July through December, indicative of falling gas prices and people cutting back on the purchases of accoutrements such as drinks and sandwiches. In a similar fashion to grocery store sales, there has been a recent increase in spending at gas stations reflected by the price of gas jumping from near $1.50/gallon to around $2.00/gallon nationally.

Obviously, jewelry is far at the other end of the staple-discretion continuum, and is a good indicator of purely discretionary spending. It is pretty apparent, at least from this graphic, that this type of discretionary spending (in total dollars) is contracting rapidly, now at a year over year rate of around -22%. Massive discounting by many national and regional jewelers have certainly contributed to fewer total dollars spent as well.

Above, we notice the same tail in total retail sales starting at the beginning of 2009. This change in total retail sales correlates well with our data on consumer level inflation and brings the mainstream’s assertion of the re-emergence of the consumer into question.

Inflation Returns to Consumer Prices

In early January, a number of our in-house statistical indicators turned positive in terms of the spillover of monetary inflation into consumer prices and we discussed this issue in detail in 2/20/2009’s article “The Turning of the Tide?”:

“If we have indeed witnessed the inflection point where the trillions of dollars parked in investment and commercial banks are finally being let out to play, then our wealth and purchasing power are about to come under serious attack. Obviously the risk in putting such an assertion to paper is that if we return to the previous trend of falling prices even for a brief time, the entire construct will be discredited rather than the possibility that the timing was a bit off being acknowledged. There are some factors that would help us to confirm or deny that such an inflection point has taken place……”

Since those indicators went positive, we have received affirmation of our observations from PPI/CPI, the GDP Price Index or GDP Deflator, nominal retail sales, and import prices. It is the retail sales portion that applies here, and the key lies in how that report is interpreted. It absolutely must be remembered that almost all of these aggregate spending metrics report in total Dollars, NOT units. Nor are these numbers adjusted for ‘inflation’. They are adjusted for seasonal factors that are at the discretion of the reporting agency, but that is it. What this means is that increases in consumer prices (especially in staple goods since people are less likely to cut back) will be interpreted as economic growth when retail sales are reported because people are spending more money. Conversely, when prices fall like they did from July through December of 2008, the interpretation will be economic contraction.

So the question needs to be asked: Did people actually buy fewer goods and services (an actual retrenchment) over the past 6 months or did they just pay less for some of the things they purchased thereby causing retail sales to drop?

The answer is more difficult to find than one might imagine. We know from the Advance GDP report on Wednesday of this week that personal income in the US dropped by an estimated $59 billion (2.0% annualized) as job losses put more and more Americans on the unemployment rolls. The rate of decay in personal income grew from $42.9 Billion or 1.4% annualized in Q4 2008.

The report also gleaned that personal outlays increased .7% in Q1 2009 after falling 9.5% in Q4 2008. Looking for example at the CPI for that period, we find that using the old CPI methodology that consumer prices increased 1.18% for Q1 2009. By extension then, if consumers would have purchased the exact same quantity of goods as they did previously, they would have spent 1.18% more yet they only spent .7% indicating that less goods/services were purchased. A terribly small cutback for sure, but certainly not the growth trumpeted by the mainstream media.

For comparative purposes let’s apply the same analysis to Q4 2008. Using the same CPI methodology as the previous paragraph, consumer prices dropped 2.93% in Q4 2008. So if consumers had bought the same quantity of goods/services, they would have spent 2.93% less. Yet consumers spent 9.5% less indicating a significant cutback.

One conclusion we can draw from this cursory analysis is that while consumers spent more in Q1 2008, they didn’t really buy more. Still, in the face of rising unemployment, falling housing prices, and general economic malaise, consumers are still trying hard to hold onto yesteryear after a very brief period of belt-tightening.

In our ‘Spin Cycle’ podcast, we are currently doing a 7-part series in which we depict the factors affecting the US economy as sides of a Rubik’s Cube – independent, yet interrelated. Episodes include Interest Rates, Economic Growth, Debt/Monetary Growth, Energy, Demographics, Geopolitics, and the State of the Consumer. To listen, visit www.my2centsonline.com/radioshow.php

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.