Who Flipped The Switch On The Stock Market?

Stock-Markets / Stock Markets 2010 Jul 30, 2010 - 05:56 AM GMTBy: David_Grandey

This is your captain speaking, we’ve turned off the keep your seat belts on sign (for those of you who have short exposure, those who have long exposure? Please fasten your seatbelts). You are now free to move about the cabin. This MAY now conclude our in flight turbulence for the time being.

This is your captain speaking, we’ve turned off the keep your seat belts on sign (for those of you who have short exposure, those who have long exposure? Please fasten your seatbelts). You are now free to move about the cabin. This MAY now conclude our in flight turbulence for the time being.

So what happened to the market Thursday? I mean wow we were up like 80 points on the Dow and the OTC was up nice too so what gives? Simple, it’s all because of this guy!

He flipped the switch! If you’ve ever seen the remake of lost in space you know what we mean.

It’s because we had a brand spanking new EMOTIONAL subscriber (shown below) call us and say we were nuts! Can’t you see this market is flying? Folks haven’t we talked time and time again about being in control of your emotions and managing them? They say the fastest way to find out who you are is to start trading. The markets give INSTANT feedback.

It’s quite obvious to us this investor is finding out who he is right now and what he needs to work on to improve his game.

Of course the captain sees the runway just ahead and that’s why he’s not emotional mind you.

On to the charts

Yesterday we told our subscribers:

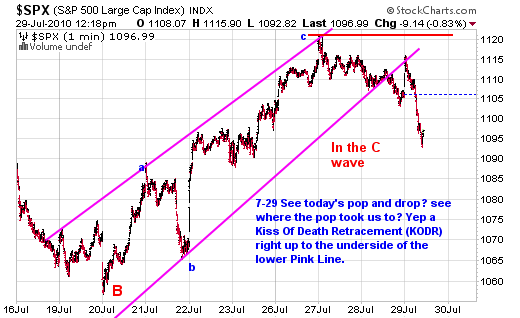

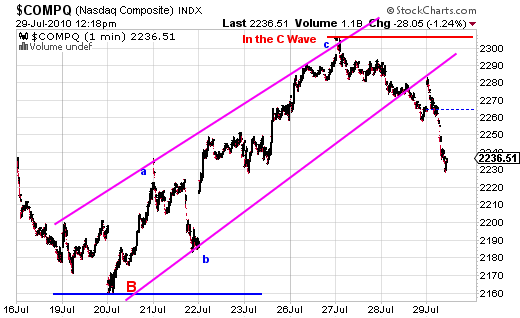

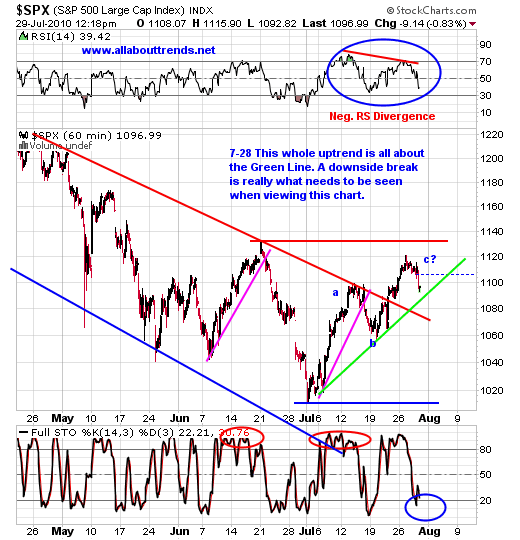

“So from here? IF we are at a turning point we should not go over the red line on the two charts below, even if we do though we’ve got 1131 not far away which is another resistance level.”

As you can see we’ve still got the green line to deal with to the downside. Call us pinned between the red line or the 1120 level on the S&P 500 to the upside and the green line to the downside.

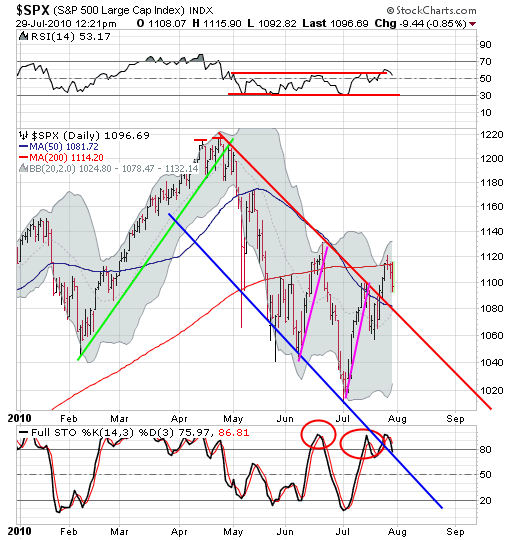

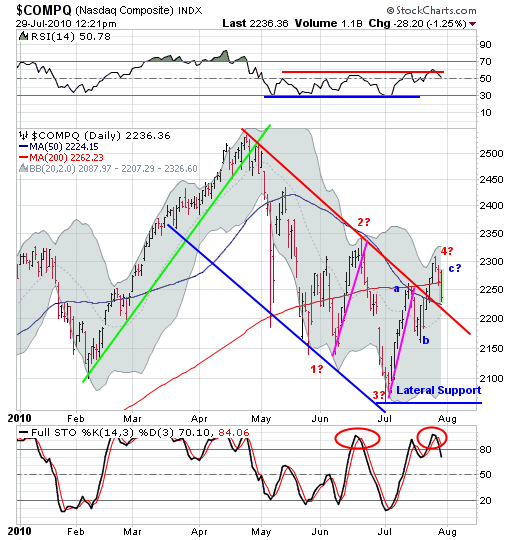

From a daily perspective in the charts below look at the Full Stoh’s, still in overbought territory and the Bollinger Bands both still have quite a ways to go.

All we can say at this point is that everything looks encouraging to those that are short this market. We’ve hit resistance/fib levels, indicators flashing overbought and in the zone, a fair amount of go go names staging the makings of “New Highs And Dies” which is what you want to see and a classic pop an drop Thursday. One step at a time folks as we always say.

By David Grandey

www.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2010 Copyright David Grandey- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.