Greek Debt Downgraded to Junk Bond Status Hitting Stocks

Commodities / Gold and Silver 2010 Apr 29, 2010 - 12:52 AM GMTBy: Bob_Kirtley

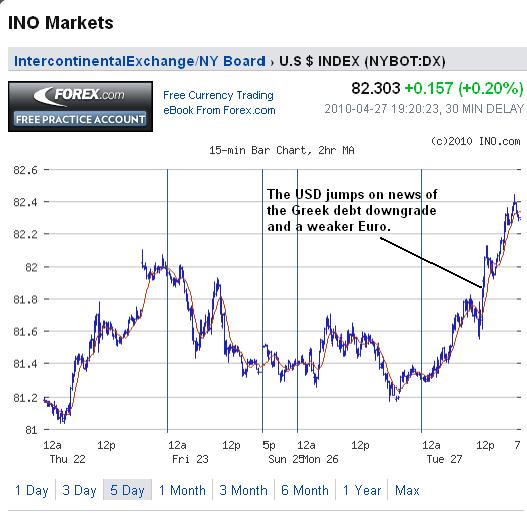

Its been coming for some time now and today it arrived, the S&P has downgraded Greek debt to Junk and took Portugal down two notches to A minus. This news, although expected, hit the Euro and promptly sent the dollar and gold prices higher, nice to see them both going up together.

Its been coming for some time now and today it arrived, the S&P has downgraded Greek debt to Junk and took Portugal down two notches to A minus. This news, although expected, hit the Euro and promptly sent the dollar and gold prices higher, nice to see them both going up together.

The broader markets also suffered with the DOW losing 213 points, the NASDAQ lost 51 points and the S&P lost 28 points.

As the market came to a close the Kitco Gold Index was showing gold down $15 due to dollar strength but up $33 due to gold buying, pushing gold prices through $1170.00/oz at one time.

A few snippets from the Wall Street Journal summarise the situation as follows:

“The downgrade of both Greek and Portuguese government debt by S&P is another indication that the eurozone’s fiscal crisis is continuing to deepen ,” Ben May, an economist with Capital Economics in London, said.

“In all, a stark warning that a Greek rescue package, if and when it finally appears, will not be the end of the crisis.”

S&P slapped Portugal with a two-notch downgrade to A minus, with the ratings agency saying it expects the nation’s government to struggle to stabilise its relatively high debt ratio until 2013.

S&P said that Portugal’s deep budget deficit — at 9.4 per cent of gross domestic product — and its dependence on scarce foreign financing will make it necessary to introduce more budget cuts.

To read the article in full please click this link.

The Euro is down about 8% so far this year and the way things are shaping up we wouldn’t be surprised to see it drop from today’s one Euro to 1.32 dollars to around 1.20 dollars as the year unfolds.

The white knight in this pantomime is Angel Merkel, the German Chancellor, however, there are regional elections in Germany on the 9th April 2010 so an expensive bailout for Greece is not flavour of the month for German voters. So until they are out of the way, a certain amount of brinkmanship can be expected. The next date to make a note of is the 19th May 2010 when Greece has a large bond maturity and subsequent roll-over, who will buy it now its been rated as junk. The heat is on the European Union and the IMF to sort through the issues and put together a rescue package that satisfies many requirements and individual players.

As we see it the austerity to be shouldered by the Greeks will be crippling and the alternative of leaving the European Union and starting again with an albeit devalued currency might be a better way to go.

As we can see from the above chart the jump in gold prices hardly effected the stocks, maybe they were held back by the general sell off in the broader markets. This is something that we have eluded to in the past, in that the precious metals stocks are failing to keep pace with the metals progress. We hold the mining stocks in order to gain exposure to the metals on a leveraged basis. Without the leverage there is very little point in holding mining stocks as they carry numerous risks so we really need to see a risk to reward ratio of about 3:1 to make it worth while. We will continue to monitor the investment landscape and hopefully position ourselves correctly in order to maximise our returns in this bull market, the only game in town.

As a suggestion for those who do want leverage to the precious metals bull, the gold and silver funds together with the careful application of options trades could be a possible solution for you. This way we are exposed to any movement in gold prices which in turn is magnified by the effect of the option. Do remember that loses are also magnified in the same way so its not a strategy for the faint hearted. On the other hand the quality stocks are not performing as anticipated and a non-producing junior stock is a shot in the dark, however, its your money and its your call.

For those interested in getting a bit more bang for your buck and adding a touch more excitement to your portfolio, then check out our Options Trading Service please click here.

Got a comment then please add it to this article, all opinions are welcome and appreciated.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.