Depression Debate - Is this an Economic Depression?

Economics / Great Depression II Sep 09, 2009 - 01:12 AM GMTBy: Mike_Shedlock

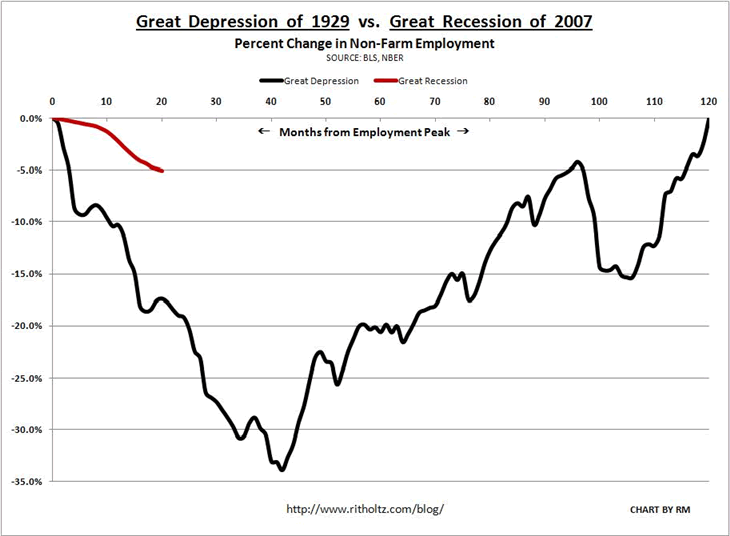

In 1929 Versus 2007: Employment Change Barry Ritholtz posted a chart of unemployment with a comment: "This chart makes it pretty clear that the current recession is no Depression"

In 1929 Versus 2007: Employment Change Barry Ritholtz posted a chart of unemployment with a comment: "This chart makes it pretty clear that the current recession is no Depression"

Actually the chart does not make anything clear other than unemployment is not as bad now as during the great depression. Given that no definition of the word depression was made it is certainly unclear whether or not we are in a depression.

Does one define a depression in terms of unemployment alone?

If so what is the cutoff?

Do we include U-3 numbers as Barry did or should we use U-6?

Is U-6 even accurate?

Do we count unemployment the same way now as during the great depression?

The answer to the latter is no, and anyone 16 years old without a job in 1930 was considered unemployed.

Comparing Recessions

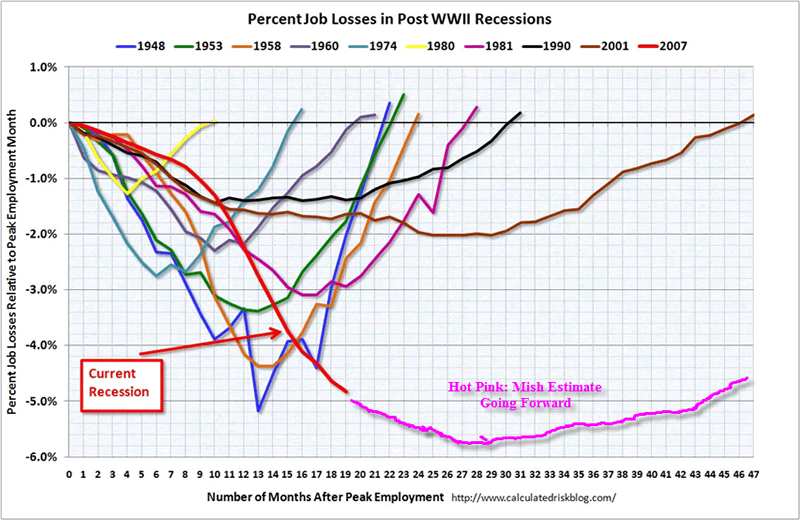

Here is a chart from Calculated Risk with my forward assessment on jobs.

Does that chart depict a "recession" or something else? If something else, do we have to keep saying the "worst recession since the great depression" or is it a "depression"?

Others have posted charts saying this was not a depression because GDP growth will not drop to -10%. Is that the definition of depression?

Point blank there is no official definition of the word.

I think one needs to look at a number of factors including GDP, unemployment numbers, duration of unemployment, consumer spending, asset prices, housing prices, consumer prices, treasury yields, wages, consumer spending, bank failures, foreclosures, etc, to make a reasonable determination.

Here's the deal.

- The US is in the midst of the steepest decline in home price on record.

- Short-term treasury yields went negative and are still close to zero.

- Long-term treasury yields hit record lows.

- Foreclosures hit record highs.

- The stock market had the biggest collapse since the Great Depression.

- U-6 unemployment is a whopping 16.8% and still rising.

- The PPI (producer price index) had the biggest drop in 59 years.

- The CPI is at -1.3% is declining at the fastest pace since 1950 according to government calculations. The real CPI by my calculations is -6.2% (See What's the Real CPI? for details).

U-6 does not count recent graduates looking for a job but living at home in search of one. It also does not count self-employed real estate agents who have not made a sale in a year. However it does count all the "self-employed" selling trinkets on Ebay making $200 a month or less. I do not have totals for that, but structural unemployment plus structural underemployment is likely North of 20%.

One does not see any of that that in the first chart. Nor does one see falling wages, the likelihood of Structurally High Unemployment For A Decade, massive bank failures, Food-Stamps Reach 33.8 Million in April, 5th Consecutive Monthly Record, or the ongoing commercial real estate bust with One Sixth Of All Construction Loans In Trouble.

These are characteristics of a depression, not a recession. It's time to stop pretending otherwise.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.