Is Gold a Bad Investment?

Commodities / Gold and Silver 2011 May 25, 2011 - 02:45 AM GMTBy: Nick_Barisheff

Numerous commentaries in the media, both on television and in print, would have us believe that gold is a bad investment. Headlines warning investors to avoid the yellow metal are commonplace. Examples such as “Five reasons not to own gold”, “Gold is in a bubble”, “Gold as an investment - think again”, “Gold is a bad hedge”, “Gold is a pointless rock,” and “Why gold is a bad investment” can be found with a simple Google search on gold and investment.

Numerous commentaries in the media, both on television and in print, would have us believe that gold is a bad investment. Headlines warning investors to avoid the yellow metal are commonplace. Examples such as “Five reasons not to own gold”, “Gold is in a bubble”, “Gold as an investment - think again”, “Gold is a bad hedge”, “Gold is a pointless rock,” and “Why gold is a bad investment” can be found with a simple Google search on gold and investment.

Each of the above points are addressed and debunked in the BMG Special Report, 'Six Biggest Myths About Gold' which readers of this article are strongly encouraged to read and which can be downloaded for free at www.goldmyths.com

These articles miss the point, because they treat gold as an investment. To fully understand gold's role in an investment portfolio, we need to adopt a new mindset, a gold mindset.

Simply put, gold is not a bad investment, and gold is not a good investment. Gold is not an investment at all - gold is money.

While many people believe gold is an archaic relic that has no role in today’s sophisticated, computerized, paper-based monetary system, three facts contradict this popular misconception:

- Gold, silver and platinum are traded on the currency desks of the major banks and brokerage houses, not the commodity desks. Traders understand gold is money to be traded against paper currencies.

- The world’s central banks hold about 30,000 tonnes of gold in reserves. While there has been a lot of media attention given to central bank sales in the past, gold holdings have only declined by about 2,000 tonnes since 1980. Central banks have become net buyers since 2009 and have been adding gold to their currency reserves. Central bankers understand gold is money.

- The turnover rate between members of the London Bullion Market Association is over US$20 billion per day, with volume estimated at five to seven times that amount. Clearly, this has nothing to do with jewelry sales and everything to do with the exchange of money

The definition of “investment” is the commitment of money or capital to purchase financial instruments or other assets in order to gain profitable returns in the form of interest, income or appreciation of the value of the investment. Through this transfer of capital, in the expectation of a profit, an investor gives up their capital and puts it at risk. The investor receives a return in dividends or interest as compensation because their capital is at risk; they may get back less than they invested, or they may get back nothing at all.

However, physical gold bullion or physical paper currencies locked in a vault are not invested; they are simply being stored. Since neither is invested, they don’t earn interest or dividends, but they don’t have any counterparty risk. The major difference between gold and currencies kept in a vault, however, is that gold’s purchasing power increases while paper currencies lose purchasing power year after year.

Both gold and currencies can be taken out of the vault with ease, and the proceeds invested by giving them to someone else in return for dividends or interest. An interesting perspective can be gained by calculating whether the proposed investment is likely to return more gold ounces than were originally invested. For example, the 44 ounces of gold required to purchase the Dow in 2000 has now dwindled to fewer than nine ounces. Might as well have left the gold in the vault. Since gold maintains and even increases in purchasing power, there is no need to put it at risk in order to earn a minimal amount of interest or dividends.

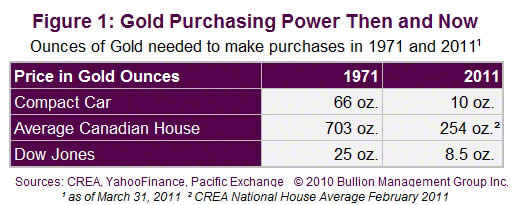

Figure 1 illustrates how gold has not only preserved but also increased its purchasing power from 1971, when the gold standard was abandoned, to 2011.

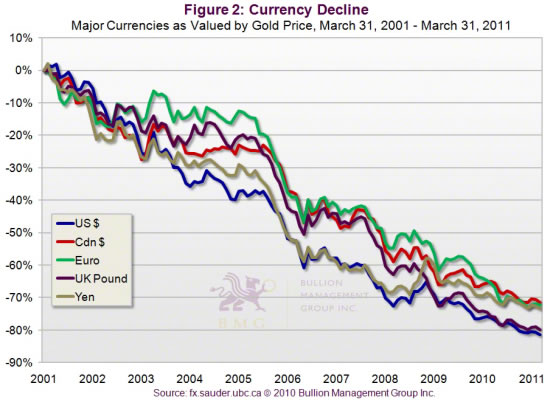

Figure 2 illustrates how all of the major currencies have declined over the last decade when measured by gold ounces.

It is crucial to recognize that physical gold bullion, held directly or on an allocated and insured basis in a vault, is not an investment because it is not someone else's promise of performance or someone else’s liability, and as a result has no counterparty risk. All other forms of gold ownership are, in fact, investments.

Paper gold certificates, unallocated bullion accounts, ETFs, shares in gold mining companies and futures contracts all have counterparty risk, and are either someone else's promise of performance or liability. They may have their place in a portfolio, but they are all investments. We hold physical gold in a vault, we hold physical currencies in a bank, but we invest in financial assets.

By Nick Barisheff

Nick Barisheff is President and CEO of Bullion Management Group Inc., a bullion investment company that provides investors with a cost-effective, convenient way to purchase and store physical bullion. Widely recognized in North America as a bullion expert, Barisheff is an author, speaker and financial commentator on bullion and current market trends. He is interviewed monthly on Financial Sense Newshour, an investment radio program in USA. For more information on Bullion Management Group Inc. or BMG BullionFund, visit: www.bmginc.ca .

© 2011 Copyright Nick Barisheff - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.