GDWheee Friday - Could be a Wild Stock Market Ride!

Stock-Markets / Stock Markets 2010 Apr 30, 2010 - 11:29 AM GMTBy: PhilStockWorld

Attention ladies and gentlemen:

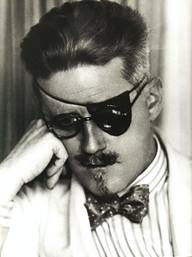

The stock market will soon be leaving the station, please secure all personal items, pull down the safety bar (our Disaster Hedges) and keep all body parts inside ride at all times. Well you know you can follow all of the safety instructions and STILL get smacked in the face with a black swan (like our friend Fabio, pictured here) which is why we elected to get back to cash ahead of this report. The markets were just too insane this week and who the heck knows if Europe will still be a Union on Monday or what the GDP number is going to be (but I do think it’s a miss).

Attention ladies and gentlemen:

The stock market will soon be leaving the station, please secure all personal items, pull down the safety bar (our Disaster Hedges) and keep all body parts inside ride at all times. Well you know you can follow all of the safety instructions and STILL get smacked in the face with a black swan (like our friend Fabio, pictured here) which is why we elected to get back to cash ahead of this report. The markets were just too insane this week and who the heck knows if Europe will still be a Union on Monday or what the GDP number is going to be (but I do think it’s a miss).

Since our biggest weekend fear is financial panic in Europe, our cash US dollars will become more valuable in a crisis and if the market drops, all the better as we can ride back in and do some bargain hunting. If the market takes off on good GDP and Greece is "fixed" and Spain is "fixed" and Portugal and Ireland are not really a problem (especially for MS and JPM) and the CRIMINAL charges against Goldman look beatable and and the Financial Reform Bill doesn’t disrupt the market with a disorderly breakup of the big banks and the Bank of International Settlements Report continues to be ignored and the run on the Greek banks doesn’t spread to other STUPID counties - well, then we can BUYBUYBUY because, if all this doesn’t matter, then it’s very likely that the entire planet Earth could explode but Wall Street will keep ticking higher.

Since our biggest weekend fear is financial panic in Europe, our cash US dollars will become more valuable in a crisis and if the market drops, all the better as we can ride back in and do some bargain hunting. If the market takes off on good GDP and Greece is "fixed" and Spain is "fixed" and Portugal and Ireland are not really a problem (especially for MS and JPM) and the CRIMINAL charges against Goldman look beatable and and the Financial Reform Bill doesn’t disrupt the market with a disorderly breakup of the big banks and the Bank of International Settlements Report continues to be ignored and the run on the Greek banks doesn’t spread to other STUPID counties - well, then we can BUYBUYBUY because, if all this doesn’t matter, then it’s very likely that the entire planet Earth could explode but Wall Street will keep ticking higher.

Yep, I can’t wait to ride this baby mindlessly higher! After all, what can go wrong? BIDU is ONLY $710 a share, BLK is $190, CMP is $76, GOLD is $84, BUCY is $65, FAST is $56, MMM is $90, FOSL $40, F $13.50, DECK $149, SHOO $55, TPX $35, LZB $14, CTB $22, NOG $16, CEO $176, FTI $75, CLB $150, CIB $46, BBD $19, TD $75, BCA $45, BAP $87, ITUB $22, EDU $94, WYNN $93, FFIV $72, CY $14, CREE $77, UPS $70, UNP $78…

These were stocks I was looking at last week, when I told members I thought it was easier to construct a Sell List than our usual Buy List for this market but, if we’re heading to 1,350+ on the S&P, then all these guys should be heading to all-time highs as well. Why not? They’re stocks and that’s good enough for any self respecting BuyBot, isn’t it?

Of course we shorted BIDU yesterday along with OIH (on that nat gas report), and we are still accumulating EDZ and TBT (of course!) and initiated SMN again but we went long on DVN, MON, VLO and SPWRA while we celebrated our DNDN plays, something we’ve been playing for years now but, as recently as Monday, we still found ways to have fun as my trade ideas for Members were:

Keeping in mind that DNDN is pretty much a one trick pony and that the approval is mainly priced in and that they could go to zero, I think the prudent trade is the 2012 $20s at $25, selling the Jan $45s for $10 and buying the Jan $20 puts for $3. That puts you in the $25 spread for net $18. To the upside, you can roll the Jan $45s to the 2012 $55s (now $9) so $35 possible upside. Flat you wipe out the Jan callers and you are still $15 in the money with a year to sell calls. Downside you have puts that will give you a profit if DNDN goes bust or if (even better) if there is panic selling on a delay.

Here’s another interesting DNDN play. It’s only $6.15 for the Jan $25/35 spread and you can buy 2 of those and sell 1 $55 call for $6 and that puts you in for net $3 on two $10 spreads so $14 of upside between $35 and $50 before you owe the caller a dime. $64 is where you would start to lose money to the upside so break even is $28-$64.

Most of us are in DNDN stock at $5 of less so these are "gravy" plays as we grew confident this week we’d be getting an approval. If you want a great read on the DNDN Odyssey, check out Michael Milken’s summary of all the nasty manipulation around DNDN. A very satisfying to read now that we’re up 1,000% but, at the time, I was none too happy with Cramer and Feuerstein as they relentlessly tried to stampede investors out of the company.

Most of us are in DNDN stock at $5 of less so these are "gravy" plays as we grew confident this week we’d be getting an approval. If you want a great read on the DNDN Odyssey, check out Michael Milken’s summary of all the nasty manipulation around DNDN. A very satisfying to read now that we’re up 1,000% but, at the time, I was none too happy with Cramer and Feuerstein as they relentlessly tried to stampede investors out of the company.

8:30 Update: Oops, back to work! The GDP for Q1 came in at 3.2%, just a little bit below expectations and quite a bit down from Q4s 5.6% pace. Consumer spending was up a whopping 3.6% (adding 2.55 points to GDP) and Business Inventories are up 13.4% (adding 1.57 points) so I sure hope that consumer number keeps up or we’ll be overfilled at the warehouse! According to the BEA: "The increase in real GDP in the first quarter primarily reflected positive contributions from personal consumption expenditures (PCE), private inventory investment, exports, and nonresidential fixed investment that were partly offset by decreases in state and local government spending and in residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased. The deceleration in real GDP in the first quarter primarily reflected decelerations in private inventory investment and in exports, a downturn in residential fixed investment, and a larger decrease in state and local government spending that were partly offset by an acceleration in PCE and a deceleration in imports."

Something about this data bothers me as Real Disposable Income (income adjusted for inflation and taxes) was flat and savings only dropped from 3.9% to 3.1% so where did the consumer spending come from? I’ll have to take a closer look at this over the weekend but the markets certainly seem happy ahead of the open (8:45) but there’s nothing in this report that makes me regret cashing out bull plays into yesterday’s rally. The WSJ pointed out last week that Mark Zandi had said as much as $60Bn worth of consumer spending was the result of money "saved" by 5M people who are living in their homes but have stopped making their mortgage payments - maybe he’s onto something because this money seems to have just magically appeared otherwise…

Something about this data bothers me as Real Disposable Income (income adjusted for inflation and taxes) was flat and savings only dropped from 3.9% to 3.1% so where did the consumer spending come from? I’ll have to take a closer look at this over the weekend but the markets certainly seem happy ahead of the open (8:45) but there’s nothing in this report that makes me regret cashing out bull plays into yesterday’s rally. The WSJ pointed out last week that Mark Zandi had said as much as $60Bn worth of consumer spending was the result of money "saved" by 5M people who are living in their homes but have stopped making their mortgage payments - maybe he’s onto something because this money seems to have just magically appeared otherwise…

The housing sector does indeed look weak here, with Residential Fixed Investment decreasing 10.8%. Home Sales and Construction fell after the expiration of the government tax credit for first-time buyers but a second tax credit kicked in to help the market this spring and should help GDP in the second quarter. Federal Government spending also helped at it increased 1.4% for the quarter. I wish Zandi had calculated how much business spending is boosted by not paying their rents or getting rent reductions - check your local paper - you can sign a 3-year business lease and get the first 6 months for free - that’s going to free up some cash too! Oh, silly me, I forgot to put VNO at $86 and BXP at $83 on my sell list!

Not on anyone’s sell list is New Home Sales, which JUMPED 27% in March but, as Cap pointed out in Member Chat, that’s up 8,000 homes from last March or 5 homes per day per state. How many realtors is that actually going to feed? In fact, 39,000 homes is 68% LESS than March 2004’s 123,000 and 69% LESS than 127,000 in March 2005 and 63% LESS than 80,000 in 2007… You get the idea, we are only celebrating mediocrity in both the markets, with their silly earnings comparisons, and in our GDP as we comp to a disaster. We’ll just have to see if this is a "sell on the news event." As I said at the top, we don’t care, we’re back to cash!

Asia had a nice morning keying off our rally with the Hang Seng gaining 1.6%, back to 21,108 but the Shanghai needed a 50-point stick into the close just to gain 2 points for the day - that must have cost someone a LOT of money to paint that picture… The Nikkei bounced back 132 points (1.2%) and got back over 11,000 to 11,057, pretty much just following the Dow around. Japanese Consumer prices continue to fall for the 13th consecutive month, dropping 1.2% in March as unemployment ticked higher.

Asia had a nice morning keying off our rally with the Hang Seng gaining 1.6%, back to 21,108 but the Shanghai needed a 50-point stick into the close just to gain 2 points for the day - that must have cost someone a LOT of money to paint that picture… The Nikkei bounced back 132 points (1.2%) and got back over 11,000 to 11,057, pretty much just following the Dow around. Japanese Consumer prices continue to fall for the 13th consecutive month, dropping 1.2% in March as unemployment ticked higher.

Europe is flat to down this morning, just ahead of our open now and I think the plan is to bail out Greece so Greece can bail out Spain who will bail out Portugal, who can then bail out Ireland who will then rejoin the UK and take over all their banks and then un-join the UK and then go completely bankrupt (sorry Ireland!) as they are used to depressions over there (have you read Joyce?) and they have really good beer anyway, which is a nice consolation.

Like last Friday, we’re going to let the markets run but unlike last Friday, I’m didn’t wait until the weekend to decide to get out. We’ll see if I was right…

By Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.