An Easy Way to Boost America’s Energy Independence

Commodities / Energy Resources Oct 17, 2010 - 06:54 AM GMTBy: Investment_U

David Fessler writes: You know, for all the talk about working towards greater energy independence through alternative energy resources like wind and solar power, there’s another much simpler solution.

David Fessler writes: You know, for all the talk about working towards greater energy independence through alternative energy resources like wind and solar power, there’s another much simpler solution.

And it’s sitting on your kitchen table.

It’s a well-known fact that America has an eating problem, with the level of overweight and obese people spiraling higher. But what you won’t hear about as often is America’s non-eating problem.

For example, think about much food you throw away each year, either in the form of leftovers or when it goes bad.

You see food wasted all the time in restaurants, too. A huge amount of perfectly good food goes uneaten and simply gets tossed in the trash. And even if people do take their restaurant leftovers home, how much of it just sits in the fridge for a day or two, only to get dumped out later?

You might not think about it much, but not only is this wasting food, it’s wasting energy, too. And two researchers have attempted to quantify exactly how much – and how it’s harming our attempts to become more energy independent.

So grab a sandwich and let’s dig in…

Eat Your Greens… Save Energy

Earlier this year, two researchers at the University of Texas at Austin published a study, which calculated the amount of energy embedded in wasted food.

The authors based their research on a number of factors, including population growth, economic expansion and the money Americans spend on food.

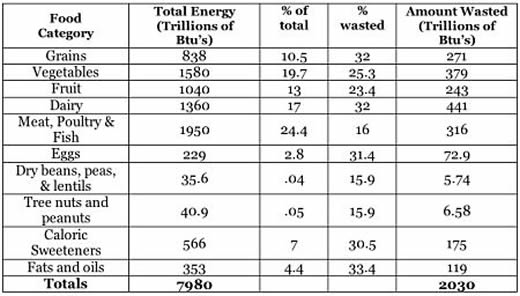

Survey says: Americans waste about 27% of all edible food. And energy-wise, if you take into account how food is produced, harvested, distributed, stored, processed, sold, and cooked, that equates to roughly 2,030 trillion BTU’s of wasted energy embedded in wasted food (as of 2007 figures).

That’s equivalent to about 2% of all the energy consumed annually in the United States. That might not seem like much, but saving this amount of energy makes other energy conservation and efficiency proposals pale in comparison.

For example…

•The authors point out that the energy in discarded or wasted food is more than the energy produced annually from grains for ethanol.

•It’s also more than the annual petroleum that comes from drilling on the outer continental shelf.

So in addition to saving leftovers for eating, another reason to be more food-conscious is the same reason to keep your thermostat a few degrees lower in the winter and higher in the summer: It saves energy.

And when it comes to energy, we need all we can get…

The Wrong Kind of Energy

If you look up the word “fad” in the dictionary, the definition might as well just tell you to flip back to “ethanol.”

The massive push towards an “ethanol society” a few years ago was nothing more than a mass of smoke and mirrors. And subsidizing it was – and still is – a complete waste of taxpayers’ money.

However, at least one good thing has come from the ethanol frenzy: It’s heightened Americans’ awareness of the relationship between food and energy with regard to the huge amount of corn diverted away from the food chain and towards ethanol production instead.

Food isn’t just an energy source for humans; it’s an energy consumer in terms of its production, preparation and transportation.

And the U.S. Department of Agriculture backed that up in a March 2010 report. It showed that in 2007, food production accounted for 15.7% of all energy consumption.

Too bad much of that energy to produce food is wasted…

Energy Intensity of Food

The study produced some surprising results. Take a look…

As you can see, the biggest energy hog is meat, poultry and fish.

But what struck me about the study was how much food – and by extension, the energy to produce it – is wasted. And that’s just here in the United States…

Wanted: Better Waste Management

The old adage that “Every problem is just an opportunity in disguise” certainly applies here. The energy sucked up by wasted food represents a serious target for decreasing energy consumption in the United States.

Increases in agricultural technology and productivity hold direct benefits to consumers. More advanced equipment from the likes of Deere & Company (NYSE: DE), plus the use of fertilizers and pesticides result in better efficiency and tougher, more drought-resistant crops.

And as mass food manufacturing and processing techniques have improved efficiency here, too, with companies like Kraft Foods (NYSE: KFT) an industry leader, these factors have combined to streamline the process and produce bigger yields.

In the end, though, consumers like you and me are responsible for our own food-buying habits – and the amount that we throw away. And I’ll wager that right now, there’s something in your refrigerator (and mine) that probably belongs in the garbage can.

Perhaps the best solution is to be more conscious of how much we’re buying and to buy less food more often.

Good investing,

Source: http://www.investmentu.com/...

by David Fessler, Advisory Panelist, Investment U

Copyright © 1999 - 2008 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.