Another Testament to Gold’s Long-Term Value

Commodities / Gold and Silver 2011 Jul 28, 2011 - 03:38 AM GMTBy: Clif_Droke

Recently a news item was brought to my attention which underscores the long-term significance of gold as an investment. A 500-year-old treasure has been discovered in a Hindu temple with approximately $20 billion. The treasure consists mainly of gold and precious stones. Below is an excerpt from a newspaper describing the treasure:

Recently a news item was brought to my attention which underscores the long-term significance of gold as an investment. A 500-year-old treasure has been discovered in a Hindu temple with approximately $20 billion. The treasure consists mainly of gold and precious stones. Below is an excerpt from a newspaper describing the treasure:

“Experts have discovered a huge treasure underneath the Hindu temple of Padmanabha Swamy in the city of Thiruvanthapuram in India. The temple serves as a shrine to the Hindu Lord Vishnu. The shrine has been around since the 10th century, but the six offering vaults have been sealed since the 1930s. Five vaults have been opened. About $20 billion in treasure was found. The sixth vault has yet to be opened because it is sealed with special locks, but it is thought to contain even more riches. Hari Kumar, a temple official, said, ‘Though we knew that offerings made to the temple by devotees for the last 500 years were lying in these secret cellars, the scale of the treasure has definitely surprised us.’”

The discovery of this ancient treasure has sparked a major interest in the mainstream media as indeed it a discovery of this magnitude would be expected to. Reading through some of the reader comments this story provoked, I found the following comment to be amusing in its blithe dismissal of the treasure’s monetary value: “When you consider that a hedge fund manager can bring home a billion each year as a bonus, $22 billion over 500 years isn’t that big a deal.”

In a time when we’re used to hearing terms like billions and trillions being thrown around every day, I supposed a measly billion doesn’t seem like much. And perhaps $20 billion stashed away for so many hundreds of years doesn’t resonate as much with today’s jaded news audience, accustomed as it is to hearing money spoken of in the trillions on a daily basis. But unlike the tens or even hundreds of billions of dollars which today’s hedge fund managers oversee, there is a vast difference between it and the billions of dollars worth of gold from centuries gone by. The chief difference lies in the fact that the gold from 500 years ago is still worth a fortune today while today’s billions could be reduced to mere pennies on the dollar in a matter of days or even minutes in today’s fast-moving financial world.

The billions of today are represented primarily in electronic entries and are ephemeral creations of debt in many cases. These “billions” will almost certainly have little or no value 100 years from, while the wealth accumulated in the form of hard assets possessing intrinsic worth, notably gold, will always have value in the long term. Indeed, the lesson learned from the $20 billion temple treasure is that gold always maintains inherent value despite the ravages of time and chance. Today’s electronic billions, by contrast, are far more vulnerable to these ravages and unlikely to maintain long-term value. For long-term investors, the best choice is obvious and has once again been validated.

Returning to the immediate-term outlook, gold has clearly benefited from the latest weakness in the U.S. dollar. The impact of dollar weakness on the gold price is obvious: a weaker dollar generally translates into a strengthening gold price. The question whether we can reasonably expect gold to continue moving higher after it has already dramatically overstretched from its nearest short-term trend lines in recent weeks? When upside momentum has been established and becomes self-perpetuating, as it has in the gold market, an “overbought” or overstretched gold price can always push higher before the proverbial rubber band snaps back and price declines. If this were a simple case of looking at the market technicals, one could argue that gold’s latest move to new highs has caused the price to over exceed its median trend line, which in turn would suggest a corrective move lower is in the offing.

In the present case, however, gold has another powerful factor in its favor right now, namely fear of the unknown. The ongoing debate over whether or not the U.S. debt ceiling should be raised is currently fueling the widespread move into gold as investors on both the retail and institutional sides of the fence buy gold as a safe haven against the fear of what may happen to the USA’s credit rating in the fallout over the nation’s debt debate. Even if Congress chooses not to take the deflationary rout in addressing the nation’s over-indebtedness, gold should still benefit from the classic fear and uncertainty factors that will continue to swirl around the nation’s – and the developed world’s – debt problems.

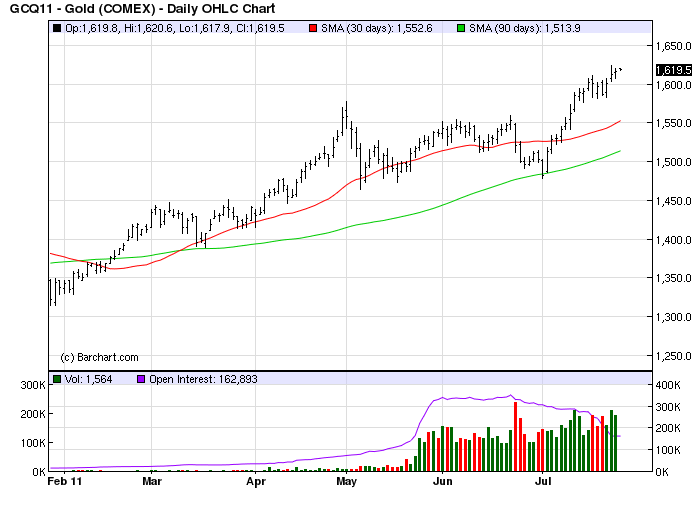

From a purely technical standpoint, the gold price remains decisively above two of its most important trend lines: the 30-day and 90-day moving averages. If gold remains above its 30-day MA on a closing basis on any near term pullback, its forward momentum will remain intact and it should be able to continue its pattern of higher highs and higher lows. Whenever gold decisively violates its 30-day MA on a closing basis, it tends to lose momentum.

The most important intermediate-term consideration for gold is the 90-day MA (green line in above chart). This particular moving average has kept gold’s interim uptrend intact during the last couple of pullbacks as you can see here.

Gold & Gold Stock Trading Simplified

With the long-term bull market in gold and mining stocks in full swing, there exist several fantastic opportunities for capturing profits and maximizing gains in the precious metals arena. Yet a common complaint is that small-to-medium sized traders have a hard time knowing when to buy and when to take profits. It doesn’t matter when so many pundits dispense conflicting advice in the financial media. This amounts to “analysis into paralysis” and results in the typical investor being unable to “pull the trigger” on a trade when the right time comes to buy.

Not surprisingly, many traders and investors are looking for a reliable and easy-to-follow system for participating in the precious metals bull market. They want a system that allows them to enter without guesswork and one that gets them out at the appropriate time and without any undue risks. They also want a system that automatically takes profits at precise points along the way while adjusting the stop loss continuously so as to lock in gains and minimize potential losses from whipsaws.

In my latest book, “Gold & Gold Stock Trading Simplified,” I remove the mystique behind gold and gold stock trading and reveal a completely simple and reliable system that allows the small-to-mid-size trader to profit from both up and down moves in the mining stock market. It’s the same system that I use each day in the Gold & Silver Stock Report – the same system which has consistently generated profits for my subscribers and has kept them on the correct side of the gold and mining stock market for years. You won’t find a more straight forward and easy-to-follow system that actually works than the one explained in “Gold & Gold Stock Trading Simplified.”

The technical trading system revealed in “Gold & Gold Stock Trading Simplified” by itself is worth its weight in gold. Additionally, the book reveals several useful indicators that will increase your chances of scoring big profits in the mining stock sector. You’ll learn when to use reliable leading indicators for predicting when the mining stocks are about o break out. After all, nothing beats being on the right side of a market move before the move gets underway.

The methods revealed in “Gold & Gold Stock Trading Simplified” are the product of several year’s worth of writing, research and real time market trading/testing. It also contains the benefit of my 14 years worth of experience as a professional in the precious metals and PM mining share sector. The trading techniques discussed in the book have been carefully calibrated to match today’s fast moving and volatile market environment. You won’t find a more timely and useful book than this for capturing profits in today’s gold and gold stock market.

The book is now available for sale at: http://www.clifdroke.com/books/trading_simplified.html

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Gold & Silver Stock Report newsletter. Published twice each week, the newsletter uses the method described in this book for making profitable trades among the actively traded gold mining shares.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.