U.S. Economy Could Be Facing More of a Downturn Than a Recovery

Economics / Recession 2008 - 2010 Apr 26, 2010 - 09:50 AM GMTBy: Gerard_Jackson

All is well. Reuters declared that the US is experiencing a "sturdy recovery". This is the same phony news agency that used to choke on the word recovery when used by the Bush administration. Now some American conservatives are warning that Republicans are being dangerously bearish on the economy, that there are signs, weak as they are, that a recovery is underway. Matthew Continetti of the conservative Weekly Standard states that the "natural tendency of economies is to grow". Nevertheless, he seriously questions whether Obama would now benefit from a recovery.

All is well. Reuters declared that the US is experiencing a "sturdy recovery". This is the same phony news agency that used to choke on the word recovery when used by the Bush administration. Now some American conservatives are warning that Republicans are being dangerously bearish on the economy, that there are signs, weak as they are, that a recovery is underway. Matthew Continetti of the conservative Weekly Standard states that the "natural tendency of economies is to grow". Nevertheless, he seriously questions whether Obama would now benefit from a recovery.

Unfortunately most conservatives remain as uninformed about economic history and economic theory as the vast majority of Democrats. If Mr Continetti were to enlighten himself -- even casually -- on these subjects he would quickly learn that there is nothing natural about economic growth. If such a tendency existed then mans history would not largely consist of abject poverty and one where it was only possible for only a handful to enjoy a very high standard of living.

Argentina was once one of the world's wealthiest country's, thanks to the kind of economic policies that Obama and his gang of economic illiterates are fighting to impose on the US it has been an economic basket case for decades, with no sign in sight of a natural recovery. The tragedy of the Great Depression should have put to rest the idea that the so-called business cycle is inevitably followed by a "natural" recovery. Any economic recovery must always be based on individual action. In fact, there is nothing natural about the business cycle in the same sense that one thinks of the seasons as being both natural and cyclical.

Before Hoover and Roosevelt appeared on the scene governments stood aside once a depression set in, allowing the market to make the necessary liquidations and adjustments, painful as they were. Hoover and Roosevelt decided to take it upon themselves to substitute their superior knowledge and experience for the market process. The result was the deepest and longest depression in American history.

Not only did a "natural tendency" for the economy to grow fail to appear but the period was marked as one of capital consumption -- the very opposite of growth. (One should never make the mistake of confusing a rise in GDP with economic growth.) Once again: growth is a process of capital accumulation. Right now the only thing America is accumulating are massive debts, deficits and spending commitments, all of which signal huge rise in the level of taxation. One would have to be a fanatical Democrat to genuinely believe that this situation is conducive to sustained economic growth, particularly when government spending is accelerating at the fastest rate on record. Obama's excesses are beginning to make Hoover and Roosevelt look like a pair of laisezz faire revolutionaries.

Despite the relentless efforts of the so-called mainstream media to paint a picture of an economy on the rebound, a peek under the sheets tells a different story. It now appears that there was only a modest rise in business revenues for the first quarter of this year. Note: I said revenues, not profits. (When headlines scream A 90 Percent Rise in Profits one should always ask: 90 per cent of what?)

Sluggish revenues do not suggest a healthy recovery that would bode well for investment and the jobless, especially when we consider that 'surging' profits have been due to severe cost-cutting measures. Given the extent of these cuts I cannot see how they can be taken much further. General Electric is an interesting case in point. It announced early this month that revenues for the last quarter were down $36.6 billion, a drop of 5 per cent from a year ago, while the last quarter earnings were down 18 per cent from the same quarter of 2009. Compounding its woes new orders fell by 8 per cent compared with the same period twelve months ago. Falling orders strongly suggest falling revenue. Hardly a recipe for a robust recovery.

Banks have been accused of restricting credit to business. But the fact remains that business is not complaining about a lack of credit but a lack of revenue. Moreover, bank earnings might not be anything to write home about, despite what the media are telling you. For example, the first quarter saw revenue from the Bank of America's commercial banking activities drop significantly compared with the same quarter last year. Revenue from credit cards fell by about 30 per cent, suggesting that consumer borrowing is contracting, while revenue from its mortgage activities dived by a massive 48 per cent compared with the same quarter twelve months ago.

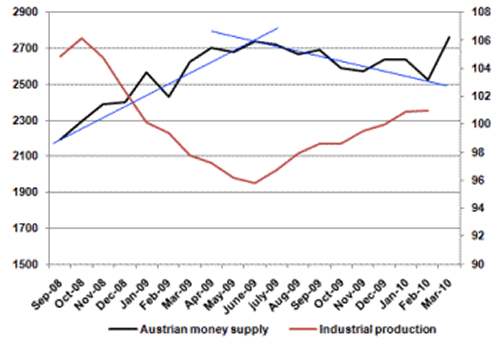

I warned in other articles that the current monetary situation is not as loose as many economic commentators have argued. Although from September 2008 to the following June it zoomed by about 25 per cent, an annual rate of about 33 per cent, it then came to a screeching halt after which it started to contract as the chart below shows. The chart also shows movements in industrial production corresponding with changes in the money supply given a time lag.

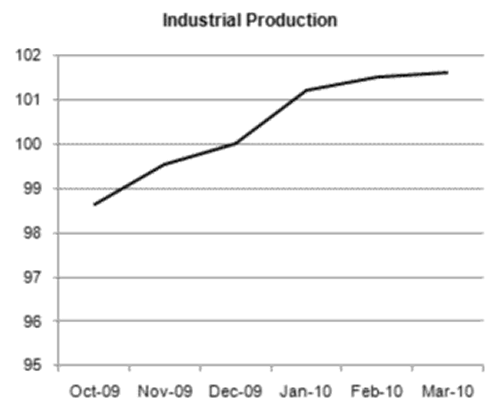

We can see that in January industrial production apparently flattened out, seven months after the monetary contraction began. However, revised figures now reveal that production had in fact continued to expand. Nevertheless, the following chart clearly shows that a deceleration did begin in January and that it continued into March*.

If the sudden spurt in the money supply turns out to be merely a spike then monetary policy will remain tight. We can therefore expect industrial production to continue to slowdown. On the other hand, if the money supply is indeed rapidly expanding then things will eventually turn very nasty. Either way, the US economy is in for a very rough ride.

--------------------------------------------------------------------------------

*Some readers concluded from this paragraph that I seem to be arguing that a fixed money supply must result in a permanent "recession" or "economic stagnation". Nothing of the kind. According to Austrian analysis the reason why a reduction in the rate of monetary growth causes industrial production to slowdown is because the previous monetary expansion created economic activities whose existence or expansion is dependent on a growing money supply. Once the money supply starts slowing so do these activities.

If the money supply had been fixed in the first place production would have continued to expand with increased productivity taking the form of gently falling prices marked by increased purchasing power. Other readers have raised the question of the current expansion in manufacturing, wondering whether it is due to the previous distortions having been fully liquidated. I do not believe this is the case which means that if a monetary tightening were to continue then manufacturing will also start to slow.

By Gerard Jackson

BrookesNews.Com

Gerard Jackson is Brookes' economics editor.

Copyright © 2010 Gerard Jackson

Gerard Jackson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.