U.S. Economic Recovery Heading For Double Dip Recession

Economics / Double Dip Recession Aug 03, 2010 - 03:16 AM GMTBy: Mike_Shedlock

Bernanke thinks consumers are going to sustain the economy, but small businesses, the lifeblood of the economy sure disagree. Please consider Wells Fargo/Gallup Small Business Index Hits New Low in July

Bernanke thinks consumers are going to sustain the economy, but small businesses, the lifeblood of the economy sure disagree. Please consider Wells Fargo/Gallup Small Business Index Hits New Low in July

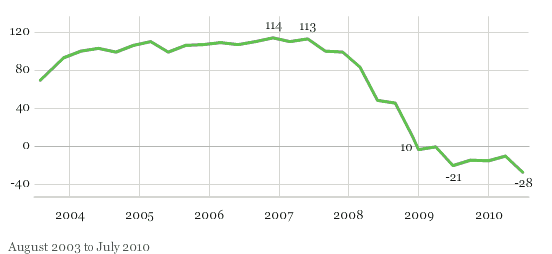

The Wells Fargo/Gallup Small Business Index -- which measures small-business owners' perceptions of six measures of their current operating environment and future expectations -- fell 17 points to -28 in July. This is its lowest level since the index's inception in August 2003.

Small Business Index

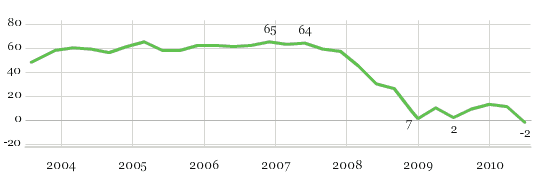

Record Pessimism in Future Expectations

Most of the decline in the overall index came in the Future Expectations Dimension of the index, which measures small-business owners' expectations for their companies' revenues, cash flows, capital spending, number of new jobs, and ease of obtaining credit. The dimension fell 13 points in July to -2 -- the first time in the index's history that future expectations of small-business owners have turned negative, suggesting owners have become slightly pessimistic as a group about their operating environment in the next 12 months.

Small-business owners' future expectations for their operating environment show significant declines in their revenue, cash-flow, capital-spending, and hiring expectations for the next 12 months. Forty-two percent expect it to be "somewhat" or "very difficult" to obtain credit -- no improvement from April and January. One in five (22%) small-business owners expect their companies' financial situations a year from now to be "somewhat" or "very bad."

Small-business owners are the embodiment of America's entrepreneurial and optimistic spirit. As a result, their increasing concerns about their companies' future operating environment do not bode well for the economy in the months ahead. Nor do small-business owners' intentions to reduce capital spending and hiring: 17% of owners plan to increase capital spending in the next 12 months -- down significantly from 23% in April -- and 13% expect jobs at their companies to increase, while 15% expect them to decrease over the year ahead.

Big-firm earnings and global growth may drive profits on Wall Street, but small business is the major source of U.S. job creation. And most small-business owners are unlikely to hire as long as they are becoming increasingly uncertain about the revenues and cash flows of their companies in the months ahead.

Click on the above link for more charts and survey questions.

No Chance of Recovery is Small Businesses do not Join In

If small business hiring does not pick up and it sure does not look like it will, then barring huge changes in the participation rate, unemployment will rise. If employment does not pick up, neither will housing nor consumer spending.

Yet somehow Bernanke thinks consumer spending is poised to lead the recovery. "Growth in real consumer spending seems likely to pick up in coming quarters from its recent modest pace, supported by gains in income and improving credit conditions" said Bernanke.

I think he is off his rocker. With 10-year treasuries under 3%, the treasury market seems to agree Bernanke is off his rocker as well. Please see Disingenuous Bernanke Calls for Bigger State "Rainy Day" Buffers, No Spending Cuts for further discussion.

Tonight small businesses have chimed in, and they do not see what Bernanke sees either.

Economic Models vs. Common Sense

Bernanke no doubt is adhering to his models as to what a recovery from a typical recession looks likes. Those models no doubt suggest that the steep yield curve will spur economic growth.

The problem is this is not the typical recession. This is a credit bust recession and consumers are still deleveraging. Moreover, with savings deposits yielding close to 0% and with credit card rates over 20%, common sense dictates consumers pay down bills. Indeed, given all the economic uncertainties, consumers are reacting in a rational manner by not spending.

Bernanke needs to throw his silly formulas out the window and use some common sense. Unfortunately, he cannot do that because he does not have any common sense.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.