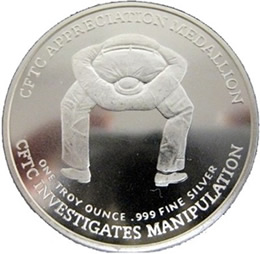

CFTC: Corrupt Foxes Tending Chickens

Politics / Market Manipulation Jul 07, 2009 - 02:57 PM GMTBy: Midas_Letter

All the hyperbole in the mainstream media announcing imminent changes by the CFTC (Commodities and Futures Trading Commission) amounts only to so much spin and P.R. There aren’t too many thinking adults involved even peripherally in the global poker game known as the Futures market who still believe the house always wins by dint of natural statistical preference.

All the hyperbole in the mainstream media announcing imminent changes by the CFTC (Commodities and Futures Trading Commission) amounts only to so much spin and P.R. There aren’t too many thinking adults involved even peripherally in the global poker game known as the Futures market who still believe the house always wins by dint of natural statistical preference.

The game is rigged.

The game is rigged.

Tracing a pattern of predictions by the financial mafia powerhouse Goldman Sachs that just happen to coincide with the evolution of short and long positions in oil reveal a pattern where Goldman profits by touting oil bullishly while building a short position, then warns of price weakness when its ready to unwind the position into the panic of their own creation. The cycle is sickening to watch, though not without some grudging admiration for the sheer force and coordination of such a well-oiled criminal enterprise.

The CFTC has been the eunuch of the American Imperial Guard (AIG) since the last Chairperson with any shred of integrity was summarily squeezed out of her role in 1999 by incumbent banksters Lawrence H. Summers, Robert Rubin and retired don Alan Greenspan. At that time, she locked horns with the presidential bagmen over exactly the kind of deregulation that made possible the massively under-capitalized Credit Default Swaps, and similarly threadbare bets on future prices of commodities. The direct result of her exile is the incomprehensibly massive “nominal” values of derivatives contracts that now exist in various futures markets, and the unregulated exempt “custom contracts” that remain unreported, unaudited, and for the most part, not subject to clearinghouse rules.

This ‘dark market’ as it has come to be known, is the abode of the “Weapons of Financial Destruction” famously coined by Warren Buffett.

At the time of Born’s forced walking of the plank, Gensler was one of the junior financial capos who lobbied in favor of this brand of de-regulation. The fact that this team of elite hitmen have now emerged intact in Obama’s regime smacks of some kind of back room deal-making that points to a compromise in exchange for cooperation.

I’ll bet that the CFTC is now going to bring actions against some sacrificial corporate lambs who neglected to donate to the democratic election fund, who, upon having their wrists very publicly and resoundingly slapped, will be held up to the glaring media light as proof positive that the problems in the derivatives markets are now over and confidence is duly warranted in the global financial system.

Today’s announcement from Lieutenant Gensler stipulating limits on speculative positions and other regulatory fortifications is heartwarming spin but in actuality more closely connotes closing the barn door after the horses have been ridden off into the sunset carrying all the loot.

In the press release Gensler, writing in the first person, declares, “The Commission will be seeking views on applying position limits consistently across all markets and participants, including index traders and managers of Exchange Traded Funds (ETFs); whether such limits would enhance market integrity and efficiency; whether the CFTC needs additional authority to fully accomplish these goals; and, how the Commission should determine appropriate levels for each market.”

The apparent holistic application of such regulation is in opposition to the inclinations of Treasury Secretary Timothy Geithner, who, in a letter dated May 13 states that, “in order to contain systemic risks, all standardized OTC derivatives should be required to be cleared through regulated central counterparties (“CCP”). CCPs in turn will be required to impose robust margin requirements and other necessary risk controls. Centralized clearing for customized OTC derivatives will not be mandated, as long as ‘customization’ of OTC derivatives is not used solely to avoid clearing through a CCP. To that end, if an OTC derivative is accepted for clearing by any CCP, a presumption for its standardized nature is created and it should be required to be cleared through CCPs as a matter of course.”

The loopholes glaring out of this most disingenuous doublespeak are better defined as Special Interest Vehicles. (SIVs) In other words, all that has to happen to avoid the clearinghouse rules is to fabricate custom contracts as opposed to standardized ones, and have ready for inspection a certificate proclaiming that their customized character is a requirement of the transaction not for avoiding clearinghouse rules.

Cute.

Also, how much would you like to bet that these “CCP’s” will most likely be incestuously bound to either Goldman Sachs or J.P. Morgan, and will then subsequently be deemed organizations that are too big to fail.

The Commodity Exchange Act states that the CFTC shall impose limits on trading and positions as necessary to eliminate, diminish or prevent the undue burdens on interstate commerce that may result from excessive speculation.

Here again, the opportunity for loophole exploitation is transparent in the vagueness of the language. What’s to prevent such excessive speculation from being distributed to several organizations under the cover of “custom contracts” to build yet another rendition of the “dark market positions” currently menacing the derivatives markets?

Interestingly, or perhaps predictably, we have moved from Geithner’s letter of May 13th stipulating good intentions to Gensler’s statement of today stipulating hearings with good intentions, and our assumption then is that this will result in legislation that embodies the spirit of such intentions.

Is it conceivable that by the time any bill makes it into the congressional process, the new loopholes will be professionally sighted and targeted by the same forces that, by virtue of their insider status with the largest criminal organization in the world, we will have forgotten about this financial crisis amidst the artificial exuberance induced by yet another over leveraged bubble?

My money’s on the foxes.

By James West

http://www.midasletter.com/commentary/090707-1_CFTC-corrupt-foxes-tending-chickens.php

© 2009 Copyright Midas Letter - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Midas Letter Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.