Screening for Dividend Yielding, Growing, Rising Stocks

Companies / Investing 2009 Jun 03, 2009 - 02:25 PM GMTBy: Richard_Shaw

What do you get when you want yield that is growing along with sales and earnings over a period of years, less than sky high valuation, and evidence of a rising price pattern?

What do you get when you want yield that is growing along with sales and earnings over a period of years, less than sky high valuation, and evidence of a rising price pattern?

The answer today is not very many stocks, and not necessarily the most exciting names. Not every exploration finds gold. Some of the results of this search are interesting, but we aren’t crying eureka.

ETFs were not included in this study of individual stocks listed on US exchanges.

Negative or neutral results can also be informative, however, for those who seek more than tips and immediate gratification.

The results are not recommendations, just the result of an exploration. We had hoped for a more exciting list, but what comes out is what comes out.

It is probably an example of asking for too much — as the saying goes, you can have anything you want, but not everything your want. Sometimes the stocks you want are going up, and sometimes the stocks going up aren’t the ones you want.

Ideally, the stocks you want for fundamental reasons are also going up in price.

Defining “going up” is a matter of investment time horizon and how much comfort you want that the price movement is actually upward. The criteria we used are fairly conservative.

If you are curious about how and what, read on.

What We Did:

We screened our fundamental stock database of 9500+ stocks for some attractive growth and yield attributes subject to maximum valuation limits — rendering 232 issues.

We then screened those 232 issues for strong upward price movements — rendering 9 issues, 5 of which are pipeline limited partnerships, and 1 of which is an emerging markets utility. Eliminating our requirement for the direction of the primary trend (200-day average), the test produced 14 total prospects.

Filtered Lists:

The list of filter survivors is presented below in alphabetical symbol order followed by Wrights Quality Ratings (rated for liquidity, financial strength, profitability and growth — see legend for ratings further below):

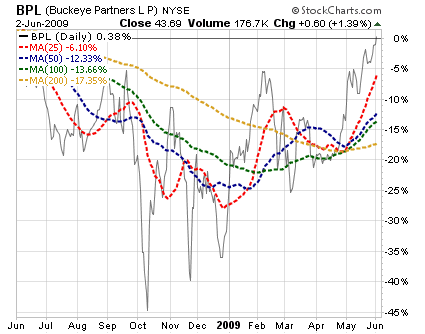

- BPL Buckeye Partners LP - ACC6

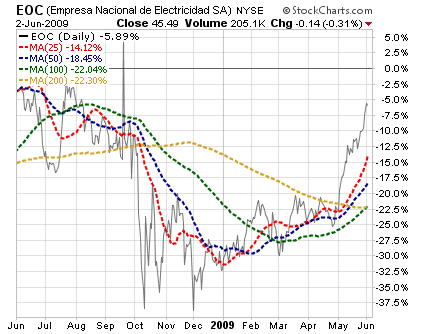

- EOC Empresa Nacional de Electricidad (Chile) - NBB1

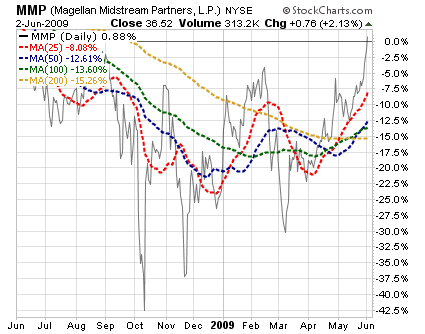

- MMP Magellan Midstream Partners LP - BCB1

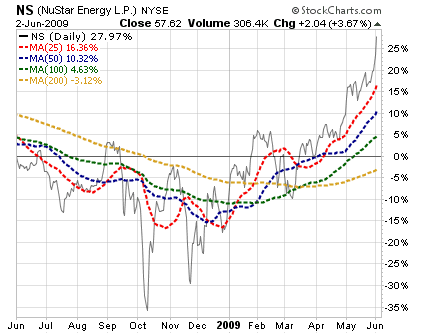

- NS NuStar Energy LP - BBD7

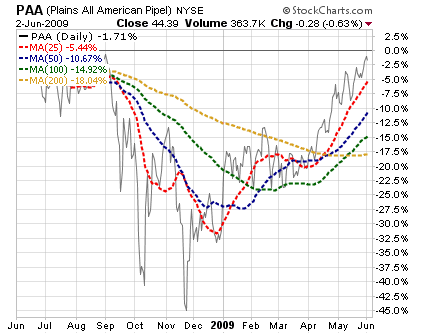

- PAA Plains All American Pipeline LP - ACC7

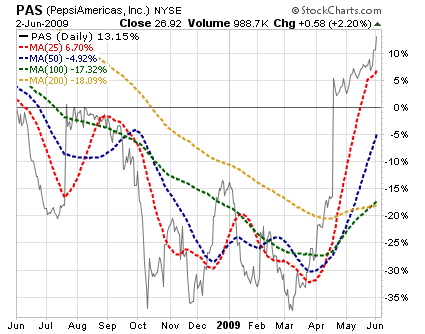

- PAS Pepsi Americas - BCC1

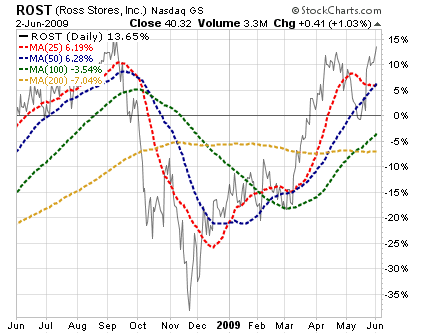

- ROST Ross Stores - AAA1

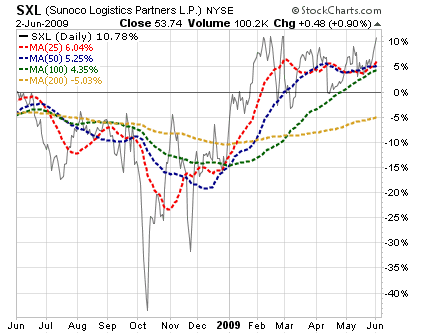

- SXL Sunoco Logistics Partners LP - BCB1

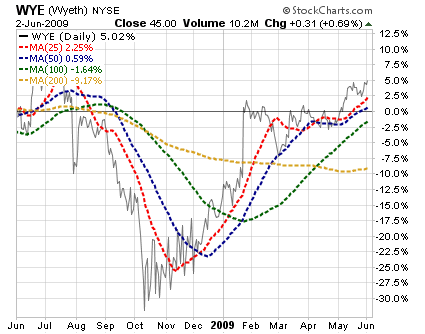

- WYE Wyeth - ABA1

If we relax the criteria and do not use a requirement for the direction of the 200-day average, the list expands by 5 more issues:

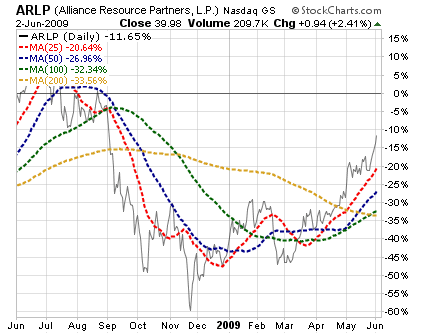

- ARLP Alliance Resource Partners LP - BCA1

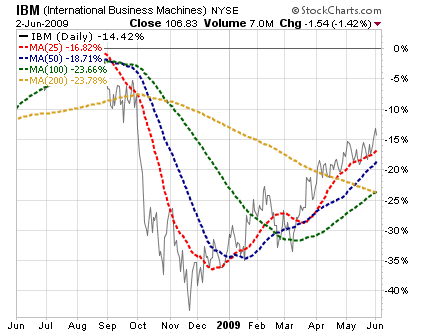

- IBM International Business Machines - ABA1

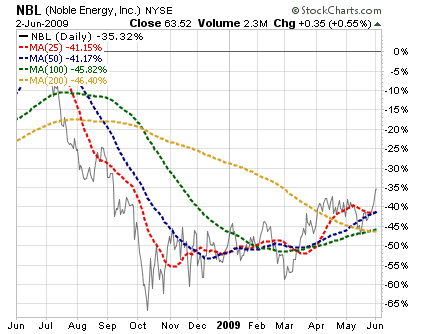

- NBL Noble Energy - AAA2

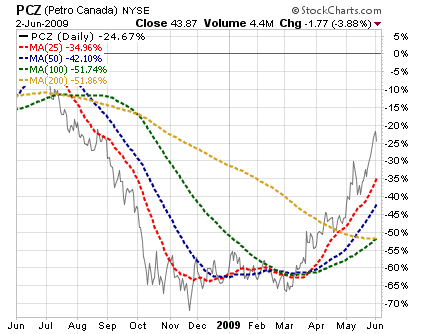

- PCZ Petro Canada - AAA1

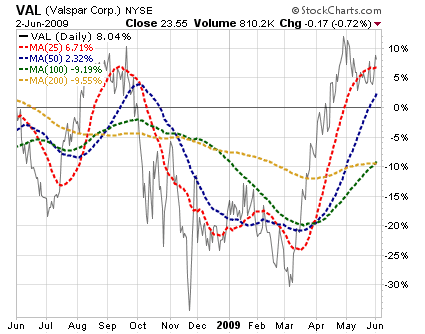

- VAL Valspar - BBB7

Fundamental Screening Details:

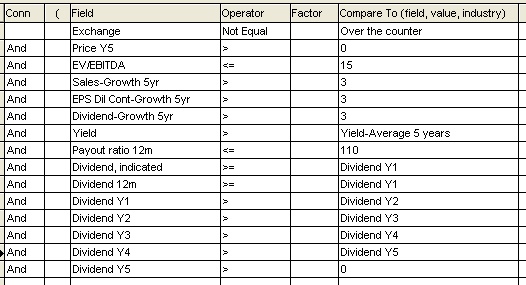

The fundamental screening criteria were as shown in the table below:

The minimum price and “not OTC” criteria reduced the 9500+ database to 4478 issues (100% of the universe of interest). The EV/EBITDA maximum valuation criteria further reduced the field to 3669 issues (82% of the universe). The 5-year sales growth, diluted continuing earnings growth and dividend growth brought the list down to 516 issues (12% of the universe). The remaining criteria of payout ratio, yield now versus 5-year average, and 5-years of successive dividend increases, eliminated all but 232 issues (5% of the universe).

Price Action Screening Details:

The price action criteria we used were as follows:

- 200-day, 100-day, 50-day and 25-day simple moving averages now are higher than the day before

- 100-day, 50-day, 25-day averages and price are higher than the 200-day average

- price is higher than the 25-day average

- 25-day average is higher than the 50-day average

- 50-day average is higher than the 100-day average

Legend for Wright’s Quality Ratings:

Quality Rating from Wrights Investor’s Services evaluate four dimensions (first three alpha and the fourth numeric). In order of appearance left to right the ratings are for:

- #1 market liquidity

- #2 financial strength and stability

- #3 profitability

- #4 growth

Ratings levels (attributes #1 - #3):

- A = Outstanding

- B = Excellent

- C = Good

- D= Fair

- L - Limited

- N = Not Rated (insufficient data)

Rating levels (attribute #4):

- 1 - 20 (20 is highest growth)

Charts for Issues Passing Both Filters:

[Disclosure: We own BPL, MMP, NS, SXL and ARLP in some managed accounts.]

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2009 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.