Stock Market Digesting JP Morgans Corporate Earnings

Stock-Markets / Stock Markets 2010 Jul 15, 2010 - 09:12 AM GMTBy: PaddyPowerTrader

U.S. stocks flat lined and failed to make it seven up on hump day, as a drop in retail sales and the Federal Reserve’s assessment that the economic outlook has “softened” trumped Intel upbeat forecast for record profit. Home Depot, American Express and Alcoa all felt the down draft and declined the most in the Dow as minutes from the Fed’s last meeting showed policy makers saw no need to boost economic stimulus even as they trimmed growth forecasts but stocks did pare losses in the final minutes of trading.

U.S. stocks flat lined and failed to make it seven up on hump day, as a drop in retail sales and the Federal Reserve’s assessment that the economic outlook has “softened” trumped Intel upbeat forecast for record profit. Home Depot, American Express and Alcoa all felt the down draft and declined the most in the Dow as minutes from the Fed’s last meeting showed policy makers saw no need to boost economic stimulus even as they trimmed growth forecasts but stocks did pare losses in the final minutes of trading.

The better sentiment and demand for risk assets faced its first real test today as the European markets absorbs the renewed weakness in US data and the disappointing data from China overnight ( with 2Q GDP 10.3% vs consensus 10.5%; June CPI cools to 2.9% vs 3.3% expected ; PPI 6.4% vs 6.8%; retail sales 18.3% vs 18.8%; Industrial production 13.7% vs 15.1%; and Fixed investment ytd 25.5% vs 25.2%), in line with the whispers I wrote about yesterday have led to today’s softness in mining and basic resources stocks. That said it looks as though the authorities are for the moment managing to engineer a Goldilocks like soft landing. Against this we’ve had the first of the major US investment banks reporting what appear at first glance to be another set of blowout numbers. JP Morgan came in with Q2 EPS of $1.09 including a 36c cut in reserves and a 14c charge. The Street had been looking for 70-80 cents. However the stock is now trading off because of the weak guidance.

Datawise from the States we’ve had a decidedly mixed bag with a welcome drop in initial jobless claims of 29k to 429k (versus consensus expectations for a 445k print) being offset by worryingly high continuing claims numbers at 4681k (versus the 4447k street was looking for) and a collapse in the NY Empire manufacturing survey to 5.08 (versus the 18.00 economists were predicting) leaving the Dow futures flat after trading up early doors.

Today’s Market Moving News

•Federal Reserve officials saw no need to boost stimulus to the economy while trimming their forecasts for growth and noting that risks to the recovery had increased, minutes of their June meeting showed. “The economic outlook had softened somewhat and a number of members saw the risks to the outlook as having shifted to the downside,” minutes released Wednesday evening in Washington said. “The changes to the outlook were viewed as relatively modest and as not warranting policy accommodation beyond that already in place.” Slowing inflation, constrained household spending and contracting credit prompted Fed policy makers last month to restate a pledge to keep the benchmark lending rate at around zero for “an extended period,” the Fed’s statement showed. The minutes indicated that U.S. central bankers were concerned about lingering high unemployment and risks that inflation could decelerate further. If the outlook worsened, the Federal Open Market committee would need to consider whether additional stimulus was appropriate, the minutes said.

•A record 269,962 U.S. homes were seized from delinquent owners in the second quarter as lenders set a pace to claim more than 1 million properties by the end of 2010, according to RealtyTrac. Home seizures climbed 38 percent from a year earlier and 5 percent from the first quarter, the Irvine, California-based data company said today in a statement. More than 1.65 million properties received a foreclosure filing, including notices of default, auction and bank repossession, in the first half. That was up 8 percent from the first six months of 2009. “Foreclosures haven’t peaked yet,” Nicolas Retsinas, director of Harvard University’s Joint Center for Housing Studies in Cambridge, Massachusetts, said in a telephone interview with Bloomberg. Unemployment suggests that bank repossessions may climb for another six to nine months, he said.

•China’s growth is “solid but less robust,” The Conference Board said, adding to evidence that the expansion is cooling. The Leading Economic Index for China rose 0.8 percent to 145.8 in May, The Conference Board said today in a preliminary report posted to its website, publishing the data for the third time. The measure included a “technical adjustment” and most of its previous figures have been revised, the New York-based research organization said. Today’s figures followed no change in April and a 0.7 percent increase in March. China’s growth eased to 10.3% in the second quarter from 11.9% in the previous three months, the government said today, after it succeeded in tempering credit expansion, investment spending and property speculation. Inflation cooled and industrial production rose less than economists estimated.

•Goldman Sachs Group. said the dollar will fall against the euro by January as U.S. growth slows, marking the bank’s second reversal in two months after it forecast in June the greenback would surge to a seven-year high. The bank raised its outlook for the yen, expecting it to climb to the highest level since 1995 versus the dollar expectations recede for an interest-rate increase by the Federal Reserve and amid a lower likelihood of currency intervention from Japan’s policy makers. Goldman expects the euro to move “notably lower” to 1.27 Swiss francs over three months on safe-haven flows out of the euro zone.

Spanish Banks Still Guzzling ECB Cash

The FT reports Spanish banks borrowed a record amount from ECB in June €126.3bn, up 48% from €85.62bn (and May’s data was itself a record) data published by Bank of Spain yesterday showed. The borrowings are the largest on Bank of Spain records dating back to 1999. It just goes to show extent to which Spanish banks have been frozen out of interbank market, and how (increasingly) dependent on ECB they have become (although data could have been distorted by hoarding ahead of the 12m expiry). PM Zapatero thinks all this will change when stress test results give Spanish banking system a clean bill of health…we’ll see on July 23. 27of the 91 EU banks to be tested are Spanish more than any other country. Gillian Tett in the FT Says stress tests are being published at the insistence of Asian investors. “Eurozone officials met powerful Asian investment groups and government officials who expressed alarm about Europe’s financial woes. And while those officials did not plan to sell their existing stock of bonds, they specifically said they would reduce or halt future purchases of eurozone bonds unless something was done to allay the fears about Europe’s banks.”

Company / Equity News

•Apple who are facing complaints over the antenna reception of its new iPhone 4, will hold a press conference on July 16 to discuss the device. The meeting will be held at the company’s headquarters in Cupertino, California, said Steve Dowling, an Apple spokesman. He declined to elaborate on what will be discussed. Since Apple released the iPhone 4 on June 24, users have complained about losing reception when they cover the lower-left corner of the device. Consumer Reports said this week it wouldn’t recommend the phone because of the problem, and some analysts have said Apple needs to address the concerns or risk harming sales.

•Global personal-computer shipments rose 22% in the second quarter, a sign consumer demand is picking up even amid lingering concerns about the pace of economic recovery, according to research firm IDC. Hewlett-Packard remained the market leader, though its share fell to 18.1 percent from 19.7 percent a year earlier, Framingham, Massachusetts-based IDC said in a statement today. Gartner Inc., based in Stamford, Connecticut, put worldwide growth today at 21% , above its forecast for 19 percent.

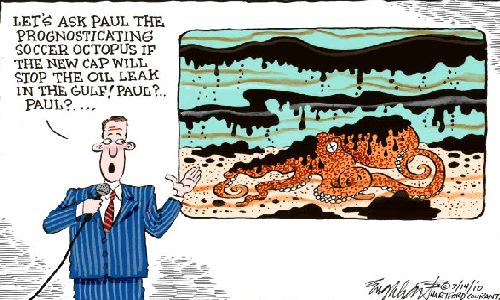

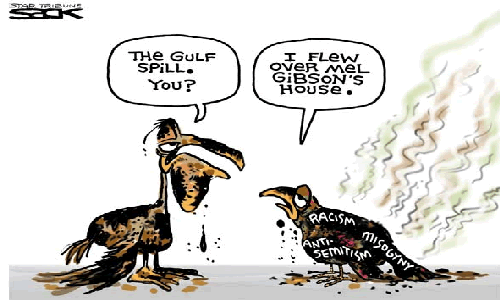

•Embattled BP faced more problems on Capitol Hill on Wednesday when lawmakers pushed ahead with a plan that would bar the UK oil group from obtaining new offshore oil leases because of its poor safety record, the FT reports. The amendment, added to a broader oil rig safety bill that was expected to pass through the House natural resources committee this morning, underscored the threat to BP’s long-term future in the US. However, the proposal faces several hurdles before it becomes law.

•A U.S. Food and Drug Administration panel voted Wednesday to recommend that GlaxoSmithKline PLC’s diabetes drug, Avandia, remain on the market despite concerns the product could raise the risk of heart attacks. Of the 33 members, 20 voted to keep Avandia on the market, although most said the product should be subject to additional restrictions or used only if other diabetes drugs don’t work. Twelve people voted to remove the product from the market, and one person abstained. But GlaxoSmithKline today announced it was setting aside £1.57 billion ($2.36 billion) to cover settlements and future claims against the diabetes drug as well as other issues of contention.

•Out of favour German Chancellor Angela Merkel and Russian President Dmitry Medvedev are expected to oversee the signing of an array of deals between German and Russian companies worth billions of dollars. In one of them, Siemens and Russian Railways will sign a euro2.2 billion contract for more than 200 new regional trains for Russia. Siemens earlier sold eight trains to Russian Railways which are now running between Moscow and St. Petersburg in Russia’s first high-speed train route. Germany is Russia’s major trading partner with the trade between two countries topping $15 billion in the first quarter of the year. Merkel and Medvedev are also expected to discuss Russia-EU relations and international issues including Iran’s nuclear program.

•Bloomberg reports that the level of bullish sentiment about the U.S. stock market fell below the level of bearishness for the first time since April 2009, according to a survey of newsletter writers. The proportion of bullish publications tracked by Investors Intelligence trailed bearish ones by 2.2 percentage points, declining to 32.6%, the lowest level since March 2009. Individuals’ optimism about equities also fell to its lowest level since March 2009, 21%, according to a survey last week by the American Association of Individual Investors. The Standard and Poor’s 500 Index has rallied 7 percent from July 2 through yesterday.

•Novartis this morning issued a strong set of Q210 numbers, reporting a 14% increase in EPS to $1.20 (consensus at $1.16) from an 11% increase in revenue to $11.7bn (market was expecting $11.4bn). Of direct relevance to Elan, management noted that the FDA Advisory Committee had unanimously recommended its oral MS drug candidate, Gilenia, for approval. The company received questions from the EMEA on 20 May on its submission for approval in the EU and plans to provide responses on 18 August.

•Tullow Oil announced this morning that the appraisal well Nsoga-5 located in Uganda’s Lake Albert encountered 10 metres of net pay. Nsoga 5 is part of the Butiaba appraisal campaign which was initiated with the aim of proving up the resource estimate in Lake Albert. The result today is another positive for the FTSE 100 listed explorer who is currently in the process of farming out 66.66% of three licences in Uganda to Total and CNOOC. Owo is the company’s next high impact prospect with results expected from this drill over the next week.

•The European Union has approved the planned merger between British Airways and Iberia, and British Airways/Iberia has won EU anti-trust approval for the joint venture with American Airlines.

•European Autos sales for June sales fell 6% and were 1% up over the first half compared to the prior year. The 6% fall was in line with the declines of recent months with market share developments also similar. Renault remains the out-performer with June market share of 10.9% higher than the 10.4% in the half to date (H109: 8.7%) against the backdrop of a slightly out-performing French market (up 5%) in H1. Peugeot’s market share gain was more modest to 13.7% (12.9%) over H1. Fiat has been the relative loser in the volume space with German and Italian sales considerably weaker and share dipped to 8.1% from 9.0% in H1. The momentum in the Italian market remains negative and H2 promises to be equally difficult and we move to market weight the credit (from overweight). Market shares for the German manufacturers were more stable, which represented an impressive performance in the context of the 29% fall in the German market in H1.

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.