Silver: The Fulcrum of Value

Commodities / Gold and Silver 2011 Jun 13, 2011 - 04:28 AM GMTBy: Submissions

Pat Fields writes: A nonchalant comment I’d posted to a thread on Facebook (1) reflecting on a Zerohedge article (2) relating to bullion bank, Scotia Mocatta’s curious accounting for their silver holdings, sparked a small brush-fire of e-mails among a few folks. Particularly, it was my characterization of silver as having the analogical position of a fulcrum, providing a natural balance to the rational valuations of gold and copper and the further societal effect that this function imparts. Consequently, I received a note to request that I write this article, expanding further on these interconnections.

Pat Fields writes: A nonchalant comment I’d posted to a thread on Facebook (1) reflecting on a Zerohedge article (2) relating to bullion bank, Scotia Mocatta’s curious accounting for their silver holdings, sparked a small brush-fire of e-mails among a few folks. Particularly, it was my characterization of silver as having the analogical position of a fulcrum, providing a natural balance to the rational valuations of gold and copper and the further societal effect that this function imparts. Consequently, I received a note to request that I write this article, expanding further on these interconnections.

As I haven’t the luxury of time to write extensively (let alone exhaustively, which I will not embark on here), I was initially hesitant to commit to the assignment, but because I nevertheless believe it important that folks can benefit greatly by affording the subject of money a deeper insight than they generally expend, I hunkered down to give the task my best shot.

Note the crossed ‘K’-like symbol on the Saxon, Greek and Chinese coins!

The Surface View

History is replete with volumes of records describing great civilizations as the central conductors and administrators of commerce in their respective regions and times. From the mythical Atlantians or Phoenicians in the Mediterranean, to the Chinese in Asia and the Moche and Olmec in the Americas; their most distinguishing common feature is their influence over commerce, which in turn, leveraged political power within their orbits of trade. Since discovery of metallic money media in those ancient times, from the Celtic lands, to those of the Lydians, clear across to the island of Japan; money is known universally to have been in the forms of copper, silver and gold. The grand Euro-Asian standard of exchange has always stood atop those three columns.

So, for millennia even beyond 4,000 BC, these three metals have together comprised the media of trade between broader civilizations and their component cultures. This fact quietly begs the question of why that had come to be; yet, I can find no dissertations on the circumstance. Is it such an endemic norm that it compels no further contemplation? I, for one, think not.

Digging Down

What then, accounts for this ‘standard’? Why have these three metals united into such an inviolate triumvirate throughout the monetary chronicle of civilizations? We might begin with reflection on psychology. We can easily observe that people crave untrammeled liberty for themselves, to as great an extent as is possible and still co-exist with others. Those with ambition to control commerce, incidentally desire to curtail the liberty of their fellows while retaining most of their own. This is the first clue as to why no one of the metals was ever allowed to dominate the other prior to the 19th century. The triumvirate impartially guarantees the liberties of the ambitious and humble without favor. It broadens their trade horizons globally, from prince to pauper, encompassing everyone in every society.

To illustrate the practicality of this phenomenon, we can see that when the Chinese economy disintegrated under their paper ‘flying money’ fiasco by the mid-1400’s, while they resolved to replace the stamps with silver (emulating the Indians) on the Zhu-Tael weight scheme (the same concept as ‘Grain-Ounce’), their oldest circulating ‘cash’ was copper, which served to bridge their reconstruction in the interim, just as the first overseas traders began to arrive offering abundant silver (3) more for their silk and crockery. The weight of copper ‘cash’ determined the ratio against silver, which in turn, variously induced their real-time estimation of gold. That process at times rendered an exchange of 1:8 gold-silver, to the delight of lucky Portuguese ship’s captains, undoubtedly.

Though it took 300 years to fully rebalance their economy to perch upon silver, had the Chinese completely abandoned their copper ‘cash’ for the ‘flying money’; as with ‘Rome’, our knowledge of ‘China’ may likely only come from history books. It was humble copper that saved China from devolving back to its autonomous provincial roots. Remarkably, the same coinage of the 1500’s onward, continued in regional trade on Tael-weight until the advent of World War Two!

The Lesson Of The Tael

So, what can we draw from this observation? Foremost, if we compare the Roman decline in tandem with its debasement of coin (4), we see that Rome came to value its silver denarius as a mere numerical unit of account, where in contrast China never departed from weight-based valuation in coin, even during the period of its ruinous ‘flying money’ (and at least so far, despite the quickly depreciating Yuan). As a result, Rome’s duration in the form of an integrated ‘state’, endured only about 840 years (5), while China continues to this day from the Neolithic epoch.

The effect is especially poignant in combination with population growth ‘demand factor’, when we consider that Roman high officials received salaries of approximately 4,676 silver dollars per year in undiminished dinarii (6), and Congressmen in 1855 received salaries of 3,000 silver dollars (7). Further, in Egypt’s 18th dynasty (8), as in 1855, copper exchanged with silver on a 100:1 ratio. On today’s exchange, copper by Troy-weight, still hovers within that same ratio (128:1)!

In The Final Analysis

The poly-metallic monetary model is superior enough to the mono-metallic alternative that, when called upon, the currently least esteemed of the triumvirate, copper, has the proven capacity to preserve a vast nation-state through its most severe economic travails, as long as it’s valued solely by weight and fineness. This is so, because the ordinary People of all societies, who represent their bulk of inhabitants, conduct their commerce in little bits every day. Yet, as they have the liberty to consistently trade savings progressively into silver and gold, their pathway is open to expression of their aspirations or more importantly, to dependably lay provision against the certain deprivations of their feeble years.

Chiefly, these metals distribute themselves along economic strata in societies. In an environment where their ratios of inter-exchange remain constant according to their relative balance of availability, each inhabitant is assured of his socio-economic empowerment and mobility. In a word, his Liberty.

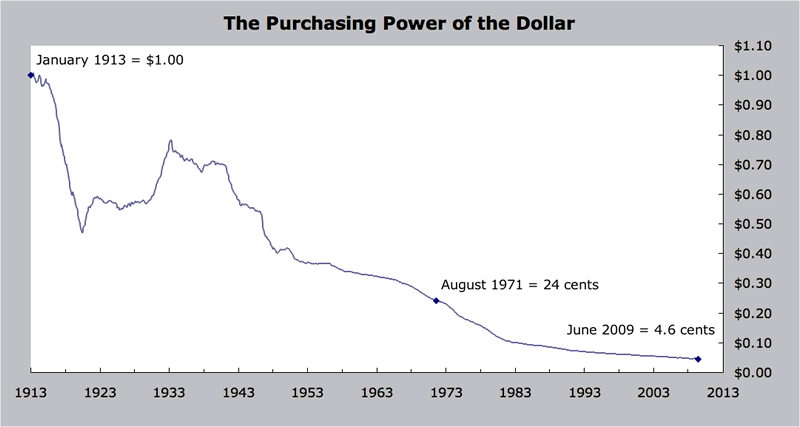

Recall the wages of Roman high officials and Congressmen above. In banknote terms, Congressmen now receive salaries (minus benefits) of 174,000 (9). In constant silver terms, that puts the silver dollar at a current banknote exchange of 58 per silver dollar. But, because our cost of living (prices of goods) bears on our real-life situational valuation, we turn to the banknote’s depreciation in purchasing power.

The current calculations for 2011 are down to 3 cents of purchasing power. Using the same 3,000 of 1855 Congressional salary, we find that in constant Purchase Power, their silver dollar now has an equivalent banknote exchange value of 90 (as the banknote reaches ½ cent PP, the ratio will then be 200:1 banknotes to silver dollar)! When the American banknote becomes truly worthless, silver will replace all other ‘valuators’. As it was when China faced this very same conundrum in the 1450’s, we will do well to mimic their response; ‘hardening’ our banknotes in copper with the intention of again straddling the balance-beam of silver that America’s founders had the genius to bequeath us in reflection on the Chinese example, so fresh an illustration in their own history. Remember, the ‘Continental’ was originally a copper piece intended to be valued in turn against silver.

Throughout the notes below, we see all along that copper, silver and gold stood as humanity’s money (except in the modern era), we can also determine that silver distinguishes itself as the fulcrum on which balance the resulting valuations of copper and gold, each imbuing the various economic levels of society a share of financial independence and opportunity. In the depths of economic despair, an occasion that was pivotal in monetary history, the Chinese recognized this maxim and while copper saved their civilization, yet they accommodated to reality and reorganized on silver’s scales, even to the extent of an abnormally high silver cost against their gold. In the end, it is the three columns together, however, that most firmly hold the capital block of Honest Commerce aloft.

-By Pat Fields

Notes:

1) http://www.facebook.com/ken.shock/posts/149431788462015

2) http://www.zerohedge.com/article/scotia-mocatta-loses-60-its-physical-silver-one-month-reclassification- total-comex-registere

3) http://www.highbeam.com/doc/1G1-91271525.html

4) http://www.lehigh.edu/~inarcmet/papers/pense%201992.pdf

5) Chart: http://www.businessinsider.com/chart-of-the-day-silver-content-in-roman-coins-2011-5

6) See Note (4)

7) http://socyberty.com/history/jeffersons-debt/

8) http://www.reshafim.org.il/ad/egypt/trades/metals.htm

9) http://www.thecapitol.net/FAQ/payandperqs.htm

10)http://www.aier.org/research/briefs/1826-the-long-goodbye-the-declining-purchasing-power-of-the-dollar

© 2011 Copyright SilverDoctors - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.