Stock Market, This Week Never Happened!

Stock-Markets / Stock Markets 2010 May 28, 2010 - 09:44 AM GMTBy: PhilStockWorld

That’s right – yoos guys didn’t see nothing this week.

That’s right – yoos guys didn’t see nothing this week.

If anyone asks you, nothin’ happened this week and you don’t know nothin’ about no crash. I mean, what crash, right? We got those markets higher than where they were last Friday (don’t ask how) and if anyone tells you anything different just tell ‘em to come see me and Lloyd and we’ll tell ‘em the way it’s gonna be. Goldman who? Euro what? Financial regulation where? You know what your problem is? You worry too much! It’s not like the World is gonna end until 2012 so why not live a little?

Sure the Banksters are using accounting tricks, including (according to the WSJ): Goldman Sachs Group Inc., Morgan Stanley, J.P. Morgan Chase & Co., Bank of America Corp. and Citigroup that ”have masked their risk levels in the past five quarters by temporarily lowering their debt just before reporting it to the public, understating the debt levels used to fund securities trades by lowering them an average of 42% at the end of each of the past five quarterly periods. “

Sure the Banksters are using accounting tricks, including (according to the WSJ): Goldman Sachs Group Inc., Morgan Stanley, J.P. Morgan Chase & Co., Bank of America Corp. and Citigroup that ”have masked their risk levels in the past five quarters by temporarily lowering their debt just before reporting it to the public, understating the debt levels used to fund securities trades by lowering them an average of 42% at the end of each of the past five quarterly periods. “Well who cares as long as it makes things look good, right? That’s the lesson we are all meant to take out of the already forgotten about financial crisis of 2008 – it’s only a crime if you get caught AND you are found guilty AND there is a penalty that exceeds a day’s worth of earnings. Other than that – Fuhgeddaboudit!

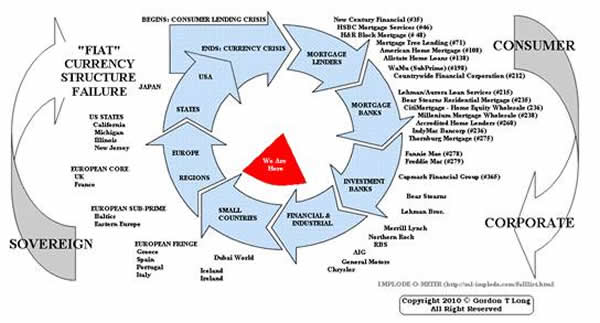

The Chinese are bailing out the Americans (who are bailing out their banks and the IMF) and the Germans (who are bailing out their banks and the IMF and the EU) and the Saudis (who are bailing out their banks and the IMF and Dubai) and the EU is bailing out Iceland and Ireland and the IMF is kicking in a little something to grease Greece along with Spain, Italy and Portugal and, once they are on their feet, I’m sure they will bail out the Baltic States and Eastern Europe before it’s time to bail out France and the UK and once those guys are all bailed out, bailing out California, Michigan, Illinois and our beloved New Jersey will be a snap and then we can all toss Japan a few dollars too - Fuhgeddaboudit!

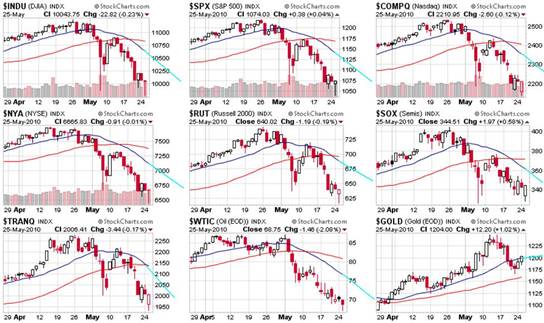

Don’t you worry your head over this chart here. We made all that other stuff go away and we’ll make the chart go away too. The fix is in, I tell ya. What did I say on Wednesday? I said “THEY” (’cause my lawyer says not to say “WE,” in case someone is listening, if you know what I mean…) were flushing out the suckers to clear the decks so “THEY” could (and I quote): “buy the SPX overnight and pump us up for a big finish so they can get back to cash on Friday and book it.” And that’s what happened. Are you surprised? I’m not surprised – how could I be surprised? I told you it was gonna happen! In fact, On Wednesday morning I even painted you this picture:

Under this picture I told you: “screw the fundamentals today, it’s all about retaking those blue lines(20 dmas) by the end of the week.” End of the week is here and how do the charts look this morning?

See, the fix is in. Oops, I meant to say – See, it’s all fixed or at least fixed enough to bring in a fresh round of suckers, the kind who didn’t go to Church with us yesterday as we prayed during Member Chat into yesterday’s close: “Dear Lloyd, lead us not into temptation. We are weak and we fall for these low-volume pops every time. Keep us on the path of the well-hedged and light our way with solid floors we can use as stops when thy will be done – Amen….

In fact, yesterday’s fireworks inspired us to get back into the insurance game and we flipped a little bearish right into the close by buying back 1/2 of our short DIA June $103 puts as we got a buck from them already. That’s our overriding “Mattress Play,” that helps us flip from bullish to bearish on the fly. We hit our goals of 5% runs, especially when we consider the S&P Futures bottomed out at 1,055 Wednesday night while our boy Jim was predicting Dow 9,500 and sending those lemmings of his off the cliff in after hours trading. That allowed our man, “THEM“ to BUYBUYBUY those index contracts and 5% over that mark is 1,107 and, wouldn’t you know it – we hit 1,106.75 in the Futures this morning when “THEY” (coincidentally, I’m sure) bolted for the exits.

In fact, yesterday’s fireworks inspired us to get back into the insurance game and we flipped a little bearish right into the close by buying back 1/2 of our short DIA June $103 puts as we got a buck from them already. That’s our overriding “Mattress Play,” that helps us flip from bullish to bearish on the fly. We hit our goals of 5% runs, especially when we consider the S&P Futures bottomed out at 1,055 Wednesday night while our boy Jim was predicting Dow 9,500 and sending those lemmings of his off the cliff in after hours trading. That allowed our man, “THEM“ to BUYBUYBUY those index contracts and 5% over that mark is 1,107 and, wouldn’t you know it – we hit 1,106.75 in the Futures this morning when “THEY” (coincidentally, I’m sure) bolted for the exits.

Nasdaq futures bottomed at 1,783 and this morning they bailed at 1,874 – two whole points over 5% and the Russell was also popped over the 666 5% line (from 634 Wednesday night) by 5 points before someone pulled the trigger but, as we know, the S&P is our button man. Someone (I don’t know who and, if you ask me, I got a guy who says I wasn’t there) bought the Dow futures at 9,828 while the sheeple were selling and they got out at 10,277, which is less than 10,319 (the 5% mark) but you know – the Dow – Fuhgeddaboutdit…

I’d talk about fundamentals this morning if they mattered but the game is over for the week. May is over, whoever wanted to pop 5% at the end of the month is long gone and all the suckers are left holding the bag into a long weekend. Like any good mob fans, we’ve got our bags of cash on the sidelines and we’ll see which way the wind is blowing next week but this weekend, we’re going to have the family over and, as you know, nothing is more important than the family!

Our boys are working overtime and Personal Income is up 0.4% but we ain’t spending none of it and Personal Spending is up 0%, nada, zip! The Feds thought they could squeeze 0.3% out of us but we gave them the slip and held onto our money. We get the May PMI from our friend in Chicago at 9:45 and then our boys in Michigan check in with the word on Consumer Sentiment, also for May. PMI should be flat around 60 but if those consumers don’t cheer up with a 20% drop in the oil vig – then watch out below!

Have a great holiday weekend,

- Don Phil

By Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.