Stock Market Rally, The Biggest Disconnect of All Time

Stock-Markets / Stocks Bear Market Oct 01, 2010 - 09:29 AM GMTBy: Mike_Larson

I’m seeing one of the biggest disconnects of all time — between the underlying U.S. economy and the performance of the stock market. Just consider what we’ve learned about the economic fundamentals in the past several days …

I’m seeing one of the biggest disconnects of all time — between the underlying U.S. economy and the performance of the stock market. Just consider what we’ve learned about the economic fundamentals in the past several days …

• Consumer confidence plunged in September — to 48.5 from 53.2 in August. That was far below the 53 reading economists were expecting, and the worst in seven months.

• The Richmond Fed’s manufacturing index plunged from 11 in August to NEGATIVE 2 in September. Economists were looking for a reading of 6. That was the worst since January. The report followed a dismal Dallas Fed reading from a day prior. That region’s index tanked to -17.7 from -13.5 in August.

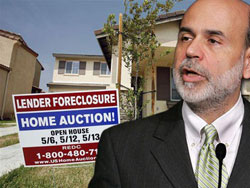

• The housing market? Yeah, it still stinks. New home sales flat-lined at 288,000 in August, the second-worst month in U.S. history. Home prices fell to their lowest level since December 2003. Builder confidence held at the lowest level since early 2009. Existing home sales bounced a bit, but they recouped less than a third of their 27 percent July swan dive.

In other words, things aren’t getting better in the real world. They’re getting worse! But on Wall Street it’s party time. Investors are essentially the most bullish they’ve ever been. And it looks like September 2010 could be the best for stocks of any September in seven decades.

What’s going on?

Promise of Free Money Distorting Markets …

Once upon a time not so long ago, asset class performance closely tracked the underlying fundamentals. If oil supplies rose, oil prices fell. If income, jobs, production, and corporate profits gained, so did stocks. If the economy improved, bond prices fell and interest rates rose. You get the picture.

But these days, it’s a different story …

Stocks, bonds, commodities, and other assets are trading in virtual lock step thanks to the Fed’s most dramatic intervention and interference in the markets of all time. All it takes is a whisper of “quantitative easing” and stocks take off, bonds take off, commodities take off, and the dollar implodes.

|

About the only asset class that’s NOT responding to all this free money talk is the one asset the Fed probably wants to respond the most — housing.

The latest S&P Case-Shiller report showed that home prices resumed their deterioration in July, falling 0.1 percent. Prices are down 3.6 percent since the Fed rolled out QE1 in November 2008 and 28 percent since the peak of the market four years ago.

Stated another way, the fundamentals haven’t mattered lately. Stocks are reacting to the prospect of the Fed debasing our currency. That debasement is driving up asset values, as well as contra-dollar investments and the price of almost everything we consume.

A few examples:

- Gold has surged almost $300 an ounce from its February low,

- Copper has jumped 188 percent from its recent low,

- Corn has exploded 58 percent,

- Wheat has climbed 65 percent,

- And sugar has risen 90 percent.

… But the Disconnect Simply Cannot Last

Stock market bulls would have you believe this will last to infinity and beyond. “Don’t fight the Fed,” they say.

I have a different take. “Fighting the Fed” may sting a bit in the SHORT TERM. But it has been an incredibly successful strategy over the LONGER TERM.

For instance …

You could’ve “fought the Fed” by shorting the heck out of housing and mortgage stocks even as Fed officials told you the problems in those sectors were “contained.” Doing so would have made you a fortune!

You could’ve “fought the Fed” by selling stocks into every single interest rate cut between 2008 and 2009. The Fed first lowered interest rates from 5.25 percent in September 2007. The Dow traded at 13,820 then. It proceeded to plunge to 6,470 over the ensuing couple of years.

|

And you could’ve “fought the Fed” back in 2000, when Alan Greenspan was singing the praises of the technology revolution even as the Nasdaq was about to crash.

The list of Fed policy failures and economic forecasting blunders goes on and on and on.

So to answer the question I’ve been hearing lately, no, I wouldn’t be buying stocks willy nilly because of the Fed. I’d be selling into the rally, and positioning for downside gains in vulnerable sectors using options and inverse ETFs.

And unless and until the real economy takes a turn for the better, the Fed’s QE2 program should ultimately fail to levitate stocks over the longer term.

Until next time,

Mike

This investment news is brought to you by Money and Markets. Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.