Five Reasons to Buy Agriculture Stocks Now

Commodities / Agricultural Commodities Oct 23, 2009 - 12:41 PM GMTBy: Q1_Publishing

The window of opportunity is still wide open.

The window of opportunity is still wide open.

When the markets were in a state of confusion last fall, we tried to keep our heads level and focus on the future.

One of the areas we inevitably turned to was agriculture:

This is a pretty simple one. The world’s population is growing and the world’s available farmland is not. The question here is not if there will be a big payoff, but when.

Of course, the whole investment world knew that. And it’s why agriculture stocks made such a big run between 2006 and 2008.

The good news is, however, the run in agriculture is far from over. In fact, it looks like agriculture stocks are just starting to get attention again. It really looks like the world is finally starting to see the “agtastrophe” approaching and now is a great time to get on board. Here’s why.

Supply and Demand: It Really is Just That Simple

The most obvious (and often touted) reason to buy agriculture stocks is simple.

The recent United Nations Food and Agriculture Organization (FAO) predicted:

Worldwide food production will have to rise by a staggering 70 per cent by the middle of this century if food riots are not to become commonplace…Almost 400 million people will face famine unless food production is dramatically and urgently increased.

Although I have reservations about accepting predictions from an organization whose funding is highly correlated to its predictions (the more dire the picture you can paint, the more funding you will receive), the FAO does sum up the core of the opportunity. Demand for food was, is, and will continue to be rising. Meanwhile, supply just isn’t keeping up.

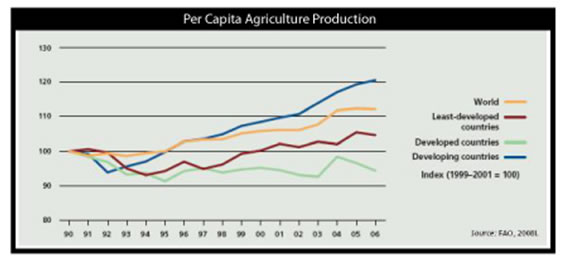

The chart above shows world agriculture production has increased a paltry 12% in the past two decades.

That’s an annualized growth rate of 0.56% per year. That’s just not going to cut it. In order to meet the FAO’s statement agriculture production must grow by 70% in the next 30 years and would require and an annualized growth rate of 1.6% - almost three times faster than the rate over the past 20 years.

It’s not just the basic supply/demand argument though. There’s also substantial upside in agriculture.

If Oil’s Headed to $200 a Barrel…

Commodities have proven to be one of the favored safe havens of Wall Street over the past few months. Oil is trading hands for more than $80 a barrel. Natural gas prices have more than doubled in the past few months. Metals prices have soared across the board. You name it - copper, gold, silver, etc. – and its up.

Agriculture commodities, however, have seemed to miss out on the majority of the race to real assets. The most actively traded agriculture commodities, like wheat and corn, have fallen back to 2007 price levels. And any recent rallies have been quickly squashed.

That’s actually good news for those of us looking at agriculture commodities now. You see, they always seem to lag behind the headline-makers like oil.

For instance, the FAO found “nominal food prices doubled between 2002 and 2008. Energy prices, led by crude oil, began rising earlier, in 1999, and have trebled since 2002.”

The chart below shows it all:

As you can see, food prices have seriously lagged energy commodities.

There are a number of reasons for this, but they will catch up. So if oil is going to $200, corn could shoot to $15 to $25 per bushel (currently trading around $4) and still be reasonably valued on a relative basis.

There’s a lot of upside from here and, as you’ll see in a moment, there just isn’t much capacity.

Technology vs. Nature

Farm productivity has improved steadily over the past few hundred years. The world has come a long way since the days when a farmer and his team of oxen were able to cultivate an acre a day.

In the past 60 years, though, farm productivity has grown by leaps and bounds. Since the Green Revolution of the 1950’s (side note: that’s the last time the world was “going to run out of food”) the amount of production per acre has increased sharply. The advent of genetically modified seeds (GMO), development of chemical fertilizers, and introduction of soil sampling and bringing science to the farm has had a tremendous impact on productivity.

Despite all the technological advancement, farming is still a very basic process. Crops still need soil, sun, and water. And one of those important factors is where the problem lies.

The lack of quality soil can be offset, to a point, with fertilizer. And there’s also the modernization of the still fertile fields of Eastern Europe and Russia, which opens up a bunch of other issues.

As for water, modern irrigation systems can transport water much farther and distribute more efficiently. Granted, water tables are falling and there are other issues, but for now, there’s enough water in most key agriculture areas.

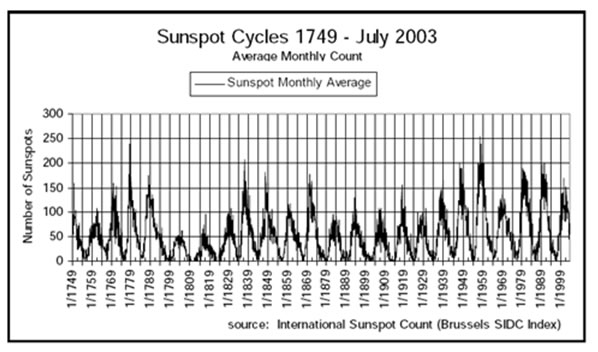

The sun will turn out to be the problem. As we’ve been covering for a long time, the sun is entering the dormant period of the sunspot cycle.

This means generally cooler temperatures, more droughts, and other less-than-ideal farming conditions. We’re just entering the low part of the sun spot cycle and this will mean lower crop yields and higher crop prices.

The relationship of the sun spot cycle to agriculture is not some new-fangled theory though. In his book Financial Astrology, David William’s states, “In 1875, English economist William Stanley Jevons…announced a correlation in the fluctuations in the prices of wheat, barley, oats, beans, peas, vetches, and rye with [the] sunspot cycle.”

The chart below shows the history of sunspot cycles:

We’re clearly in the downtrend and that is not good news for farmers. If you look closely and think historically, you can see a strong correlation with many of the major famines.

Odds Favor “Agtastrophe”

Now, the sunspot cycle isn’t anything new. We’re actually in the 24th sunspot cycle. The world knows it’s coming. The world knows the effects. And the rational person would expect the world to be getting prepared, right?

In fact, the world as a whole isn’t getting prepared at all.

As the chart below reveals, stockpiles are at record lows for wheat, rice, and coarse grains:

This reminds me of Aesop’s fable about the grasshopper and the ants.

Everyone knew winter was coming. The ants toiled away all summer and during the fall harvest season while the grasshopper just lounged around. In the end, the ants had all the food and, through their own benevolence, allowed the grasshopper to eat.

Sound similar? A period of reduced agriculture production is coming. Some investors are putting their money to work. Others are just lounging around chasing other much more fun and exciting hot money trades.

Fear and Greed

The combination of rising demand, low stockpiles, and falling production are creating the very real risk of an imminent “Agtastrophe.” Add in the upside potential of commodities and you’ve got a tremendous investment opportunity.

There’s one other very important factor here though. If and when agriculture commodities start to run up, people will start stockpiling food.

That will only exacerbate the supply/demand imbalance. That’s what happened in late 2007 with the Asian rice riots and it’s still happening all around the world. There have been a total of 70 food riots in the past three years.

That’s what makes a strong bull market in agriculture commodities different than others. When it does eventually peak, the run in agriculture will be driven by fear and greed. Those are two forces which by themselves are tremendously profitable for early investors, but are downright explosive when combined.

The big run in agriculture is coming. It may not be this month or next month, but everything is in place. And, quite frankly, it’s tough to imagine a scenario where you won’t regret owning agriculture stocks in the next five years.

Good investing,

Andrew Mickey

Chief Investment Strategist, Q1 Publishing

Disclosure: Author currently holds a long position in Silvercorp Metals (SVM), physical silver, and no position in any of the other companies mentioned.

Q1 Publishing is committed to providing investors with well-researched, level-headed, no-nonsense, analysis and investment advice that will allow you to secure enduring wealth and independence.

© 2009 Copyright Q1 Publishing - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Q1 Publishing Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.