New Profits in the Old World - Europe

Stock-Markets / European Stock Markets Jun 04, 2007 - 08:41 AM GMTWhen I think of the Old World, among the images that first spring to mind are those of medieval castle towns like Heidelberg, where Rupert the Red founded the fourth university of the Holy Roman Empire in 1386 … or of the Acropolis, rebuilt by Pericles during the Golden Age of Athens between 460 and 430 BC.

It's only on second thought that I remember the modernity of today's Europe.

Similarly, when you think of the European economy, you typically associate it with outdated economic models — burdensome taxation, non-productive social support systems, and a tangled web of government regulations.

You rarely associate Europe with the dynamic thrust of modern free labor markets — let alone the fresh energy of emerging entrepreneurial vigor.

Indeed, it has been the lack of these impulses that explains why growth in Western Europe's largest nations — particularly Germany and France — lagged behind the U.S. for so many years … and even further behind emerging markets.

But in recent months, unprecedented winds of change have begun to sweep the Continent. And while it may be too soon to declare the beginning of a new era, it's not too soon to give you a heads up …

The First Major Sign of Change: Massive New Investment In Essential Infrastructure

Highways and railroads are the underlying foundation of a vibrant economy. You simply cannot expect sustained growth without them.

In America's 20th century, the massive investment in the Interstate Highway System returned countless dollars in economic productivity for each dollar of cost. It positioned the nation for improved international competitiveness. And it enriched the quality of life for virtually every American. Ditto for our railroads in our 19th century.

Today, we see a similar wave of new investment in Europe:

- Brand-new, ultra-modern subway systems have recently been completed or upgraded in Copenhagen, Warsaw, Barcelona, Seville, Valencia, Lisbon, Porto, Rennes, Genoa, Naples, Turin, Vienna, Oslo and Cologne.

- Major urban redevelopment projects are being completed in London's South Bank district … in Dublin's Docklands financial center … in Rotterdam, Copenhagen, Brussels, Athens, Naples and Lille.

- Valencia's futuristic City of Arts and Sciences, blending classic and contemporary design, is typical of the new wave of urban projects sweeping the Continent.

- In May, Europe's most advanced outdoor Wi-Fi network was turned on across the entire city of London. Built and operated by The Cloud, a leading wireless broadband provider, the system allows anyone to get online from almost anywhere in the city.

- Similar citywide Wi-Fi systems are in place, or in the works, in Amsterdam, Bologna, Dublin, Manchester, Prague, and Paris — all with broadband speeds averaging 10 times faster than most in the U.S.

- European cities are also rated more livable: According to Mercer's Quality of Living Index, for example, the only U.S. cities in the top 30 are Honolulu (#27) and San Francisco (#29). In contrast, Zurich is #1, Geneva #2, Vienna #4, Düsseldorf #5, Frankfurt #7, Munich #8, Bern #9, Copenhagen #11, and Amsterdam #13.

Berlin — which only 18 years ago was crisscrossed with barbed wire and mile after mile of crumbling concrete tenements — is now wonderland of modernity, where former army checkpoints are transformed into tourist attractions.

Germany has spent upwards of $1.54 trillion rebuilding Berlin and the East. They have obliterated almost every trace of Communism and the old Wall. And they fashioned Berlin into a glamorous city of futuristic buildings built along the banks of the River Spree.

Old landmarks, such as the historic Brandenburg Gate, now stand side by side with Jahn's Sony Center or Debis-Haus, Kollhof-Tower and Daimler Chrysler Quarter on the Potsdamer Platz.

Everywhere in Europe, new, gleaming, energy-efficient technology is overlaid seamlessly on a bedrock of classic culture and style.

Slowly at first, but with growing momentum in recent months …

Europe's Economy Is Beginning to Surge Ahead of The U.S.

Just last week, the U.S. Commerce Department reported that U.S. GDP growth in the first quarter plunged to an anemic 0.6% — the worst showing in over four years. The second quarter seems to be off to a slightly better start. But for the year, economists will be happy if they can squeeze out more than 2%.

In contrast, Germany's first quarter growth has improved to an annual pace of 3.6%, Spain is up to 4.1%, Greece is at 4.6%, Sweden is running at 4.7%, the Czech Republic is trotting along at 5.8%, and Poland's racing ahead at the annual pace of 6.4%.

Result: This year, despite the drag of lagging economies like Italy, the Eurozone will likely outperform the U.S. economy for the first time in decades. And, at the same time , the euro has reached an all-time historic high against the U.S. dollar.

Combine the two, and it should come as no surprise that most European stocks are greatly outperforming ours.

This is an enormous reversal of the recent pattern: From 1990 to 2000, it was Europe that was lagging — with an average growth of 2.2%, compared to 3.3% in the U.S.

And in the first five years of the new millennium, while the U.S. slowed down to 2.4%, Europe slowed even more — to just 1.5%.

Now, that's changing, and much more quickly than most economists dreamed possible. What are the forces driving the change? I can count at least six:

Force #1

Years of Pent-Up Demand for Investment in Infrastructure

Many of the countries showing the strongest growth are in Eastern Europe — including Hungary, Poland, the Czech Republic, even Serbia. Russia, not normally included as part of Europe proper, soared 7.9% in the first quarter of 2007. And last year, Estonia and Latvia grew at a rate of 11.6 and 10.9%, respectively.

After decades of communist rule, the newly liberated states are leading the pack in making up for lost time — building badly needed roads, hospitals, factories, schools, and Internet superhighways. West European countries are among the first to benefit.

Force #2

Tax Cuts

Like New Zealand did 20 years ago, more and more West European countries have finally realized that corporate and individual taxes stifle economic development — and they've begun slashing both.

Ireland reduced its corporate tax rate from 47% in 1988 to just 12.5% today. Not surprisingly, global businesses — including Microsoft, Intel and Dell — began moving operations to Ireland, and its economy boomed.

This success, in turn, has prompted traditionally socialist regimes on the Continent to wake up, smell the coffee, and find the pathways for doing much of the same:

Spain cut its tax rate on corporate profits from 35% to 30%. Britain cut its rate from 30% to 28%. Germany is cutting its rate from 39% to 30%.

And now, newly elected French president Nicholas Sarkozy — a champion of the free market — has promised to slash his country's 33% rate down to 25% or less.

Bottom line: Already, the overall tax rate of European Union countries is down to a historic low of 26%, while in the U.S, when you combine federal and local taxes, the burden is close to 40% rates.

Force #3

Reduced Regulation

Until recently, government regulation of business in Europe was typically more onerous than in the U.S.

Now that, too, is changing.

In the U.S., in the wake of the Enron fiasco and new requirements imposed by the 2002 Sarbanes-Oxley Act, the cost of running a public company has skyrocketed.

Meanwhile, most of Europe is moving in the opposite direction.

As a result, more global businesses are moving their operations — and their underwriting — to Europe and elsewhere. Indeed, so far this year, 14 of the world's 15 biggest IPOs were listed outside of the U.S. And IPOs in Europe have raised nearly double the money of IPOs in the United States — $37.8 billion compared to just $21.2 billion.

Force #4

Newer Trading Partners

Last year, the European Union launched its "Global Europe" initiative to pursue bilateral free trade agreements with major emerging economies.

The goal: To secure new profitable markets for its companies.

To help pave the way, European Union nations have slashed their tariffs and other protectionist trade barriers. They've aggressively pursued new business with Russia, China and Latin America. And they've changed the face of world trade.

Germany, for example, which used to rely mostly on North American markets, now ships a whopping 91.2% of its products to countries other than the U.S.

Germany has surpassed the U.S. as the world's number one exporting nation.

And unlike the U.S., Germany has done all this with a giant trade surplus.

But it's not just in Germany. Throughout Europe, the U.S. is becoming progressively less relevant to their economic success.

Force # 5

Falling Unemployment

Because of generous social benefits — four-week summer vacations, guaranteed maternity leaves, state-subsidized medical care — European businesses have traditionally paid a hefty premium for labor.

And labor also paid a hefty price — in the form of chronic high unemployment. In 2004, for example, the unemployment rate in France was 9.5%, reminiscent of depression levels in the U.S.

In Poland, it was double that — as much as 19%!

But that picture is also shifting …

- Spain's unemployment rate has fallen from 10.6% in 2004 to 8.2% today.

- Germany's unemployment has fallen from 9.5% to 7.1% over the past three years.

- Denmark has only 3.9% of its labor force out of work; Norway, only 2.7%.

- Overall, the European Union has seen its unemployment rate decline from an average of 8.0% in 2004 to 6.9% today.

Is there still a long way to go? You bet! But what counts most for investors is not so much the current level of economic barometers like these. It's the direction of change. And that direction is now turning positive.

Force #6

New Investment

Globalization isn't just limited to new factories in Brazil or China and outsourced jobs to India or the Philippines. Money is also pouring into Europe.

According to a Merrill Lynch survey of 201 money managers in May, the appetite for European stocks has reached an all-time record high. And with new, easy access to European investments, individuals are following suit.

The Most Convenient, Most Diversified and Most Efficient Vehicle: ETFs

ETFs now give you better and quicker access to these markets than was ever possible in previous years.

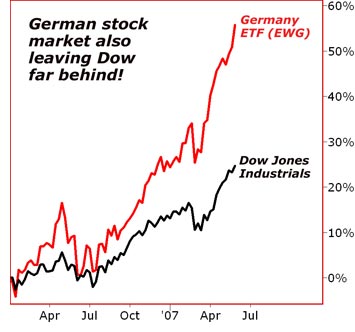

Among the best performing European ETFs this year: iShares MSCI Germany Index (EWG), a virtual Who's Who of giant German businesses — including Siemens AG, Allianz Bank, the utility conglomerate E.ON, DaimlerChrysler, Deutsche Bank, Bayer, Volkswagen, and Porsche.

Average annual returns: 29.3% over the past three years; 18.5% over the past five. And since January 2006, it's up by over 55%, nearly double the rise in the Dow during the same period.

Meanwhile, if you're worried about the continuing decline of the U.S. dollar, it's now easy to diversify out of the U.S. currency without opening a foreign bank account. You can open U.S. savings accounts and hold your money in euros, Swiss franc or other major world currencies. Or better yet, you can buy ETFs linked to key currencies.

I don't recommend putting all of your money in overseas investments. But with the U.S. lagging and the dollar falling, if you don't allocate at least some, I think you could be making a big mistake.

Good luck and God bless!

By Martin Weiss

P.S. I will be off next Monday (June 11), and in my place Money and Markets Associate Editor Nilus Mattive will provide an intriguing update.

Until now, Nilus has been working mostly from behind the scenes, reviewing and editing nearly every issue that's delivered to your e-box each morning. But starting right now, he will also be contributing his own specialty to Money and Markets — how to find the best dividend-paying stocks.

On Saturday, with his gala edition " High Income with Richer Dividends ," he told you about conservative, steady dividends that aim to double and triple your yield over time … hot, fast-growing dividends that can give you up to 23.1% right now … and even dividends where you'd least expect them — on global stocks and tech shares.

Next Monday, he will follow up with even more.

This investment news is brought to you by Money and Markets . Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com .

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.