Ben, If You're Going to Cut US Interest Rates...

Interest-Rates / US Interest Rates Aug 15, 2007 - 06:50 PM GMTBy: Tim_Iacono

Federal Reserve Chairman Ben Bernanke pays pretty close attention to the inflation statistics, so he's probably already figured out that if he's going to cut short-term rates this year, he ought to do it in the next two months.

Just in case he hasn't figured it out already, maybe this explanation will assist in what will likely be a difficult decision-making process.

You may have already heard the headlines from earlier today after the Bureau of Labor Statistics released the consumer price data for July - headlines all around the mainstream media read "Inflation Moderate".

Within the reports you were likely to see comments about a very benign year-over-year inflation total such as, "The price index rose just 2.4 percent from last year, the lowest year-over-year gain in six months".

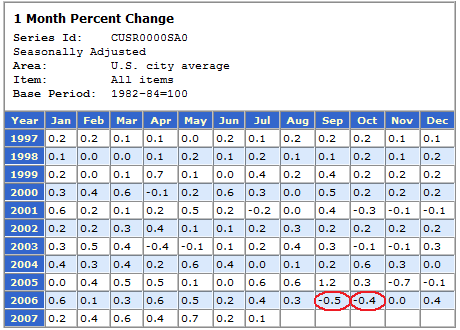

Well, here's why you aren't likely to see inflation statistics or comments like that again in a couple months - look what's set to roll off the year-over-year figures in the months ahead.

You can add up the monthly percent change from August of 2006 through July of 2007 and you'll get the current yearly total of 2.4 percent for overall inflation. But the addition gets much more interesting when the big negative numbers circled in red roll out of the calculation.

Recall that last year about this time, energy prices began tumbling after the Israel-Lebanon conflict subsided, the Goldman Sachs commodity index was re-jiggered, and the hurricane season turned out to be a dud. From early August to the first week of the new year, oil prices plunged from close to $80 all the way down to near $50.

More than anything else, falling energy prices made the late-2006 monthly inflation totals much lower than they would otherwise have been and they will soon be history as far as the year-over-year calculation is concerned.

Even if the monthly figures come in at 0.2 percent for the next three months (the average monthly increase over the last year), the year-over-year total will increase by 1.2 percentage points to 3.6 percent. If the weeks ahead prove to be an above-average hurricane season (as currently forecast), we could be looking at four percent inflation again this fall in the BLS data - that hasn't happened in more than a year, since the late-2005 to mid-2006 energy price surge.

When government inflation tops four percent, then people really start to squirm because, by now, nearly everyone has some multiplier in their head with which to calculate the inflation they experience based on the government's version (1.2x, 1.5x, 2x - it depends what you buy).

Ben Bernanke will find it much easier to maintain his inflation fighting credibility by lowering interest rates when inflation is at two percent ( such a benign number ) than he might in a few months when, even if prices don't rise, inflation will go up.

By Tim Iacono

Email : mailto:tim@iaconoresearch.com

http://www.iaconoresearch.com

http://themessthatgreenspanmade.blogspot.com/

Tim Iacano is an engineer by profession, with a keen understanding of human nature, his study of economics and financial markets began in earnest in the late 1990s - this is where it has led. he is self taught and self sufficient - analyst, writer, webmaster, marketer, bill-collector, and bill-payer. This is intended to be a long-term operation where the only items that will ever be offered for sale to the public are subscriptions to his service and books that he plans to write in the years ahead.

Tim Iacono Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.