What the Big Mac Can Tell You about Currencies

Currencies / Forex Trading Jul 17, 2010 - 02:31 PM GMTBy: Bryan_Rich

Currencies have experienced a massive wave of volatility in the past three years. Driving some of that volatility are the early stages of a sovereign debt and currency crisis.

Currencies have experienced a massive wave of volatility in the past three years. Driving some of that volatility are the early stages of a sovereign debt and currency crisis.

As I laid out in my June 26 Money and Markets column, history suggests many of the sovereign debt problems in the world will likely be responded to with competitive currency devaluations. So it’s reasonable to expect large moves in currencies.

How large should we expect?

For our guide, let’s take a look at the market’s estimate of the current “fair value” of currencies.

We’ll use an economic theory known as purchasing price parity (PPP), which adjusts the exchange rate so that an identical good in two different countries has the same price when expressed in the same currency.

And here are two tools to help with that analysis …

Tool #1— Big Mac Index

If you were to visit a McDonald’s outside of your home country, would you expect to pay more or less for a Big Mac?

It depends.

You’d likely notice a difference though.

A major cause of this difference would be the value of the local currency relative to your home country’s currency. And that’s where the Big Mac Index comes in …

A Big Mac in the U.S. will run you about $3.50. If you’re traveling around Germany, you’ll pay in the neighborhood of 3.15 euros for that sandwich. So at current exchange rates, the same sandwich in Germany will cost you $4.10 or 17 percent more than you’d pay in America.

|

| Expect to pay more for a Big Mac in Germany than you would in Kansas. |

What does this analysis tell you about the value of the euro?

It could tell you that the euro is overvalued. But there are also other factors to consider when comparing the Big Mac’s prices: Labor costs, real estate costs, taxes, transportation costs, trade-related costs, the quality perception of the product and other variables that impact doing business in different countries.

The bottom line: Running a McDonald’s in Omaha is quite different than running a McDonald’s in Berlin. Nonetheless, the Big Mac Index is a useful quick analysis for comparing currency values.

Tool #2— OECD’s PPP

The more academically accepted version of PPP is the measure against a basket of goods and services. These statistics are compiled by the Organization for Economic Co-Operation and Development (OECD).

Both the Big Mac Index and the OECD’s work are broadly accepted tools for assessing the relative under or over valuation of currencies. But keep in mind that PPP analysis in general is a longer-term tool. It does not incorporate many of the short-term influences that can drive currency values.

Yet it does provide a benchmark equilibrium exchange rate as a reference point, which combined with a healthy dose of assumptions, can be used to normalize the cost of a product across countries.

So What Does PPP Tells Us Right Now about the Most Overvalued Currencies in the World?

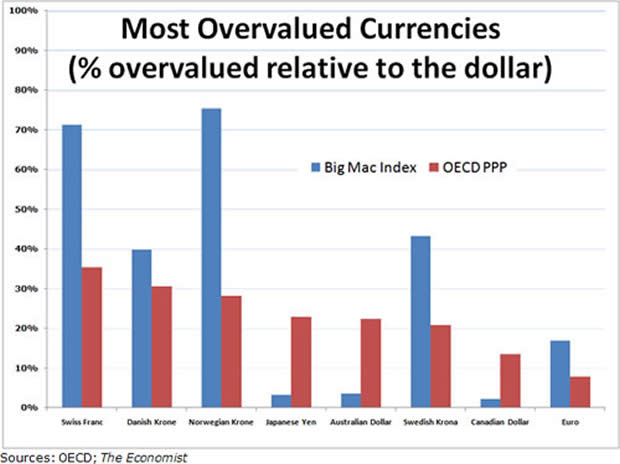

In my chart below, you can see some of the most overvalued currencies according to the Big Mac Index and the OECD’s PPP. The axis on the left shows how overvalued these currencies are relative to the equilibrium exchange rate based on purchasing price parity.

Both measures agree that the Swiss franc is one of the most overvalued currencies in the world, relative to the U.S. dollar.

The franc’s strength has come from its traditional appeal as a safe haven currency. Market participants have fled the troubled euro, and used the Swiss franc as a safe parking place. That’s pushed the value of the Swissie well out of line with economic fundamentals.

Also sitting well in overvalued territory is the Japanese yen …

The yen has gained 28 percent against the dollar since the onset of the financial crisis in 2007 as investors exited the highly popular carry trade — where they borrowed cheap yen to buy high yielding currencies. And it continues to find favor, ignoring Japan’s inferior economic fundamentals.

As for the euro, despite its sharp collapse since November of last year, the OECD PPP puts a fair value even lower, at $1.18. Given the fluid nature of the problems in Europe and the tendency of markets to overshoot, it could go much lower.

As For the Undervalued Currencies …

|

| Weak currencies help many Asian countries maintain a massive trade surplus. |

The major Asian export-centric economies dominate those currencies deemed the most undervalued, according to purchasing price parity. Among them are the Malaysian ringgit, the Thai baht, the South Korean won, and the widely scrutinized currency for its gross undervaluation … the Chinese yuan.

The Big Mac Index and the OECD’s PPP aren’t great trading tools. But they do give some additional perspective, when combined with fundamental, technical and sentiment analysis. Indeed, helpful in a world of increasingly vulnerable currencies.

Regards,

Bryan

P.S. For more news on what’s going on in the currency markets, be sure to check out my blog, Currencies Corner. You can follow me on Twitter, too, and get notified the moment I post a new message.

This investment news is brought to you by Money and Markets. Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com.© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.