Silver Verses Gold?

Commodities / Gold & Silver Sep 03, 2007 - 11:25 AM GMTBy: Bob_Kirtley

As you already know the team here are gold , silver and uranium bugs and we regard all three as precious metals. However in recent months a number of analysts have placed gold ahead of silver in terms of which will generate the best returns. Some of our readers have wrote and asked if we agree that gold will be the better performer?

The short answer is no we do not agree .

Firstly we will look at why they might think this way by bringing up this short-term chart of silver verses gold :

It looks real bad for silver as you can see silver has been hit very hard. As investors who follow this on a day to day basis our minds are filled with the micro activity occurring on our screens by the minute so much so that last month appears to be a long time ago. Isolated instances such as these must not be seen as the ‘norm' as you all know one swallow does not make a summer.

Now stand back and look at the longer-term history of silver verses gold. Wow, we now have a totally different picture with silver outperforming gold over last few years.

Try to bear in mind that 51% of silver is used for industrial purposes and is therefore effectively taken off the market with little chance of ever coming back, the same cannot be said of gold.

We can also see that silver is much more volatile than gold which in turn provides us with both investment and short-term trading opportunities. We have recently given a number of buy calls on quality silver stocks ( PAAS and SSRI ) and also taken out a short term bet on silver itself in the London market (the silver spot price has risen 22 cents since our BUY signal and we are very happy with the progress so far ) .

We are bullish and excited about the prospects for gold and anticipate excellent returns from both gold and it's associated quality mining stocks .

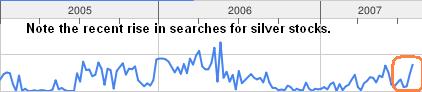

The next chart is from Google trends and clearly shows the increased interest in silver stocks by the increase in the number of searches carried out for 'silver stocks'

And finally a quick look at the chart for silver itself depicting the recent sell off, presenting us with a buying opportunity and also showing us that silver has already started on the road to recovery.

Going back a little further we can see that silver lost around 1/3rd of its value in a sell off last year, however, the come back is persistent.

We believe that silver will give us a hair raising, gut wrenching, white-knuckle ride, definitely not for the faint hearted. If you have some spare cash and you feel a little like Captain Jack Sparrow then come and join us in what we see as the most exhilarating ride at the starting gate right now.

For ideas on which silver stocks to invest in, subscribe to the Silver Prices newsletter at Silver-Prices.net completely free of charge.

By Bob Kirtley

www.silver-prices.net

Bob Kirtley spent many years working on Oil projects including some in Alberta, such as the tar sands installations in Fort McMurray. He lived and worked in many different countries, as that is the nature of the construction business. Planning and cost control are key to a projects success and he tries to apply those disciplines on a daily basis when dealing with investments. His training in such areas as SWOT and Risk analysis can be applied from time to time. His qualifications include being chartered in the United Kingdom, which is similar to that of a Professional Engineer in Canada, along with a Masters Degree in Project Management from South Bank University, London, England.

He has been working for a number of years on a full time basis representing a group of investors in England.

DISCLAIMER : Silver Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.