Why China’s Rare Earth Exports Really Matter

Commodities / Metals & Mining Jun 06, 2011 - 03:18 PM GMTBy: Jeb_Handwerger

For several months, I have alerted readers to the potential supply crisis of critical rare earths (REMX), which are used in our most vital defense technologies (ITA) and high tech industries (QQQQ). The recent volatility in the equity markets have caused many investors to flee rare earth mining stocks in search of safe havens in gold (GLD) and long term treasuries (TLT). This trend should be transitory in nature. We may see a strong rebound in many of these rare earth stocks once the uncertainty regarding the ending of QE2 winds down.

For several months, I have alerted readers to the potential supply crisis of critical rare earths (REMX), which are used in our most vital defense technologies (ITA) and high tech industries (QQQQ). The recent volatility in the equity markets have caused many investors to flee rare earth mining stocks in search of safe havens in gold (GLD) and long term treasuries (TLT). This trend should be transitory in nature. We may see a strong rebound in many of these rare earth stocks once the uncertainty regarding the ending of QE2 winds down.

The latest Chinese data indicates that rare earth exports are continuing to drop by more than half compared to last year's output. In April, China exported only 1,819 tons of rare earths, a shortfall of 53% from the previous year.

High tech manufacturers outside of China must look elsewhere to satisfy their rare earth needs. Rare earth prices are soaring, but the rare earth mining stocks are not reflecting the elevated prices yet. This phenomenon will not last long as institutions will begin catching on to the divergence between rare oxide prices and undervalued rare earth miners. Prices are soaring, rising almost ten times in the past year, forcing manufacturers in Japan (EWJ), South Korea (EWY), United States(DIA) and Europe to search for future supply for their survival. This should be a bonanza for rare earth developers down the road, once manufacturers dip their toe into the water and acquire some of these vital assets. Once one does, we may see a domino effect of consolidation. It's within the realm of possibility that cash-rich manufacturers will be compelled to enter off take agreements and alliances with global sources of supply and potential miners.

It's time for the affected industrialized nations to do their own heavy lifting in providing these vital elements so necessary for the very survival of their manufacturing base. We are talking here of an emergency process, which will take time to develop from mining to manufacturing. Advanced nations must think of urgent measures such as developmental fast tracking, financing and legislative expediting to bring these projects to fruition.

Noises are being made about taking China (FXI) to court, namely through the World Trade Organization. It is questioned whether such a resort to complicated and lengthy legal procedures can be successful.

Time is truly of the essence. Whether the proposed case has merit or not, modern industrialized nations must seize the high ground and move rare earth mining forward.

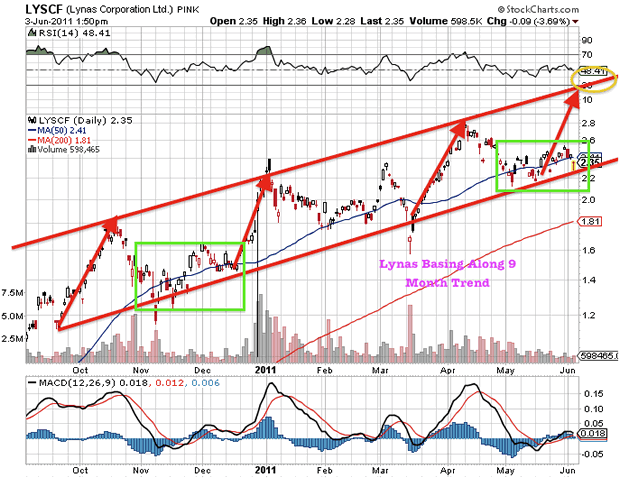

I have highlighted some eligible heavy rare earth projects suitable for immediate development in North America and Europe. Lynas (LYSCF.PK) and Molycorp (MCP) are not capable of filling the supply deficit for rare earths alone. Additional projects must be developed and brought into production.

Development of the rare earth initiative is long past due. The Department of Defense requires it and the high tech industry demands it. The West has the expertise and the capability of recapturing the base that was once ours and was co-opted by the Chinese.

Lynas appears to be reaching support at its 9-month trendline. This is an area in which we have seen major moves higher into new high territory. Lynas has the best odds of being the first miner to the market outside China. Over the past nine months, Lynas has bounced off of support and made breakout moves. Lynas is experiencing higher highs and higher lows characteristic of a healthy trend. Lynas could make a move into new record high territory.

Disclosure: Long Lynas

Be assured that we are keeping a weary eye on these constantly evolving developments. Partake in a free trial of my daily intelligence report by clicking here.

By Jeb Handwerger© 2011 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.