To QE or Not To QE? That Is The Question

Stock-Markets / Quantitative Easing Jun 22, 2011 - 03:36 PM GMTBy: Jeb_Handwerger

While the media is customarily thought to disseminate news, there is a far more intriguing purpose in the role of the relationship between the national mindset and the intended purposes of economic establishment.

While the media is customarily thought to disseminate news, there is a far more intriguing purpose in the role of the relationship between the national mindset and the intended purposes of economic establishment.

It has ever been thus, going back to Shakespeare's Salanio character in "Merchant of Venice." Upon meeting colleagues, the characters would greet each other with the question: "Now, what news on the Rialto?"

The Rialto was a place where the powers that be would meet in the morning and exchange ways to use the day's news to establish desired policy. The Roman baths were also venues in which senators and policymakers would formulate strategies. Of course, Joseph Goebbels and the Stalinists also realized the pivotal role played in the intermarriage of news and economic policy.

Similarly, today we observe the fine "Roman hand" in planting stories to influence a kind of Orwellian mindset in the furtherance of establishing desired fiscal objectives--the doublethink, paranoia, deception and delusion.

It is more than coincidental that, when the elites wish to formulate their desired goals in such matters as quantitative easing (QE), bailouts and Keynesian pump priming, negative economic data will be released. It's the same old story.

The Obama team is dedicated to Federal Reserve Chairman Ben Bernanke's philosophy of avoiding depression through the printing press to proliferate cheap money. We are being set up for the acceptance of quantitative stimulus by whatever means and guises necessary.

Until now, everything was coming up roses. National recovery was in the air. Then, all of sudden these past few weeks, data turned on a dime? Economists were compelled to rethink hitherto positive figures. Are we being programmed for more QE?

It would not be surprising if we were finessed into acceptance of inflationary policies. Bills could be paid with cheap dollars. Moribund local and state governments could pay off their strangling debts. Think of our swollen budget being paid with cheap dollars. A seemingly simple solution to a complex problem. However, there may be another side to the seesaw.

Our erstwhile allies, such as China and Russia, have been making noise about setting up an alternative currency. Witness Greece and the PIIGS nations (Portugal, Italy, Ireland, Greece and Spain). They are desperate for money to extricate themselves from their financial quicksands. More bailouts anyone?

Foreign governments are buying gold(GLD) at levels not seen in 30 years due to risk of further declines in the U.S. dollar (UUP).

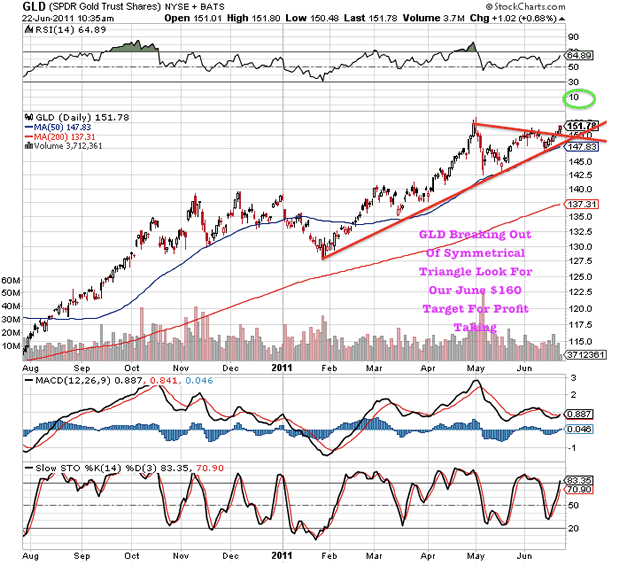

Gold (GLD) is breaking out of the symmetrical triangle formation on its way to our late January target of $160 or $1600 gold. Monitor for a powerful leg higher as we break $1575 or $152 on the GLD.

Goldman Sachs (GS) is under subpoena in Manhattan as possibly playing a major role in the housing market fiasco. The Manhattan District Attorney is investigating "activities in creating and selling mortgage-based securities designed to allow the bank to profit from the collapse of the housing market."

One cannot but hope to consider that many of these dramatis personae are some of the very same folks that are steering our national financial ship of state. Prayer anyone?

All these roads lead clearly to the validity of Gold Stock Trades' essential message, either mining stocks (GDX) and gold (GLD) and silver (SLV) bullion, may be the requisite ports in the upcoming storm.

I invite you to partake of my members only stock analysis service for free by clicking here.

By Jeb Handwerger© 2011 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.