Gold and ‘The’ Parabolic Peak

Commodities / Gold and Silver 2010 Apr 29, 2010 - 10:09 AM GMTBy: Dudley_Baker

Frequently we are told that gold will go to $2,000, $3,000 or more. We will not get into all of the arguments of attempting to arrive at a reasonable price based on supply/demand, inflation/deflation, etc. but rather to see if there is a pattern we can detect from reviewing some historical charts.

Frequently we are told that gold will go to $2,000, $3,000 or more. We will not get into all of the arguments of attempting to arrive at a reasonable price based on supply/demand, inflation/deflation, etc. but rather to see if there is a pattern we can detect from reviewing some historical charts.

Sometimes we hear in the press that gold is in a bubble or has gone parabolic. What does all of this mean to investors and how do we make decisions based upon these statements?

To us a bubble is a kin to a parabolic move in the underlying stock or commodity which is not easy to explain. Our definition would be a market that has gone straight up and this could be for a period of days, weeks, months or years depending on our time horizon of interest. Looking at charts frequently paints a good picture of what is meant by a parabolic move.

Most of us can recall parabolic moves in many markets so we put some historical perspective to some past parabolic moves of other commodities and stocks, i.e., Nasdaq 100, Japanese Nikkei 225, Crude Oil, Toll Brothers (as a proxy for the housing stocks) and Homestake Mining.

We have presented charts on each of these commodities or stocks below on a monthly basis to best see the long term picture. We are trying to identify when the last obvious resistance was broken to the upside, thus setting up the move into the ultimate parabolic peak.

After a review of charts for each presented to you below, we come to the conclusion that gold will hit its parabolic peak between a low of $2,450 to $3,500. We thus find it interesting that our target price aligns very closely with the projections of others thus giving us more comfort that we are all on target.

Nasdaq 100 Index

Remember what most of us recall as the ‘internet bubble’?

Japan Nikkei 225

Another great bubble chart is that of the Japan Nikkei 225. Look at that monster rise into January 1990 and rate of the rise. Now this was a parabolic rise.

Toll Brothers

Crude Oil

Remember all the excitement when crude ran up to $147?

Now let’s look at gold:

Where is the parabolic move? There is none. Look at this beautiful monthly chart on gold from the low in 2001. This is a chart of beauty and it is not a chart of a bubble, yet.

Gold (Monthly)

Gold (Daily)

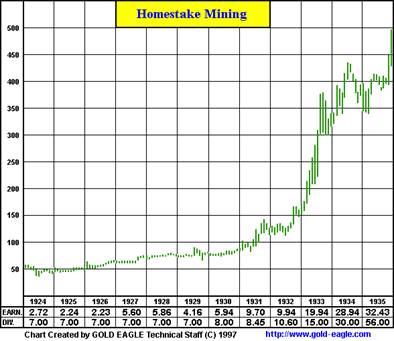

Homestake Mining

We are in the camp with Jim Rogers, Bob Hoye, David Nichols, Marc Faber and Pamela & Mary Anne Aden. Up is the direction and the remaining question is how high? With the analysis above we believe we can potentially frame the high between $2,450 and $3,500. A wide range we agree, but we believe we will see signs along the way as price reaches our estimated time frame for the top.

When we start to see gold go parabolic, rising day after day and everyone in the world getting excited and joining the party, then we will know gold is in a bubble. We believe that gold’s big move up with be a moon shot like this chart of Homestake Mining from 1932 to 1934. Our challenge then will be to exit before the masses and we see the strong possibility of this event happening within the next 18 months.

We believe investors are being given the rare possibility of a once-in-a-lifetime-opportunity, yes, a parabolic move in gold. The question is what will you do with it and do you need some assistance?

For those readers unfamiliar with our services:

- PreciousMetalsWarrants.com provides an online database for all warrants trading on the natural resource companies in the United States and Canada.

- InsidersInsights.com tracks the buying and selling of corporate insiders with a focus on the junior mining and natural resource sectors. Buy and Sell Alerts are issued as deemed relevant based upon our analysis.

We encourage all readers to sign up for our free weekly email.

Dudley Pierce Baker

Guadalajara/Ajijic, Mexico

Email: support@preciousmetalswarrants.com

Website: PreciousMetalsWarrants

Website: InsidersInsights

Dudley Pierce Baker is the owner and editor of Precious Metals Warrants and Insiders Insights. Articles are written by Dudley Baker along with contributing editors, Arnold Bock of Mendoza, Argentina and Lorimer Wilson of Toronto, Canada. PreciousMetalsWarrants provides an online subscription database for all warrants trading on junior mining and natural resource companies in the United States and Canada and a free weekly newsletter. InsidersInsights alerts subscribers when corporate insiders of a limited number of junior mining and natural resource companies are buying and selling.

Disclaimer/Disclosure Statement:PreciousMetalsWarrants.com is not an investment advisor and any reference to specific securities does not constitute a recommendation thereof. The opinions expressed herein are the express personal opinions of Dudley Baker. Neither the information, nor the opinions expressed should be construed as a solicitation to buy any securities mentioned in this Service. Examples given are only intended to make investors aware of the potential rewards of investing in Warrants. Investors are recommended to obtain the advice of a qualified investment advisor before entering into any transactions involving stocks or Warrants.

Dudley Pierce Baker Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.