Stock Market Cycle Turning Points Analysis 21st May 2007

Stock-Markets / Cycles Analysis May 21, 2007 - 08:23 AM GMTBy: Andre_Gratian

A 3-dimensional approach to technical analysis

Cycles - Breadth - Price projections

Current Position of the Market

SPX: Long-Term Trend - The 12-year cycle is still in its up-phase but, as we approach its mid-point some of its dominant components are topping and could lead to a severe correction over the next few months.

SPX: Intermediate Trend - With the price reaching the preferred target area, the rally from 3/14 should be coming to an end.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which determines the course of longer market trends.

Daily market analysis of the short term trend is reserved for subscribers. If you would like to sign up for a FREE 4-week trial period of daily comments, please let me know at ajg@cybertrails.com .

Overview

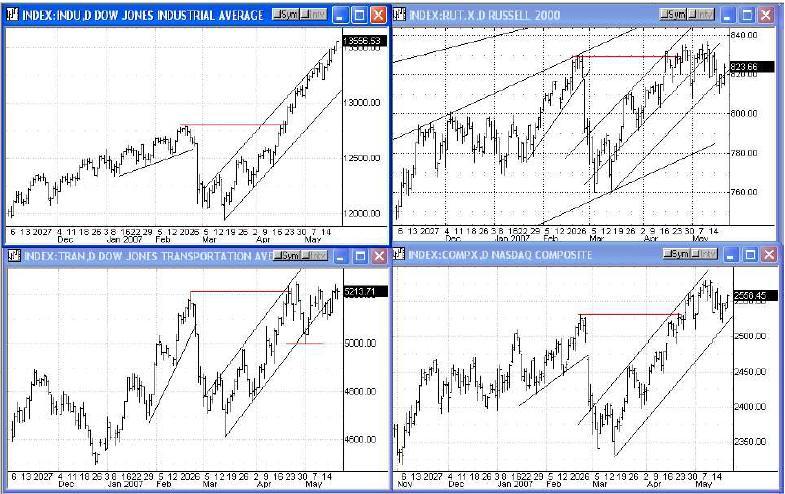

While the Dow Industrial's rise continues unabated, there is plenty of evidence that all is not well with some of the major indices. Deceleration, and even topping action, is becoming more and more noticeable in the Russell 2000, Nasdaq, and the Dow Transportation. See for yourself:

Even the NYSE Composite and S&P 500, although they made new bull market highs in the last couple of days, look as if they are going to have problems following through on the upside. Particularly noteworthy was the performance of the Dow Jones REIT index which took a beating last week and now appears to have conclusively reversed its long-term uptrend. Since this index directly reflects the state of the housing market, it suggests that more retrenchment is probable in that industry, with inevitable repercussions on a weakening economy.

Several renowned technical analysts are calling for a major top which could lead to several years of decline. I am not ready to buy into that scenario, but I do feel that the market has reached an important level which could lead to a reversal and several months of decline.

What's Ahead?

Cycles

... there is still plenty of strength in the uptrend calling into question how much of a factor the 10-week cycle will be in putting a stop to the prevailing bullishness.

In the past, the 10-week cycle has had a mixed influence on the market, ranging from a few days up to 3 weeks of decline into its low.

As the above quotes in the last newsletter demonstrate, I spent some time discussing the up-coming 10-week cycle final down phase and speculating on how much impact it would have on the indices. Now we know! The bottoming of the 10-week cycle has been a good gauge of each index's individual strength, with the Russell 2000 having the greatest reaction and the Dow Industrial the least.

The up-phase of this cycle is also affecting each index differently, but the overall reaction has so far been muted. Furthermore, two other dominant short-term cycles which are due to make lows over the next two weeks are going to put a damper on any attempt at further gains. The 6-week cycle is due to bottom next week, and the 9-week the following week. I believe that this will essentially cause the market to form a sideways pattern with a downward bias until the end of the month.

After this corrective action is over, there should be an attempt at making new highs for the final phase of the intermediate trend -- and perhaps of the bull market as well, although labeling the next downtrend may be a matter of semantics. If there is a sustained decline into 2008 followed by a rise to a new high in 2009 or 2010, will these be considered separate bull/bear phases, or merely fluctuations in the long-term uptrend?

The downward pressure will intensify over thenext few weeks because of several cycles that have been discussed before and which are due to make their lows in the early Fall of 2007. More importantly however, is the fact that even longer cycles which are subdivisions of the 12-year cycle, are currently in the process of topping and will be bottoming in late 2008. I expect them to have a growing influence over the next few months and especially after the early part 2008.

Technical Indicators:

An updated chart of the daily SPX (courtesy of StockCharts) clearly shows the impact of the 10-week cycle. It caused a dip in the indicators and now, for the first time in this uptrend, the recovery has created negative divergence, especially in the RSI (top). These are only the beginning signs of a market which has reached the extent of its potential and the cycles bottoming over the next two weeks should create additional deceleration which will also be reflected in these indicators. But since there has been so much upside momentum, it will take time to dissipate and the short and intermediate-term cycles are forecasting a period of distribution before prices roll over.

I have drawn an up-channel on the chart separated into two sections. Note how the index has been trading in the upper half of the channel but has started to pull away from the top trend line. I would now expect the price to move sideways toward the lower trend line over the next couple of weeks and make a final rally attempt before breaking through.

Projections

The SPX has now reached the upper price range which was forecasted several week ago. Longer term projections are always subject to refinements as they get closer and closer to their targets. Each short-term fluctuation sets up a new set of projections, and the latest one has more validity; just as a recent support or resistance level is more valid than one which occurred several months ago.

By measuring the pattern which was made as a result of the 10-week cycle dip, we can establish another set of shorter-term targets between 1520 and 1525. This coincides with a P&F count to 1523.

Since the SPX closed at 1522 on Friday, it is now within its projected range. And since the 6-week cycle is very close to the end of its normal phase and its low is overdue, the index is ripe for a shortterm reversal.

Breadth

As a result of the poor action of the McClellan oscillator, the NYSE and the Nasdaq summation indices have shown a pattern of deceleration for several weeks. But last week they started to roll over into a more pronounced downtrend.

The most obvious deterioration can be observed in the hourly Advance/Decline figures of the past week. Making this kind of pattern as we reach the price target zone is a huge red flag and a warning of an imminent reversal.

Market leaders

The Russell 2000 has been the weakest index for several weeks going nowhere, while the Dow Jones Industrials continued to move sharply higher. This kind of disparity between big caps and small caps is normally a precursor to an important top. For a while, the NDX was keeping pace with the SPX but in the past two weeks it has clearly under-performed and, together with the Nasdaq Composite and the Dow Transportation index, is beginning to form a pattern similar to the Russell.

The same kind of deceleration can be seen in the Broker-Dealer index (XBD) and the Banking index (BKX).

Although GE has shown some near-term strength, its longer price pattern has clearly been devoid of the momentum generated by the overall market.

In other words, all the indices that are normally leaders, are beginning to lag badly behind the Dow Jones shooting star! This is not bullish.

Summary

There are growing signs that we have arrived at an intermediate-term top. Besides reaching the projection zone which was established several weeks ago, only the 30 Dow stocks appear capable of pushing just a little higher over the next month. More and more indices are saying "enough!". Short-term projections are reinforcing longer-term targets to about the 1520-1525 level of the SPX. The short-term cycle pattern calls for a two-week period of sideways trading which should culminate with a final attempt at making new highs before an important reversal.

If this information is of value to you, you should consider our trial subscription offer (above). Daily updates consist of a Morning Comment, Closing Comment (which occasionally includes an updated hourly chart of the SPX to illustrate the analysis), and at least one or more updates during the trading session whenever it is warranted by market action. These updates discuss phase completions, give projections, potential reversal points, and whatever else may be pertinent to the short-term trend.

Testimonial: I do want you to know that I consider your service to be excellent and your analysis sound. What is most impressive about your service is that you provide constant communication with your subscribers. I would highly recommend your service to traders. David A.

By Andre Gratian

MarketTurningPoints.com

If this information is of value to you, you should consider our trial subscription offer (above). Daily updates consist of a

Morning Comment, Closing Comment (which occasionally includes an updated hourly chart of the SPX to illustrate the

analysis), and at least one or more updates during the trading session whenever it is warranted by market action. These

updates discuss phase completions, give projections, potential reversal points, and whatever else may be pertinent to the

short-term trend.

“By the Law of Periodical Repetition, everything which has happened once must happen again, and again,

and again -- and not capriciously, but at regular periods, and each thing in its own period, not another’s, and

each obeying its own law … The same Nature which delights in periodical repetition in the sky is the Nature

which orders the affairs of the earth. Let us not underrate the value of that hint.” -- Mark Twain

You may also want to visit the Market Turning Points website to familiarize yourself with my philosophy and strategy.www.marketurningpoints.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.