Silver Breaks Above $46 on Short Squeeze Rumour

Commodities / Gold and Silver 2011 Apr 21, 2011 - 11:33 AM GMTBy: GoldCore

Gold and silver have surged to new record nominal highs in dollar terms (all time and 31-year) with the dollar falling sharply on international markets. Silver has continued to surge in all currencies and has surged to a new record nominal high of $46.25/oz (£27.85/oz and £31.54/oz) on growing rumours of a short squeeze involving a billionaire or state interest attempting to corner the silver market (see FT news story below).

Gold and silver have surged to new record nominal highs in dollar terms (all time and 31-year) with the dollar falling sharply on international markets. Silver has continued to surge in all currencies and has surged to a new record nominal high of $46.25/oz (£27.85/oz and £31.54/oz) on growing rumours of a short squeeze involving a billionaire or state interest attempting to corner the silver market (see FT news story below).

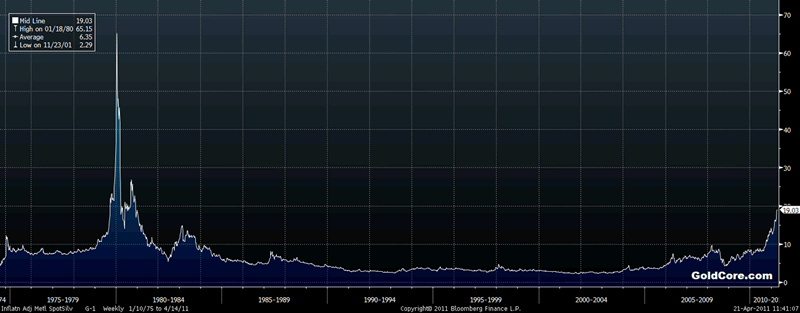

Bloomberg Composite Silver Inflation Adjusted Spot Price – 1975-2011 (Weekly)

Traders and technically minded investors are firmly focused on silver’s record nominal high of $50.35/oz. Some with a longer term fundamental focus continue to see silver in triple digits if it is to match the real record highs of $130/oz seen in 1980. The inflation adjusted silver chart puts the present sharp rise in the all important historical context.

The massive concentrated short positions of some Wall Street banks have incurred serious losses and a desperate attempt to close their futures positions due to the tight physical marketplace may be leading to a short squeeze. This is something that GoldCore and a few other analysts have warned for some time.

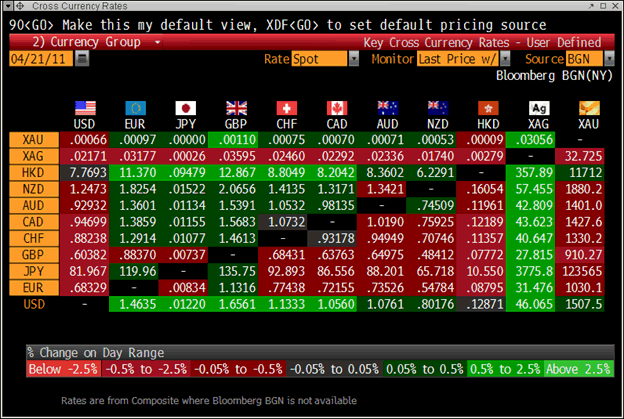

Cross Currency Table

We have long said that the very small silver market was ripe for cornering by private or state interests and that appears to be happening on some level. However, there is an increasingly large number of silver buyers who realise the market can be cornered and they are buying in anticipation of this event.

The blogosphere has again been ahead of the curve and dismissal of much circumstantial evidence of silver manipulation, a short squeeze etc. as “conspiracy theories” is becoming less easy to do. It looks like many investors internationally and one or a few private individuals and states are cornering the silver market.

At one stage the Hunt Brothers cornering of the market was a “conspiracy theory” - it soon became fact.

Silver’s volatility is set to increase and sharp corrections are likely, however the sharp falls seen after the Hunt Brothers manipulation ended are unlikely today given the very strong supply and demand fundamentals.

US Dollar Index – 5 Year (Daily)

Gold’s movement today, unlike in previous weeks and months, is a function of dollar weakness as gold has remained at the same price in terms of other major currencies.

The degree of complacency regarding the risk of the dollar coming under severe pressure remains high (as seen in Financial Times Lex column on gold and the US dollar today – see below).

Below the lows of 71.32 on the US Dollar Index (see chart above) is unchartered territory and the US’ massive $14 trillion plus debt will likely lead to the dollar continuing to fall particularly against gold. In a worst case scenario, it could lead to a form of a run on the dollar when speculators smell blood as happened to sterling when the Bank of England was “broken” by George Soros.

Gold

Gold is trading at $1,503.80/oz, €1,031.34/oz and £907.49/oz.

Silver

Silver is trading at $45.80/oz, €31.41/oz and £27.63/oz.

Platinum Group Metals

Platinum is trading at $1,811.00/oz, palladium at $759/oz and rhodium at $2,250/oz.

News

(Financial Times) -- Silver surge prompts conspiracy theorists

In 1980 it was the Hunt brothers. In 1998 it was Warren Buffett. And in 2011?

For anyone unversed in the history of the silver market, those dates refer to market squeezes that caused surges in the silver price. The talk among some conspiracy-minded traders and analysts is that something similar could be happening today.

It is easy to see why: during the past 12 months the price of silver has risen 154 per cent, outpacing gold (32 per cent), wheat (65 per cent), oil (45 per cent), and indeed almost any investment you’d care to mention.

Perhaps the most telling measure, the ratio between the price of silver and that of gold (ie the price of an ounce of gold divided by the price of an ounce of silver) has dropped to 33.5 times – after averaging 60-70 during the past decade.

The last time the ratio fell even close to this level was in 1998, when Warren Buffett’s Berkshire Hathaway quietly accumulated a huge position in the silver market, driving prices up 90 per cent in a few months to what was then a 10-year high of $7.90. On Wednesday, silver hit $45.37.

Before that, the last time the ratio was below 40 was in the early 1980s, following the most notorious silver market squeeze – that of William Herbert Hunt and Nelson Bunker Hunt, two billionaire oil baron brothers.

Is something similar happening today?

The silver market is never short of a wild rumour. The difference this time, though, is that the conspiracy theories are being seriously considered by senior figures in the industry.

As one senior banker puts it: “I just do think it has the smell of somebody with a pretty significant buying programme ... Silver is the sort of market that every decade attracts someone.”

The reason why the conspiracy theories have taken hold is because few traders or analysts can see a convincing reason for silver’s astonishing rise. According to data from consultancy GFMS, the silver market was in a surplus of 178m ounces last year.

Crucially, of course, that surplus was mopped up by investors. But visible investor positioning is hardly overwhelmingly positive – indeed, last week, even as silver prices rose, investors cut their bullish positions in the US futures market by 8.4 per cent.

Hence the conspiracy theories. Some of the whispers making the rounds in dealing rooms in London and Zurich include:

• A Russian billionaire with an eye for silver has been discreetly buying (for some reason Russia seems to be the most popular location of this putative billionaire – he or she could also be Middle Eastern or perhaps East Asian).

• There has been a secretive silver buying programme by the People’s Bank of China or some other central bank (but China is the favourite).

• Chinese traders are using silver imports as collateral to obtain credit in a similar way to copper – thus vastly inflating the country’s silver demand.

It is impossible to say if there is even a grain of truth in any of these tales. While some traders are taking them seriously, others believe the rise in prices is perfectly well explained by very strong, inelastic industrial demand plus extremely high retail demand in the US, India and China.

One explanation for why the silver market is confusing to many bankers and traders may be that they typically deal with large investors and so see little of the flow to retail investors and industrial consumers.

What is certain, however, is that with the view that silver is a speculative bubble so widespread, a sharp and painful correction can’t be ruled out.

Again, history may be informative. After the Hunt brothers’ squeeze in 1980, the price of silver collapsed 80 per cent in four months; the Hunts were later sanctioned for market manipulation and went bankrupt.

And following Warren Buffett’s silver play in 1998, the price of the metal dropped 40 per cent and Berkshire Hathaway recorded its worst annual results on record, relative to the S&P 500, in 1999.

(Financial Times ) -- Lex - Gold and the dollar: bottoms up

As of this week, one troy ounce of gold will cost you more than $1,500. Meanwhile, the US dollar, on a trade-weighted basis, is back to a post-crisis low. These facts are not coincidental, and reflect well-embedded trading trends that could persist for a while longer. They do not, however, cohere with events in the real economy.

Gold’s ascent has been far greater in dollar terms than when measured in other currencies. Worries about US inflation are part of this, as are low interest rates. The real interest rate on cash is the opportunity cost of holding gold – so, with rates historically low, there is less reason not to hold gold.

“Carry trading”, as investors borrow at low dollar rates and park money elsewhere, is made easier by very low levels of volatility. That money generally finds its way into the emerging markets commodity complex.

But this reflects mutual confusion. Sharply higher commodity prices are – even hawkish central bankers concede – deflationary. Discretionary spending falls when non-discretionary spending on essentials has to rise.

Meanwhile, continued rises in commodity prices, and the flows of funds they bring with them, have prompted capital controls in countries such as Brazil, and repeated measures to tighten money and to limit price rises in China.

And, despite all the betting on emerging market exports, the weak dollar has had a predictable effect – strip out petroleum costs and the US trade balance has steadily improved as the dollar has made US exporters more competitive.

Such market inconsistencies can carry on for a while. But if investors want signals that the dollar has bottomed, note that volatility looks unsustainably low and that real interest rates cannot fall much lower and are likely to rise with the end of the Federal Reserve’s QE2 bond purchases.

The dollar is now almost exactly back to its post-crisis low point from last year, a classic point for chart-driven traders to start buying it again.

(Telegraph) -- Gold Price Could Rise to $1,700 An Ounce

Gold's decade-long rally could last for another four years, with the price climbing to $1,700 an ounce, analysts predicted, as the precious metal reached another record high in morning trading.

Inflation will help the price of gold go up, but the strong gains seen in recent months are likely to be tempered as the world economy improves.

A poll of 12 analysts by Reuters found the average price forecast for gold in 2015 was $1,700, a 12.7pc rise on the all-time high of $1,508 reached today.

The forecasts ranged from $1,000 an ounce to $2,750, but even if the price reached the top end of that, the pace of gains would be slower than in recent years.

The price of gold increased by 24pc in 2009 and 30pc in 2010.

Today, the spot price rose as high as $1508.88 an ounce, before falling back slightly to $1507.45, a 0.3pc increase on yesterday's closing price.

The metal's price is being supported by worries over European sovereign debt, fighting in the Middle East and the state of the US public finances, which are weighing on the dollar, the other traditional safe haven for investors.

"The US effectively lost its triple-A rating in the eyes of investors that really matter quite some time ago, back when gold broke $1,000 an ounce," said Fat Prophets commodities analyst David Lennox.

(Irish Independent) -- A golden opportunity beckons but can the metal keeps its shine

Investors turn to gold in times of trouble, but the herd instinct has run riot.

Gold is a bubble and wise investors would do well to avoid its charms. You would think that in this country, after getting so badly burned by the property bubble, we would be wise to another ballooning bubble. But not a bit of it.

As in a lot of countries at the moment, gold is proving to be a very popular investment.

Investors generally buy gold as a hedge against any economic or currency crises. But gold is displaying the classic characteristics of a bubble, and investors need to be careful that this is not the year that it bursts.

A bubble occurs when a particular investment performs particularly well. This tends to draw the attention of investors. This in turn leads to more money being put into the investment which causes further price rises.

Investors get even more confident. This leads to an upward spiral that takes prices far above the levels which can be justified by any rational assessment of the real value of the future cash flows an investment may generate.

The gold bubble could stay inflated for a while. But that doesn't make gold less speculative and risky than it was a year ago.

However, investors need to note that you will never look too wise tying to call a bubble.

This week gold tipped over $1,500 an ounce, up from less than $500 just five years ago. That works out an eye-popping annualised return of 23pc.

Fear is driving the price ever upwards. Investors have always turned to gold in times of trouble, but it is questionable if rises like this can be maintained.

If you like bling, then gold is the thing.

But if you are buying gold as an investment you need to consider that it is nothing more than a bet that someone else will be prepared to pay more for it tomorrow than you did.

Heydays

This year could mark the last of the heydays for gold, warns Pat McCormack of Barclays Bank Ireland.

"The dollar isn't about to collapse, hyperinflation is not lurking around the corner, the gold price has already risen a long way and there is no yield -- nor any prospect of one.

"It wouldn't be a surprise to see gold at some stage fall by 20pc to 30pc if investors were to regain confidence in other assets."

You should never have more than 5pc of your investment portfolio in gold. This is especially so as gold has few industrial uses.

Almost every industrial use of gold is also an industrial use of silver. Since silver is much cheaper than gold you can imagine that people would rather use silver than gold for industrial purposes.

And gold does not pay you a return, unlike a share or a deposit.

With a share you have some hope of getting your money back over time from dividends.

In fact, if gold were a house, it would be one you could not live in and could not get rent from.

One of the richest men in the world, and truly the most successful investor of our time, Warren Buffett, is not a gold bug.

Speaking about gold, he said recently: "Look, you could take all the gold that's ever been mined and it would fill a cube 67 feet in each direction.

"For what that's worth at current gold prices, you could buy all -- not some -- all of the farmland in the United States. Plus, you could buy 10 Exxon Mobils, plus have $1 trillion of walking-around money. Or you could have a big cube of metal.

"Which would you take? Which is going to produce more value?"

It is hard to argue against the Sage of Omaha.

- Charlie Weston Personal Finance Editor

(Editor's Note: A lack of facts, blind belief in ‘gurus’, preconceived notions and a little knowledge are dangerous things).

(Irish Independent) -- Consumer demand in India and China will be long-term driver of stable high prices

With the price of gold continuing to test record nominal highs, it would be easy for investors to think they've already missed the boat if they're seeking decent returns.

After all, in dollar terms, at over $1,500 an ounce, the price has risen two-and-a-half fold in the past five years; and even over the past 12 months, it's up 37pc.

Geopolitical turmoil, a yawning US deficit and concerns over its credit outlook, as well as instability in the euro region, are all elements that are helping to underpin gold prices.

This week, Evy Hambro, who manages the $17bn (£11.7bn) Blackrock World Mining Fund, said that he believed gold prices may keep rising for "some years into the future".

"When you look at the underlying fundamentals in gold, they're all very supportive of today's pricing points and of pricing points higher than where we're trading right now," said Mr Hambro.

"So we would expect to see this positive, gradually rising price trend in gold to continue for some years into the future. I think some of the uncertainty that exists around exchange rates, quantitative easing, what paper money will buy you in the future, all of that is only helping gold from a financial point of view."

But it's simple consumer demand that is also expected to sustain high gold prices. The World Gold Council (WGC) -- a London-based organisation that promotes the use of the metal -- recently estimated that by 2020 cumulative annual consumer demand for gold in India -- the largest market in the world for gold jewellery -- will increase to in excess of 1,200 tonnes.

"India's continued rapid growth which will have significant impact on income and savings, will increase gold purchasing by almost 3pc per annum over the next decade," the WGC forecast.

"In 2010, total annual consumer demand reached 963.1 tonnes [in India]," it noted. "As seen in the last decade, Indian demand for gold will be driven by savings and real income levels, not by price."

Mark O'Byrne, the founder of Dublin-based GoldCore, a company that acts as a broker for well-heeled clients wanting to buy gold bullion and which also has a wealth management arm, also believes that consumer demand in India and China will be the long-term driver for sustained high gold prices.

In China, citizens weren't permitted to own gold from 1950 until 1982 -- although significant amounts of gold were reportedly smuggled into the country from Hong Kong and Singapore.

Commercial gold trading only resumed in China in 2003. It's only in recent years, however, that as the country's middle class expands, that gold jewellery has become an affordable luxury for many.

Mr O'Byrne also points out that the price of gold might be at a nominal high, but it's still way off what has previously been reached in real terms.

Around 1980, gold almost reached $2,400 an ounce in real terms when adjusted for inflation; and today's price would probably have to touch $2,200 an ounce or so to match that performance. Mr O'Byrne thinks $2,400 an ounce remains a realistic long-term price target.

But more than just buying gold in the hope of big returns, Mr O'Byrne says he and his team advise clients that about 5pc of their investment portfolio should be gold, helping to provide a shield against the vagaries of inflation, currency and equity fluctuations.

"With interest rates remaining low in most countries, there is little reason not to own gold, as the metal currently offers the best returns around," according to Gavin Wendt, founding director with Australia-based MineLife.

He believes that coupled with the debt turmoil in Europe and violence in the Middle East "it's a perfect storm for precious metals, including gold and silver".

(Bloomberg) -- Gold Climbs to Record on Dollar, Debt Concern; Silver Advances

Gold climbed to a record in London and New York for a fifth day, trading above $1,500 an ounce, as a weaker dollar and debt concerns boosted demand for the metal as an alternative investment. Silver rose to a 31-year high.

The dollar slid to the lowest level since August 2008 against a basket of six major currencies. Greek two- and 10-year government bond yields reached euro-era records amid speculation the nation won’t be able to avoid restructuring its debts.

Fighting in Libya and Japan’s nuclear crisis helped gold, which typically moves inversely to the greenback, to gain 6.1 percent this year.

“The key element determining gold’s near-term direction right now is the U.S. dollar,” Edel Tully, an analyst at UBS AG in London, said today in a report to clients. “Sovereign debt concerns in U.S. and Europe along with inflation fears provide a good backdrop for gold.”

Immediate-delivery bullion gained as much as $6.32, or 0.4 percent, to $1,508.88 an ounce and was at $1,507.70 by 11:21 a.m. in London. Gold for June delivery was 0.6 percent higher at $1,507.80 an ounce on the Comex in New York after reaching a record $1,509.50.

Bullion rose to $1,507 an ounce in the morning “fixing” in London, used by some mining companies to sell output, from $1,501 at yesterday’s afternoon fixing. Seventeen of 20 traders, investors and analysts surveyed by Bloomberg, or 85 percent, said bullion will rise next week. Two predicted lower prices and one was neutral.

Dollar Decline

The U.S. Dollar Index dropped as much as 0.9 percent before a report forecast to show U.S. house prices fell for a fourth month, underscoring prospects the Federal Reserve will maintain monetary stimulus. Central banks in Europe and Asia have raised interest rates to help combat accelerating consumer prices. The U.S. Treasury Department projects the government could reach its debt ceiling limit of $14.3 trillion as soon as mid-May and run out of options for avoiding default by early July.

The uprising in Libya, which began Feb. 17, has settled into a military stalemate near the central oil-port city of Brega. Italy, France and the U.K. said they are sending military advisers and trainers to help Libya’s disorganized and poorly equipped rebels, as French President Nicolas Sarkozy called for intensifying airstrikes against forces loyal to Muammar Qaddafi.

“Trading is expected to be thin today and next week as market participants will be out” because of holidays, UBS’s Tully said. “The lack of liquidity means that gold may not be as orderly as it has been this week and we could see large price swings.”

Silver for immediate delivery climbed as much as 1.8 percent to $46.07 an ounce, the highest price since January 1980, the year the metal reached a record $50.35 in New York. It was last up 1.5 percent at $45.9188 and has surged 49 percent in 2011. An ounce of gold bought as little as 32.73 ounces of silver in London today, the least since June 1983, data compiled by Bloomberg show.

Palladium was 1.2 percent higher at $769 an ounce. Platinum rose 0.7 percent to $1,816 an ounce.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.