The Double-Dip Recession, Four Reasons Why Its Not Going to Happen

Economics / Economic Recovery Jul 22, 2010 - 11:29 AM GMTBy: Investment_U

Louis Basenese writes: The dreaded double-dip recession chatter is getting louder by the minute. And it’s clearly scaring the dickens out of most Americans.

Louis Basenese writes: The dreaded double-dip recession chatter is getting louder by the minute. And it’s clearly scaring the dickens out of most Americans.

How else do you interpret the five-fold increase in the number of Google searches for “double-dip recession” since May?

My advice? Get some earplugs. Seriously.

I’ll concede that the wounds from the Great Recession might still be raw. And given the impact of the crash on investment portfolios, many retirement plans might still be on pause.

But as demoralizing as the thought of another downturn is, the chances of a double-dip actually happening are slim. And it’s certainly not worth losing any sleep over.

Here are four reasons why…

Do You Believe in Double-Dip Recessions and Unicorns?

The first reason not to worry about a double-dip recession is simple. They’re rare. Extremely rare.

In fact, the National Bureau of Economic Research says that over the past 80 years, we’ve only endured one of them – from 1980 to 1982.

And over the past 150 years, we’ve only encountered… (wait for it)… three.

Translation: We have a better chance of seeing a unicorn before another double-dip recession. Well, almost.

If you’re looking for a little more meat on the bone, look no further than my second reason…

Double-Dip Defiance From Corporate America

If America were heading into a double-dip recession, we’d see the downturn reflected on corporate balance sheets across the country.

But that’s not happening. Quite the opposite, actually…

Corporate profits are rising – up 52% during the first quarter, with analysts forecasting a 34% increase once the second-quarter results are tallied.

And that’s not the only positive trend. Consumer spending, capacity utilization, industrial production, retail sales and the average number of hours worked are all rebounding, too.

In fact, of the 40 economic indicators that I track, the overwhelming majority have steadily improved over the past year.

I’m not the only one who believes the current economic data flies in the face of the double-dip recession talk, either. Credentialed economist and Lord Abbett’s market strategist Milton Ezrati offers seven reasons why you shouldn’t fear a double-dip in a recent Wall Street Journal blog post.

Now I’ll readily concede that the momentum of the economic recovery might have slowed over the past couple of months. But that’s not fazing these guys…

These Two Heavyweights Are on the Same Page

Former Federal Reserve Chairman Alan Greenspan notes that the current environment seems to resemble the typical pause patterns witnessed during previous recoveries. In other words, the recovery is still intact.

Don’t trust Greenspan’s assessment? No worries. Consider Warren Buffett’s…

In his 2008 “Letter to Shareholders,” he wrote of “life-threatening problems,” “non-functional” credit markets, “tumbling home prices” and “a freefall in economic activity… that I have never before witnessed.”

Financial Armageddon, you might say.

But nowadays he’s preaching a different story, saying: “There’s no doubt in my mind, we’re coming back.” And he offers irrefutable proof: Most of the 70 companies in which Berkshire Hathaway owns a stake are improving their margins and hiring workers again.

And then there’s the Federal Reserve…

This Indicator Says There’s Zero Chance of a Double-Dip Recession, Too…

What’s one of the best indicators that the Fed uses to determine the probability of a recession?

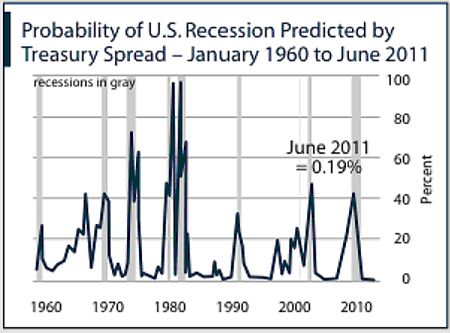

It’s the Treasury spread – i.e. the difference in yields between 90-day Treasury bills and 10-year Treasury bonds.

The calculation allows the Fed to construct a yield curve.

As the New York Fed reveals: “Research beginning in the late 1980s documents the empirical regularity that the slope of the yield curve is a reliable predictor of future real economic activity.”

So how do you read the yield curve? Simple…

- Steep Yield Curve: Points to economic growth.

- Flat or Inverted Curve: Signals an economic slowdown or recession.

And as the latest Treasury Spread Model shows, there’s a 0.19% probability of a recession in the next year. Take a look… and relax.

What can we conclude from this? That there’s essentially no chance of a double-dip recession in the year ahead.

The fact that previous spikes in the indicator accurately predicted other recessions (denoted by the gray bars) should only increase your confidence in this indicator, too.

Bottom line: While the economic picture isn’t all rosy (unemployment remains uncomfortably high and credit remains tight), we’re certainly not facing the dire fundamentals of two years ago. And too many economic readings are improving for a double-dip recession to be in the cards.

And that’s before we even get to one final – and the most important – reason not to fear a double-dip recession…

It’s NOT the Economy, Stupid!

Simply put, it doesn’t matter!

No matter what happens, it’s still possible to invest safely and profitably – even if you’re the most risk-averse investor.

All you have to do is focus on this strategy…

- Pinpoint simple businesses, selling recession-resistant products or services.

- Look for companies that have a minimal need for credit and are churning out gobs of cash.

- Identify stocks that pay a modest, safe and increasing dividend. After all, countless studies show that almost half the gains in the S&P 500 since 1925 can be attributed to reinvested dividends.

Basically, look for companies that will thrive in any environment.

Now here’s the good news: You don’t have to look very far to find such investments…

The Ultimate Retirement Portfolio

At The Oxford Club we dedicate an entire portfolio to sleuthing out such opportunities and we call it The Ultimate Retirement Portfolio.

And our strategy doesn’t just look good on paper, either. It works.

Consider this…

- None of the 15 companies in our portfolio suffered a debilitating blow to demand during the Great Recession. In fact, sales at all but three companies actually increased – by an average of 13% – right through the recession. And the three laggards only suffered modest declines of 5% to 8%.

- Every single company maintained its dividend. And 10 out of 11 were able to increase their dividends in 2008 and 2009.

- We’ve only experienced one loss (a modest one of 7%) since we created the portfolio.

Such stats don’t happen by accident. They’re a result of steady demand and conservative financial management. And there’s never a bad time to buy such companies – including now.

I encourage you to sign up for risk-free trial today so you can find out the identity of these 15 all-weather, ultra-safe, high-yielding stocks (plus new ones as we recommend them).

Or you can let fear get the best of you and miss out on the opportunities altogether. You decide.

Good investing,

Article - http://www.investmentu.com/2010/July/the-double-dip-recession.html

by Louis Basenese , Advisory Panelist

Copyright © 1999 - 2008 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.