Don't Fall for the Gold Stock Death Cross

Commodities / Gold & Silver Stocks Jul 13, 2011 - 12:54 AM GMTBy: Jeff_Berwick

Recent trader 'chatter', to use the US Government term, has indicated that some people have become concerned with the "death cross" appearing in major gold stock indices like the Gold Bugs Index (AMEX:HUI). A death cross is denoted when a short term moving average (50 day) crosses over a long term moving average (200 day).

Recent trader 'chatter', to use the US Government term, has indicated that some people have become concerned with the "death cross" appearing in major gold stock indices like the Gold Bugs Index (AMEX:HUI). A death cross is denoted when a short term moving average (50 day) crosses over a long term moving average (200 day).

Certainly, with a name like Death Cross, it does sound scary! But, is it really something to be concerned about.

The Dollar Vigilante's Take on Technical Analysis

First, we should outline our take on technical analysis - or, more accurately, statistical analysis. Here, at TDV we do use charts as part of our toolkit but it is only one small part of our analysis of any investment.

It should be noted that this stance leaves us to be attacked from two groups. The first, the academic economist, usually discounts technical analysis as 100% self-fulfilling nonsense. The other crowd, the pure "technician," consider us heretics for not making ALL our investment decisions from the tea leaves in the charts alone.

Nonetheless, we have always felt no need to submit to the pressure of groups and follow our own instincts and analysis no matter if that leads us down a lonely path.

In response to the academic economists, we agree totally that there is no knowledge of the future in the chart but we disagree with academics about the utility of technical analysis.

Charts have utility to the professional investor. We use charts carefully to understand which way the wind is blowing at the moment or whether there are signs of change in the trends.

Stock price trends can usually easily be explained by economic theory. In the big picture by monetary inflation trends (one of the most important indicators we watch but one that is almost completely ignored by mainstream investors); but also, at the individual company (or stock) level we see trends explained by improving fundamentals AND outlooks. The improvement in earnings or sales may often in of itself portend more improvement ahead, especially if it is a growth business; but there are also fluctuations in valuation that tend to trend for periods of time in relation to those improving fundamentals. Granted, this says nothing about the future. But it does explain why trends exist without relying on the random walk hypothesis, or other equally unlikely theory.

Of course, from the chart technicians perspective, they don’t like to hear how limited technical analysis is, and how trading off charts alone is akin to gambling.

In summary, in our opinion, technical analysis is but one tool in a speculator’s and trader’s tool kit.

Death Cross in Gold Stocks is Wrong Much More than Right

That being said, lets look at some statistical facts.

Looking at the HUI there has been 6 'death crosses' since 2000. Only one of them turned out to be significant, in 2008. But we were already very bearish on gold stocks at that time due to other more important indicators including money supply growth (as calculated by the Austrian School).

There were death crosses early in 2002, late in 2004, again in 2005 and late in 2006. The only time it worked was in the 2008 crash...but it would have kept you out of the gold stock market more than in over the past ten years. You would have been shaken out each of those times - which is what we have continually stated is the greater risk - being shaken off the bull.

Gold Stocks Can Lag and then Catch Up in Violent Rallies

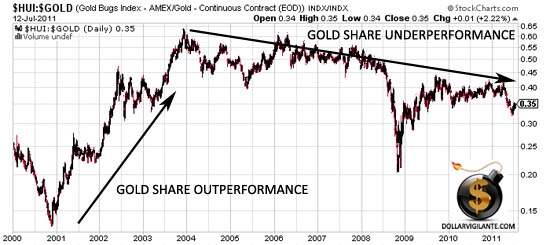

What often happens is that gold stocks do nothing for extended periods of time, even while the price of gold itself is rising. Gold share booms are relatively shorter as a result, but they are more violent in their catch up rallies than gold prices. The only time gold shares really outperformed gold greatly was in 2001-04 (as can be seen in the chart below). Ever since then the bears have always used the relatively lackluster performance of the gold equities (relative to gold) as a bearish indicator forecasting lower gold prices.

With gold up $35 to $1,566 today and close to all-time highs and with gold stocks at very attractive current valuations, the odds are much more in favor of a gold stock move to the upside than the downside.

And with all the politicos in Washington scurrying around trying to find a way to increase the debt ceiling by more than $2 trillion and the European union falling apart in front of our eyes, it seems to us that even if the "death cross" were a much more dependable indicator that it still would be risky to listen to it and be out of the gold market at this time.

Subscribe to TDV today (90 day moneyback guarantee) to access our Special Report on How to Own Gold as well as get complete access to our newsletter and portfolio selections.

The Dollar Vigilante is a free-market financial newsletter focused on covering all aspects of the ongoing financial collapse. The newsletter has news, information and analysis on investments for safety and for profit during the collapse including investments in gold, silver, energy and agriculture commodities and publicly traded stocks. As well, the newsletter covers other aspects including expatriation, both financially and physically and news and info on health, safety and other ways to survive the coming collapse of the US Dollar safely and comfortably. The Dollar Vigilante offers a free newsletter at DollarVigilante.com.

© 2011 Copyright Jeff Berwick - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.