Inflation or Deflation, Make Sure You Get This One Right

Economics / Deflation Jul 06, 2009 - 08:49 PM GMTBy: John_Mauldin

There are those who sweat over every decision, worrying about how it will affect their lives and investments. Then there is the school of thought that we should focus on the big decisions. I am of the latter school.

There are those who sweat over every decision, worrying about how it will affect their lives and investments. Then there is the school of thought that we should focus on the big decisions. I am of the latter school.

85% of investment returns are a result of asset class allocations and only 15% come from actually picking investment within the asset class. Getting the big picture right is critical. In this week's Outside the Box we look at a very well written essay about the biggest of all question in front of us today. Do we face deflation or inflation?

This OTB is by my good friends and business partners in London, Niels Jensen and his team at Absolute Return Partners. I have worked closely with Niels for years and have found him to be one of the more savvy observers of the markets I know. You can see more of his work at www.arpllp.com and contact them at info@arpllp.com.

John Mauldin, Editor

Outside the Box

Make Sure You Get This One Right

By Niels C. Jensen

"You can't beat deflation in a credit-based system." ~ Robert Prechter

As investors we are faced with the consequences of our decisions every single day; however, as my old mentor at Goldman Sachs frequently reminded me, in your life time, you won't have to get more than a handful of key decisions correct - everything else is just noise. One of those defining moments came about in August 1979 when inflation was out of control and global stock markets were being punished. Paul Volcker was handed the keys to the executive office at the Fed. The rest is history.

Now, fast forward to July 2009 and we (and that includes you, dear reader!) are faced with another one of those 'make or break' decisions which will effectively determine returns over the next many years. The question is a very simple one:

Are we facing a deflationary spiral or will the monetary and fiscal stimulus ultimately create (hyper) inflation?

Unfortunately, the answer is less straightforward. There is no question that, in a cash based economy, printing money (or 'quantitative easing' as it is named these days) is inflationary. But what actually happens when credit is destroyed at a faster rate than our central banks can print money?

A Story within the Story

Following the collapse of the biggest credit bubble in history, there has been no shortage of finger pointing and the hedge fund industry, which has always had an uncanny ability to be at the wrong place at the wrong time, has yet again been at the centre of attention. And politicians, keen to divert attention away from themselves as the true culprits of the crisis through years of regulatory neglect, have been quick at picking up the baton. Admittedly, the hedge fund industry is guilty of many stupid things over the years, but blaming it for the credit crisis is beyond pathetic and the suggestion that increased regulation of the hedge fund industry is going to prevent future crises is outrageously naïve.

If you prohibit private investors from investing in hedge funds which on average use 1.5-2 times leverage but permit the same investors to invest in banks which use 25 times leverage and which are for all intents and purposes bankrupt, then you either don't understand the world of finance or you don't want to understand. Shame on those who fall for cheap tactics.

Let's begin by setting the macro-economic frame for the discussion. I have been quite bearish for a while, suspecting that the growing optimism which has characterised the last few months would eventually fade again as reality began to sink in that this is no ordinary recession and that 'less bad' doesn't necessarily translate into a quick recovery. I still believe there is a good chance of enjoying one, maybe two, positive quarters later this year or early next; however, a crisis of this magnitude doesn't suddenly fade into obscurity, just because the economy no longer shrinks at an annual rate of 6-8%.

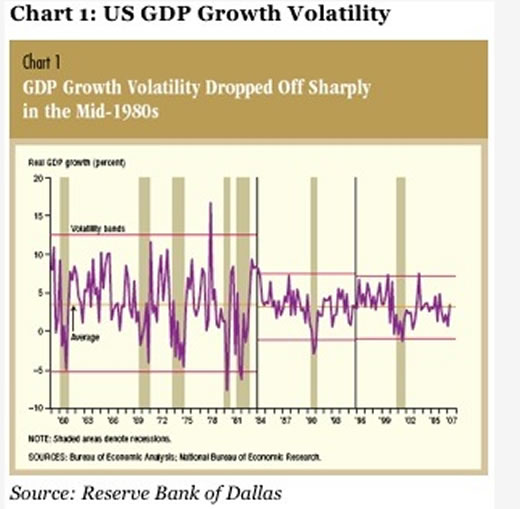

Going forward, not only will economic growth disappoint, but the economic cycles will become more volatile again (see chart 1) with several boom/bust cycles packed into the next couple of decades. This is a natural consequence of the Anglo-Saxon consumer-driven growth model having been bankrupted. Growing consumer spending over the past 30 years led to rapidly expanding service and financial sectors both of which will now contract for years to come as overcapacity forces players to downsize.

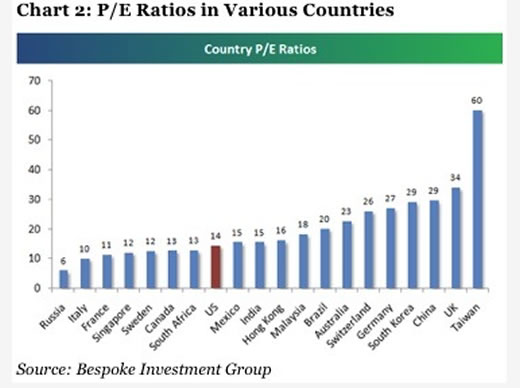

This will again lead to higher corporate earnings volatility which will almost certainly drive P/E ratios lower, making conditions even trickier for equity investors. At the bottom of every major bear market in the last 200 years, P/E ratios have been below 10. As you can see from chart 2 overleaf, few countries are there yet. The next decade is therefore not likely to be a 'buy and hold' market for equity investors. The combination of low economic growth and pressure on valuations will create severe headwinds. The most likely way to make money in equities will be through more active trading.

So now, two years into this crisis, where do we stand and where do we go from here? History offers limited guidance, as we have never experienced the bursting of a bubble of this magnitude before. The closest thing is the collapse of the Japanese credit bubble around 1990. As the Japanese have since learned, recovering from a deflated credit bubble is a long and very painful affair.

Governments and central banks on both sides of the Atlantic are pursuing a strategy of buying time, hoping that a recovery in economic conditions will allow our banking industry to re-build its capital base. The Japanese pursued a similar strategy back in the early 1990s. It failed miserably and set the country back many years in its recovery effort. Ironically, the Japanese approach was almost universally condemned as hopelessly inadequate. It is funny how you always know better how to fix other people's problems than your own. A little bit like raising children, I suppose.

Another lesson learned from Japan is that once you get caught up in a deflationary spiral, it is exceedingly hard to escape from its grip. The Japanese authorities have used every trick in the book to reflate the economy over the past two decades. The results have been poor to say the least: Interest rates near zero (failed), quantitative easing (failed), public spending (failed), numerous attempts to drive down the value of the yen (failed); the list is long and makes for painful reading.

We are effectively caught in a liquidity trap. The Bank of England, the European Central Bank and the Federal Reserve have all flooded their banking system with enormous amounts of liquidity in recent months but what has happened? Instead of providing liquidity to private and corporate borrowers as the central banks would like to see, banks have taken the opportunity to repair their balance sheets. For quantitative easing to be inflationary it requires that the liquidity provided to the market by the central bank is put to work, i.e. lenders must lend and borrowers must borrow. If one or the other is not playing along, then inflation will not happen.

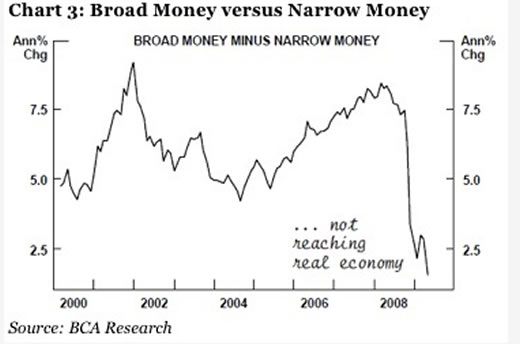

This is illustrated in chart 3 which measures the growth in the US monetary base less the growth in M2. As you can see, the broader measure of money supply (M2) cannot keep up with the growth in the liquidity provided by the Fed. In Europe the situation is broadly similar.

There is another way of assessing the inflationary risk. If one compares the total amount of credit destruction so far (about $14 trillion in the US alone) to the amount spent by the Treasury and the Fed on monetization and fiscal stimulus ($2 trillion), it is obvious that there is still a sizeable gap between the capital lost and the new capital provided.

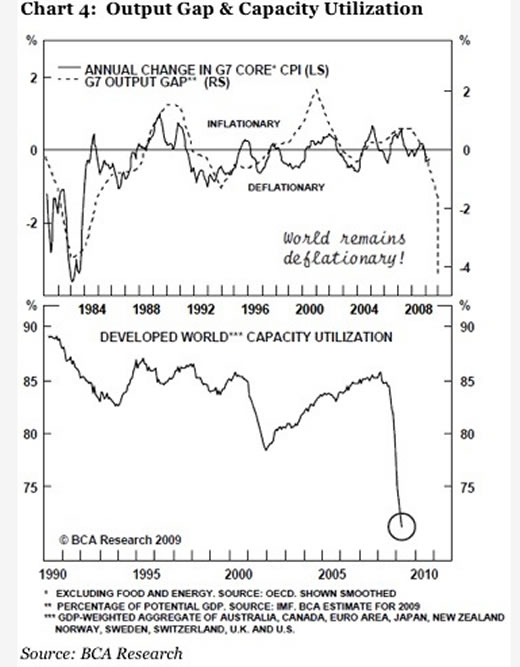

If we instead move our attention to the real economy, a similar picture emerges. One of the best leading indicators of inflation is the so-called output gap, which measures how much actual GDP is running below potential GDP (assuming full capacity utilisation). It is highly unlikely for inflation to accelerate during a period where the output gap is as high as it currently is (see chart 4). Theoretically, if you believe in a V-shaped recession, the output gap can be reduced significantly over a relatively short period of time, but that is not our central forecast for the next few years.

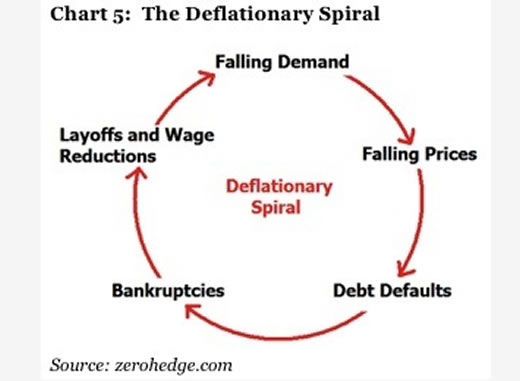

I can already hear some of you asking the perfectly valid question: How can you possibly suggest that deflation will prevail when commodity prices are likely to rise further as a result of seemingly endless demand from emerging economies? Won't rising energy prices ensure a healthy dose of inflation, effectively protecting us from the evils of the deflationary spiral (see chart 5)?

Good question - counterintuitive answer:

Contrary to common belief, rising commodity prices can in fact be deflationary so long as demand for such commodities is relatively inelastic, which is usually the case for basic necessities such as heating oil, petrol, food, etc. The logic is the following: As commodity prices rise, money earmarked for other items goes towards meeting the higher commodity price and consumers are essentially forced to re-allocate their spending budget. This causes falling demand for discretionary items and can in extreme cases lead to deflation. We only have to go back to 2008 for the latest example of a commodity price induced deflationary cycle.

A price increase on a price inelastic commodity is effectively a tax hike. The only difference is that, in the case of the 2008 spike in energy prices, the money didn't go towards plugging holes in the public finances but was instead spent on English football clubs (well, not all of it, but I am sure you get the point) which have become the latest 'must have' amongst the super-rich in the Middle East.

For all those reasons, I am becoming increasingly convinced that the ultimate outcome of this crisis will turn out to be deflation - not inflation. Inflation may eventually become a problem, but that is something to worry about several years from now. The Japanese have pursued an aggressive monetary and fiscal policy for almost 20 years now, and they are still nowhere.

So why are interest rates creeping up at the long end? Part of it is due to the sheer supply of government debt scheduled for the next few years which spooks many investors (including us). And the fact that the rising supply is accompanied by deteriorating credit quality is a factor as well. But countries such as Australia and Canada, which only suffer modest fiscal deficits, have experienced rising rates as well, so it cannot be the only explanation.

Maybe the answer is to be found in the safe haven argument. When much of the world was staring into the abyss back in Q4 last year, government bonds were considered one of the few safe assets around and that drove down yields. Now, with the appetite for risk on the increase again, money is flowing out of government bonds and into riskier assets.

Perhaps there are more inflationists out there than I thought. Several high profile investors have been quite vocal recently about the inevitability of inflation. Such statements made in public by some of the industry's leading lights remind me of one of the oldest tricks in the book which I was introduced to many moons ago when I was still young and wet behind the ears. 'Get long and get loud' it is called; it is widely practised and only marginally immoral. Nevertheless, when famous investors make such statements, it affects markets.

The point I really want to make is that the inflation v. deflation story is the single biggest investment story right now and being on the right side of that trade will effectively secure your investment returns for years to come. If I am wrong and inflation spikes, you want to load your portfolio with index linked government bonds (also known as TIPS for our American readers), gold and other commodities, commodity related stocks as well as property.

If deflation prevails, all you have to do is to look towards Japan and see what has done well over the past 20 years. Not much! You cannot even assume that bonds will do well. Recessions are bullish for long dated government bonds but a collapse of the entire credit system is not. The reason is simple - with the bursting of the credit bubble comes drastic monetary and fiscal action. Central banks print money and governments spend money as if there is no tomorrow, and all bets are off. Equities will do relatively poorly as will property prices. But equities will not go down in a straight line. The market will offer plenty of trading opportunities which must be taken advantage of, if you want to secure a decent return.

All in all, deflation is ugly and not conducive to attractive investment returns. It is also not what governments want and need right now. With a mountain of debt hitting the streets of Europe and America over the next few years, as the cost of fixing the credit and banking crisis is financed, one can make a strong case for rising inflation actually being the favoured outcome if you look at it from the government's point of view. The problem, as the Japanese can attest to, is that deflation is excruciatingly difficult to get rid of, once it has become entrenched. I am in no doubt which of the two evils I would prefer, but we may not have the luxury of choosing our own destiny.

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2008 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

dva

16 Jul 09, 12:43 |

agree

i agree with deflation. |