Gold Real Safe Haven, as U.S. Soviergn Debt Status Questioned

Commodities / Gold and Silver 2011 Apr 19, 2011 - 06:45 AM GMTBy: GoldCore

Gold and silver closed higher yesterday (+0.45% and +0.65%) after S&P, somewhat belatedly, cut its outlook for the US from stable to negative. While the move seemed to surprise some, many market participants have been warning that this was inevitable for some time.

Gold and silver closed higher yesterday (+0.45% and +0.65%) after S&P, somewhat belatedly, cut its outlook for the US from stable to negative. While the move seemed to surprise some, many market participants have been warning that this was inevitable for some time.

Gold in US Dollars: 3-Day (Tick)

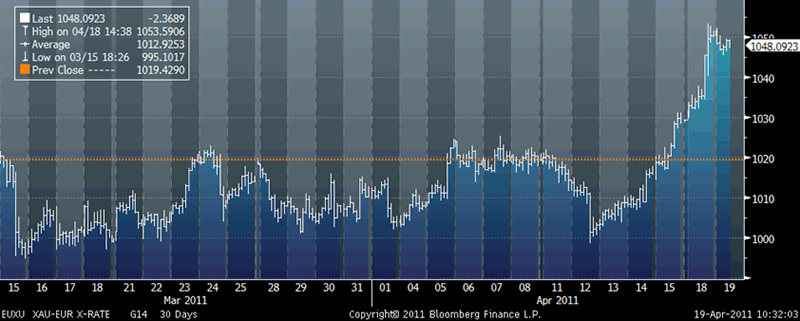

Despite somewhat sensationalist reporting, gold did not surge, nor did equities “plummet”. However, both acted as they are expected to with more risky equities selling off internationally and safe haven gold rising marginally in all currencies. Gold was particularly strong in euros due to eurozone contagion fears and rose from €1,035/oz to over €1,050/oz.

Gold in Euros: 30-Days (Tick)

In dollar terms, soon after rising nearly $20 per ounce, gold gave up the gains with very determined selling seen at the $1,500/oz level. $1,500/oz will likely be reached in the coming days and the question is do we see profit taking and a correction at this level or does gold surprise most market participants again by continuing to rise to the $1,600/oz level.

The real high or inflation adjusted high of $2,400/oz remains a long term price target that seems increasingly inevitable, given the disastrous fiscal position of the US and equally poor fiscal positions of many other major western economies .

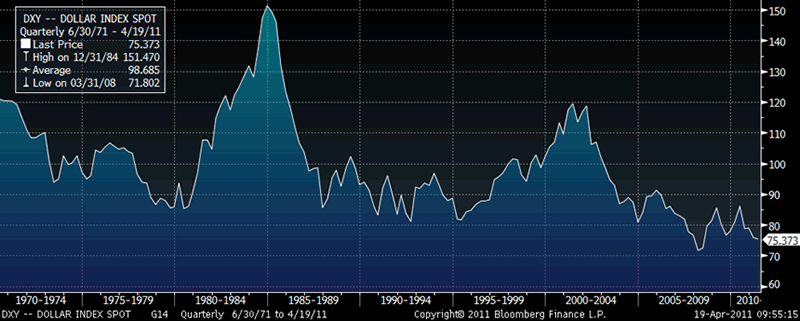

Dollar Index: 40-Year (Quarterly)

Technically and fundamentally, the dollar looks vulnerable to falling to the record low of 71.8 (on US Dollar Index) that will see increased concerns about the reserve currency status of the dollar and further inflationary pressures which will be bullish for gold and silver.

The risks posed to the dollar come at a time of a high level of risk confronting all major currencies, the dollar, the yen, the euro and the pound, and these risks with the threat of inflation will inevitably lead to higher interest rates.

Rising interest rates will be bullish for gold as they were in the 1970s. It is likely only when real interest rates are positive and guarantee a return over the rate of inflation (and taxes) that gold’s bull market will be threatened.

Gold

Gold is trading at $1,493.83/oz, €1,046.91/oz and £916.46/oz.

Silver

Silver is trading at $43.16/oz, €30.25/oz and £26.48/oz.

Platinum Group Metals

Platinum is trading at $1,781.50/oz, palladium at $737/oz and rhodium at $2,275/oz.

News

(Financial Times) -- Gold hits fresh high on US debt warning

The price of gold shot to a fresh record of nearly $1,500 a troy ounce on Monday after Standard & Poor’s warned that the US government’s triple-A rating was under threat.

The announcement added to growing fears about the debasement of paper currencies in the US and elsewhere, which have been a primary driver of gold’s strong rally.

Prominent hedge fund managers such as David Einhorn of Greenlight Capital and John Paulson of Paulson & Co have invested heavily in bullion as a bet that governments and central banks will be unable to manage the withdrawal of the stimulus policies put in place during the financial crisis.

The move by S&P to downgrade the long-term outlook for US government debt from “stable” to “negative” is the first concrete sign that the concerns over sovereign debt have spread from Europe to the US. The rating agency reaffirmed its sovereign rating at triple A.

Spot bullion surged more than $14 in less than 10 minutes in the wake of the announcement on Monday afternoon, touching a fresh all-time nominal high of $1,497.20.

However, adjusted for inflation, it remains well below the peak of 1980, which translates to about $2,300 in today’s money.

Analysts said a number of important pieces had fallen into place before S&P’s move on Monday, providing the backdrop for gold to approach $1,500 for the first time. Inflation is picking up as oil prices rise, fresh concerns about the global economy are emerging after the earthquake in Japan and the eurozone’s sovereign debt woes have returned to the headlines.

“The issue of sovereign debt risk seemed to have been pushed to the backseat at the beginning of the year and we saw a great deal of profit-taking in January,” said Suki Cooper, precious metals analyst at Barclays Capital in New York. “Since then we’ve just had a raft of issues driving prices higher.”

GFMS, the precious metals consultancy, last week predicted that continuing concerns about sovereign debt would propel gold beyond $1,600 this year.

Gold and silver have become the investments of choice for those dissatisfied with the ballooning debt in the US and the apparent political stasis in Washington. Last month, the state government in Utah passed a bill making gold and silver coins legal tender in a statement of protest against the perceived profligacy of the Federal Reserve.

Edel Tully, precious metals strategist at UBS, said the rating agency’s move would redouble those concerns. “It brings up the debate again about gold being the alternative currency,” she said. “I was in the US last week, and you could feel the growing unease regarding the state of the US fiscal imbalances.”

Silver also benefited from the renewed concerns over the creditworthiness of the US. The precious metal hit a fresh 31-year high of $43.51 a troy ounce and was up 40 per cent since the start of the year.

However, some investors are beginning to worry that silver has overshot its fundamentals.

“The consensus opinion is that silver has outpaced logic and a correction is overdue,” Ms Tully said.

Investors have flocked to gold in recent years as an alternative to paper currencies, and prominent hedge fund managers such as David Einhorn of Greenlight Capital and John Paulson of Paulson & Co have made large bets on the metal as an explicit bet that governments and central banks will be unable to manage the withdrawal of the extraordinary policies put in place during the financial crisis.

The warning by S&P, which on Monday downgraded the outlook for the US government’s credit rating to negative, is the first concrete sign that the concerns about sovereign debt have spread from Europe to the US.

GFMS, the precious metals consultancy, last week forecast that gold would surpass $1,600 an ounce this year, helped by continuing concerns about sovereign debt.

“With the spotlight shining on the state of government finances, there is every reason to believe that investors will remain focused on the gold market,” said Philip Klapwijk, GFMS executive chairman.

Spot bullion surged more than $14 higher in less than 10 minutes following the warning from S&P on Monday afternoon, touching a fresh all-time nominal high of $1,497.20.

Adjusted for inflation, however, the price remains well below the peaks of 1980, which translate to roughly $2,300 in today’s money.

The latest move higher for gold came after precious metals had already been driven higher by a combination of concerns about inflation and the debt crisis in the eurozone.

Silver rose to a 31-year high of $43.51 a troy ounce and is now up 145 per cent during the past 12 months.

(Bloomberg) -- Gold Prices May Rise for ‘Some Years,’ Blackrock’s Hambro Says

Gold prices may keep rising for “some years into the future,” Blackrock Inc. fund manager Evy Hambro said on Bloomberg TV’s On the Move with Mark Barton.

(Bloomberg) -- Platinum ‘Remains Supply Constrained,’ Blackrock’s Hambro Says

Platinum “remains supply constrained” and the demand from automobile manufactures is “OK,” Blackrock Inc. fund manager Evy Hambro said on Bloomberg TV’s On the Move with Mark Barton.

Silver’s industrial demand is “very strong,” he said. The question is how fast production grows over the next few years, he said.

(PRNewswire) -- Sovereign Society's Andy Hecht Reports from CME Gold/Silver Dinner: "Anyone ... Short Silver is Going to Get Their Face Ripped Off

The CME Group, a diverse derivatives marketplace, hosted its annual Gold and Silver Dinner on April 14, 2011.

Andy Hecht, commodities options expert working closely with The Sovereign Society, attended the CME dinner as a highly respected industry peer. He reports, "The tone of the event was bullish, but cautious. Many of us see daily gold and silver prices that are higher than any we have seen in our careers."

During this event, the keynote speaker, Guy Adami, issued the stern warning that gold and silver are in strong bull market trends and anyone betting against those two commodities will suffer the painful losses.

The traders attending the event discussed several themes that affect anyone trading options in gold and silver.

These ranged from why gold and silver will continue to ride higher to what impact these moves will have on the commodities' volatility and what proposed new regulations will do to the market.

Adami, best known as the original Fast Money Five on CNBC, opened the dinner saying: "Anyone who is short silver is going to get their face ripped off." He went on to say, "This trend in precious metals is a bet against fiat currencies and we're only in the third inning. It's only the beginning of the game folks!"

(Telegraph) -- Gold Soars, Markets Tumble as US Warned It Could Lose AAA Crown

America risks being stripped of its prized 'AAA' credit rating unless it delivers a deficit-cutting plan within two years, Standard & Poor's has warned, in a move that sent stock markets tumbling and the gold price to a fresh record.

The rating agency cut its outlook on the US from stable to negative in a powerful shot across the bows of politicians in Washington who have recently struggled to reach agreement both on short-term measures to keep the government running as well as a long-term plan to balance the budget for the first time since 2001.

Congress and The White House need to have begun "meaningful implementation" of a strategy to tackle the deficit by 2013 to preserve its status as a top borrower, S&P said. A sharp drop in tax revenues during the recession has seen America's national debt balloon from about 40pc of gross domestic product (GDP) before the crisis to more than 60pc last year. S&P said on Monday that it expects that figure to reach 84pc in 2013.

Although investors have been aware of the country's deteriorating public finances, the threat by S&P still surprised many. "We believe this is an aggressive timetable, since it means that policy makers will have to agree on a long-term deficit reduction plan before the 2012 elections," said Ajay Rajadhyaksha, a debt analyst at Barclays Capital.

In London, the FTSE 100 fell 2.1pc to 5,870.08, while the Dow Jones Industrial Average was 1.1pc lower at 12,201.59 in New York. Meanwhile, gold futures jumped to a record $1,498.60 an ounce, before falling back to $1,490.65 at 6am.

Asian markets continued the stock market woe on Tuesday, with Tokyo's Nikkei falling 1.24pc, Hong Kong's Hang Seng down 1.28pc and the Shanghai Composite giving up 1.88pc at 6am.

America's position as the world's biggest economy, and the dollar's role as a reserve currency, has afforded politicians a breathing space not enjoyed by smaller economies like Britain. In sharp contrast to the deficit-cutting – sometimes forced – seen across Europe in the past 12 months, last December Congress extended tax cuts that will push the country's budget deficit higher this year.

S&P'a move comes just a week after President Barack Obama laid out a plan to cut $4 trillion (£2.47 trillion) from the deficit over the next 12 years through a mix of spending cuts and tax rises. But analysts said that S&P's action suggests that, with the presidential election already looming, the rating agency believes that agreement on a long-term plan will only get harder over the next two years.

The struggle Democrats and Republicans have had to agree on budgets for this year and next, has sparked S&P's concern about their ability to take tougher long-term choices on spending programmes such as Social Security, Medicare and Medicaid.

Without reductions in spending and tax rises, the Congressional Budget Office (CBO) forecasts national debt will reach $17.3 trillion in 2020 from $9 trillion last year. In turn, the CBO has predicted that annual interest payments will soar from $197bn last year to $751bn in 2020.

"The debt is a bit like an escalator," said Kevin Logan, chief US economist at HSBC. "It's easy to turn round and get off after the first three steps, but becomes much harder after that."

Economists at Goldman Sachs said that although the change in outlook from S&P technically now puts the chances of a cut in the US rating at one in three, historically the agency has not always followed up. Britain had its outlook cut to negative in May 2009 but, because of the deficit plan, has retained the AAA rating.

The US Treasury hit back yesterday, arguing S&P "underestimates the ability of America's leaders to come together to address the difficult fiscal challenges facing the nation.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.