Exploding Government Debt to Send Gold to $3000, Silver to $300

Commodities / Gold and Silver 2011 Jul 18, 2011 - 02:43 AM GMTBy: George_Maniere

For those of you that have not read my writing I will save you the suspense and tell you here and now that I have been I gold and silver bug since I was 8 years old. I'm now 58. As far as I know I was the only kid I know that wanted either a St. Gauden's Gold Double Eagle or an 1885 Carson City PCGS MS 67 Morgan Dollar for my birthday. Back then it was a hobby. Now it is very serious business.

For those of you that have not read my writing I will save you the suspense and tell you here and now that I have been I gold and silver bug since I was 8 years old. I'm now 58. As far as I know I was the only kid I know that wanted either a St. Gauden's Gold Double Eagle or an 1885 Carson City PCGS MS 67 Morgan Dollar for my birthday. Back then it was a hobby. Now it is very serious business.

I only preface my remarks to save the readers who don't want to hear from any more gold and silver bugs. However, if you are like me and think that gold and silver will be our hedge against whatever economic winds and "Black Swans" come our way, please read on.

I don't for one minute doubt that the debt this country has run up over the last 6 years has exploded. I also don't think for one minute that the debt that has been run up was truly "AAA." I can't possibly be the only one who finds it ironical that the same agencies that stamped the collateralized debt obligations and derivatives "AAA", while they allegedly took bribes, and share equally for the economic morass we find ourselves in are the same agencies that are now holding us hostage by warning of a possible credit downgrade. The truth, as I see it, is that the financial sector as a whole was the great enabler of this scheme as the cause of the economic collapse was their voracious appetite for risky loans as a way to work the system. This certainly has to rate as one of the greatest lies in economic history.

In Europe, Greece has already defaulted. It's just a matter of semantics. Meanwhile, the EU continues to fiddle while Lisbon, Dublin, Madrid and now Rome burn. As reported in this week's Barron's eight European banks failed the "stress tests" and the other 16 banks passed marginally but the IMF warned that these banks were also insufficiently funded.

Those of you that read me regularly know that I am a big fan of Martin Armstrong. Those of you that are not conversant in Martin Armstrong and his Princeton Economic Model I strongly urge that use visit http://martinarmstorng.org and read about this truly unrecognized and unappreciated genius. This man's understanding of money and debt is most assuredly still not appreciated today.

Everything he warned would happen in Europe did happen because Europe failed to listen when he told the ECB that all the debts had to be consolidated into a single national debt in order for there to be a single currency (the Euro). The politicians would not listen because politically they assumed it would have been a bailout of the lesser states and that they could not sell it to their people. They were wrong and we are now reaping what they sowed.

What Armstrong is saying about the gold standard idea is that money is never a constant. It fluctuates in purchasing power rising in depression and declining in booms. Those who cannot see what he is saying are making the same mistake as Karl Marx made assuming that there can be a perfect world without a business cycle where gold as money is the magical constant value. Sadly the same scenario is playing out in this country today.

The much maligned, Dr. Bernanke this week displayed better tap dancing than I've seen on "Star Search." On Tuesday Congress heard him say that he was ready to step in with further QE3 measures and on Wednesday Congress heard him say that while QE3 is an option it is not something that the FOMC is considering at this time. On Friday, he was quoted as saying that "even with the federal funds close to zero, we have a number of ways in which we could ease financial conditions further." I can only conclude that the Fed needed to open the door to QE3 given the deteriorating economic conditions, particularly the weak payroll data that was released on Friday.

The only thing that could derail gold and silver assent would be if Congress starts to act in a rational manner, the Federal Reserve starts to normalize monetary policy or if conditions in Europe begin to settle down. I see this as the least likely of all possibilities.

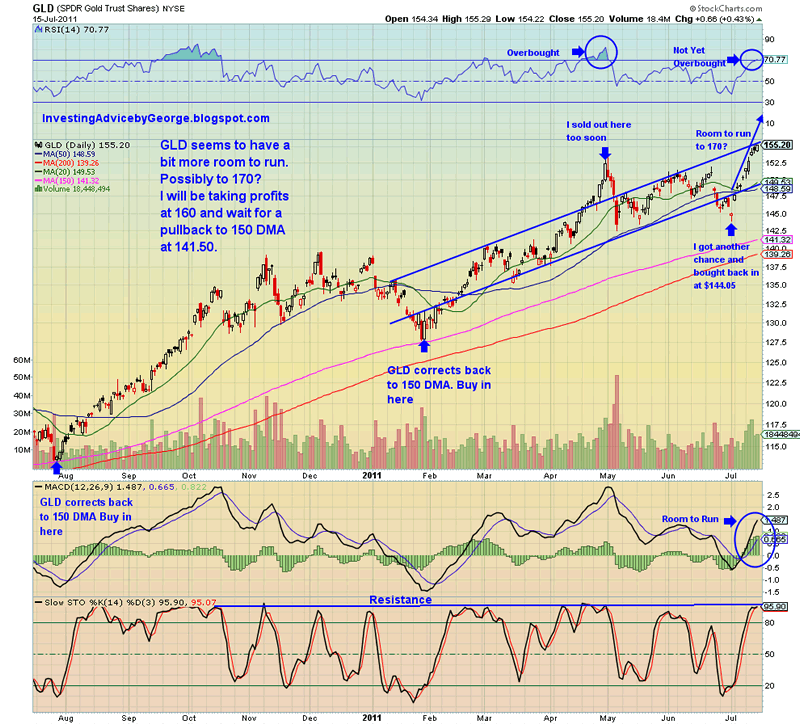

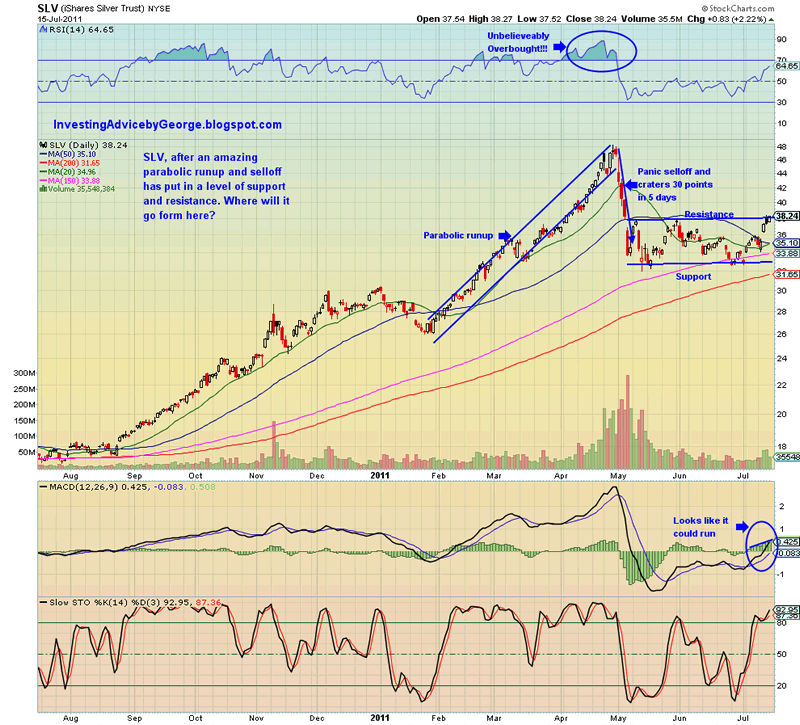

I will use the Gold ETF (GLD) and the Silver ETF (SLV) to base my analysis on. Please see the charts below:

While GLD fooled me in May and I sold my position at $152.00 I was given another chance and reopened half my position at 144.05 because I thought it would go back to $142.00 or the 150 DMA. GLD has enjoyed a slow, steady and healthy rise but while it looks like it could go to $170.00, it seems to be getting a little long in the tooth and I will start taking profits at $160.00.

SLV which enjoyed an amazing parabolic run from January to the last day in April seems to have put in a firm area of support at $32.50 but also seems to have some resistance in the $38.50 area. I opened small positions in SLV at $33.00 and $35.00. However I am not sure the faint of heart investors and institutional buyers have been sufficiently punished. While I see silver going to at least $60.00 within a year, for now I will stand aside and wait until I am sure which way the wind is blowing. I certainly see the possibility of silver going back for one more try at the $32.500 support level. Especially if gold corrects back to $141.50 or the 150 DMA.

Oddly, if Congress continues its squabbling and does not raise the debt ceiling, Moody's and S&P will have no choice but to downgrade our credit rating and Gold will be $3000.00 an ounce and silver will be $300.00 an ounce in a week. Either way things play out, Gold and Silver will be long term winners.

By George Maniere

http://investingadvicebygeorge.blogspot.com/

In 2004, after retiring from a very successful building career, I became determined to learn all I could about the stock market. In 2009, I knew the market was seriously oversold and committed a serious amount of capital to the market. Needless to say things went quite nicely but I always remebered 2 important things. Hubris equals failure and the market can remain illogical longer than you can remain solvent. Please post all comments and questions. Please feel free to email me at maniereg@gmail.com. I will respond.

© 2011 Copyright George Maniere - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.