Gold Going Higher or About to Pop? Part1

Commodities / Gold & Silver 2009 Dec 22, 2009 - 01:05 AM GMTBy: Graham_Summers

I get more emails and questions about Gold than any other investment class on the planet. With that in mind, I wanted to take a few minutes today to map out my thoughts on this subject.

I get more emails and questions about Gold than any other investment class on the planet. With that in mind, I wanted to take a few minutes today to map out my thoughts on this subject.

For starters, we need to consider that there are, in fact, two types of Gold: actual physical bullion OR paper Gold (Gold as represented by an ETF or futures contract)

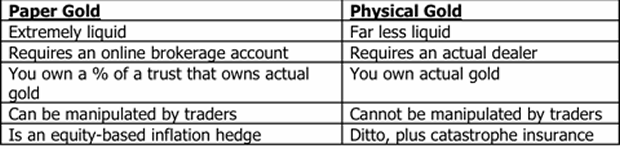

While both of these investments are called “Gold” in common conversation, the fact of the matter is that they are very different in several striking ways. I’ve mapped out a few of the differences in the table below:

As you can see, there are quite a few noticeable differences, mostly concerning liquidity (a lot vs. not as much) and manipulation (ditto). However, the key item for me is that physical bullion is something YOU own, whereas buying an ETF requires you to TRUST that the ETF owns gold.

Indeed, several investment commentators have made allegations that the Gold ETF (GLD) is not actually backed by physical Gold. Personally I have no insight on this issue. But in my opinion, if you’re going to buy Gold, you should actually OWN Gold rather than trusting a bank to own if FOR YOU (given how trustworthy the banks have proven to be). This means buying actual bullion NOT an ETF (though if you want to trade the ETF that’s probably fine).

So where is Gold going from here?

This actually is a VERY tricky subject to analyze because there is such a confluence of factors. Indeed, even if we go from what history shows us, we get mixed messages.

For starters, Gold has outperformed every asset class on the planet for the last 10 years. The last bull market in Gold was roughly ten years, running from 1970 to 1980. So strictly looking at Gold from a timing perspective (with no eye to fundamentals, inflation forecasts, etc.) this current Bull market is looking a little long of tooth.

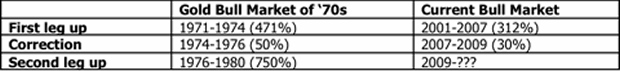

In contrast, from a gains perspective, Gold looks like it’s just getting started. During the last bull market in gold, the precious metal rose 2,329% from a low of $35 in 1970 to a high of $850 in 1980. From mid-1971 to December 1974, gold rose 471%. It then fell 50% from December ’74 to August ’76. After that, it began its next leg up, exploding 750% higher from August ’76 to January 1980.

In its current bull market (2000 to today) Gold has followed a similar pattern albeit at a much slower pace. The precious metal took nearly twice as long to complete its first leg up (2000-2007) rallying 300+% ($250 to $1,032).

Then, just like during the last Gold bull market, the precious metal staged an 18-month correction (Feb 2007-September 2009) though this time around it only fell 30% rather than the full 50% retracement in the ‘70s. Gold then erupted into its second major leg up a few months ago, tearing through the $1,000 price point and soaring to over $1,200+.

Here’s a chart detailing the two decades:

If Gold were to follow the historic trends of its last Bull Market, one could argue, from a gains perspective, that the precious metal has only JUST begun its second leg higher. And if history is any guide, THIS leg will be the BIG one (last time around Gold rallied 750% which would forecast a move to $7K+ per ounce in today’s Dollars).

Thus, right off the bat, history is showing us two very different points of view. In terms of timing, this current Gold bull market is looking pretty old (if history serves as a guide it will end in 2011). However, from a historic gains perspective, Gold’s bull market is still very much in its infancy.

Tomorrow, I’ll continue with my analysis of Gold from a supply/ demand perspective. Until then…

Good Investing!

Graham Summers

Ps. I’ve put together a FREE Special Report detailing an unusual means of playing the gold explosion. While most investors blindly pile into the gold ETF or buy gold bullion, this backdoor play allows you to buy the precious metal at an incredible $188 an ounce. As the gold speculative bubble explodes higher in the coming years, this investment offers the potential for triple digit gains.

Swing by www.gainspainscapital.com/gold.html to pick up your FREE copy!!

Good Investing!

Graham Summers

Graham Summers: Graham is Senior Market Strategist at OmniSans Research. He is co-editor of Gain, Pains, and Capital, OmniSans Research’s FREE daily e-letter covering the equity, commodity, currency, and real estate markets.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2009 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.