How to Buy Silver at 10% Off

Commodities / Gold and Silver 2011 May 20, 2011 - 03:22 PM GMTBy: Casey_Research

Kevin Brekke, Casey Research writes: Inflation has certainly been all over the headlines lately. As the cost of basic materials and commodities has pretty much risen across the board, it was just a matter of time until this rise made its appearance on store shelves at a retailer near you. With prices at the pump squeezing motorists as well, the drive to the supermarket is as painful as watching your groceries being scanned at checkout.

Kevin Brekke, Casey Research writes: Inflation has certainly been all over the headlines lately. As the cost of basic materials and commodities has pretty much risen across the board, it was just a matter of time until this rise made its appearance on store shelves at a retailer near you. With prices at the pump squeezing motorists as well, the drive to the supermarket is as painful as watching your groceries being scanned at checkout.

The tide of rising prices has consumers looking for ways to stretch their purchasing power – coupon clipping and cents back on gasoline via certain credit cards is one way to fight back.

Metals investors like us are also alert to any opportunity to add to our precious metal holdings at the cheapest price. And there is good news for those of you who listened to our advice and converted some of your U.S. dollar-denominated wealth into select non-dollar-denominated assets and foreign currencies. The so-called “commodity currencies” have certainly put in a good performance against the dollar.

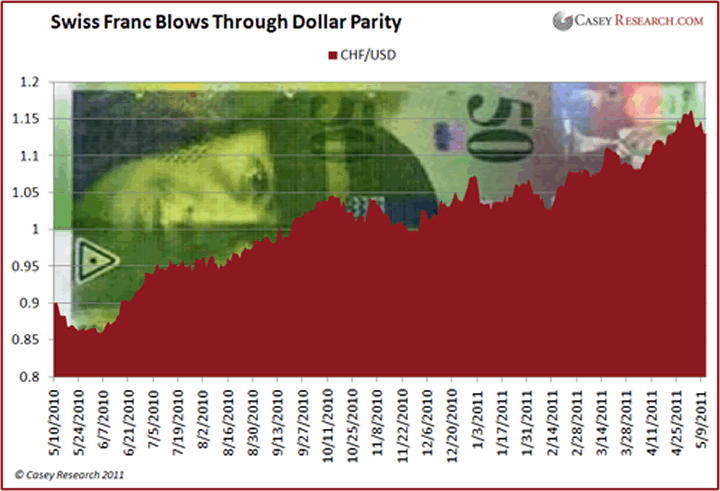

However, I want to highlight another currency that has been flying under many analysts’ radar: the Swiss franc. The franc has gained more than 20% against the dollar over the past year and now sits about 11% past parity against the US$. Here’s a one-year chart:

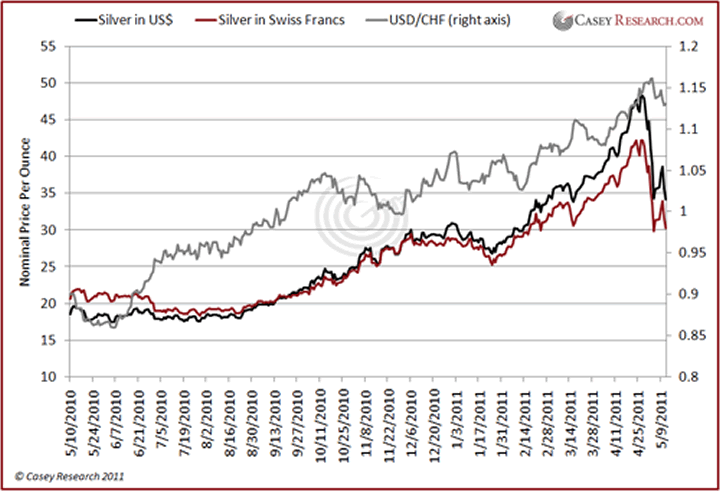

An investor who bought Swiss francs a year ago can today buy an ounce of silver for 30 francs and change. As shown in the next chart, the nominal gap in silver pricing now exceeds 10%:

Admittedly, my 10% off claim assumes that parity between the currencies somehow represents a “fair” exchange. Since the exchange rate between the dollar and the franc floats, it is the free market, as it should be, that determines the number of units of one currency needed to buy another.

In the end, I use parity between the two currencies as a random reference to illustrate a point: diversifying some of your wealth outside the dollar is a necessary tactic. Not only will this strategy protect your purchasing power, but it is a way to leverage the value of your precious metals holdings.

Holding precious metal outside the U.S. allows you to not only capture the metal’s price advance, but when the value of the metal is converted back to dollars, an additional gain on the currency conversion will likely be captured as well. The dollar has crashed 50% against the Swiss franc since 2001. It could easily repeat this feat over the next ten years, adding rocket fuel to your precious metals gains.

And there’s an added bonus. When it comes time to sell some of your metal, and you choose not to repatriate the funds back to the U.S., you’ll have the means to take a nice vacation without the budget-busting effects of converting an ever-decaying dollar into the local currency.

[If you don’t own enough gold and silver yet, you still have a chance to load up on the dips. Read the current BIG GOLD edition to learn how to take full advantage of a correction in the precious metals – try BIG GOLD today for only $79 per year, plus 3-month money-back guarantee.]

© 2011 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Mick

23 May 11, 07:58 |

you can't be serious

The results are the same but with additional costs of currency conversion. |