U.S. Debt Downgrade Drama and the Stock Market

Stock-Markets / Stock Markets 2011 Jul 29, 2011 - 06:02 AM GMTBy: George_Maniere

I was watching Speaker of the House John Boehner speak today on Bloomberg TV (yes I have the TV on while I trade but the sound is off until I see something that is newsworthy). Speaker Boehner made the same old pitch about how the Republicans have out plans on the table and the Democrats have done nothing. I watched as his entourage climbed over each other to say something to the media and it hit me hard. This is July 28, 2011. In one year we will be in full reelection mode. How much money would one of these congressmen have to raise to get some prime time face time? I would guess it would be quite a bit.

I was watching Speaker of the House John Boehner speak today on Bloomberg TV (yes I have the TV on while I trade but the sound is off until I see something that is newsworthy). Speaker Boehner made the same old pitch about how the Republicans have out plans on the table and the Democrats have done nothing. I watched as his entourage climbed over each other to say something to the media and it hit me hard. This is July 28, 2011. In one year we will be in full reelection mode. How much money would one of these congressmen have to raise to get some prime time face time? I would guess it would be quite a bit.

Meanwhile the media dutifully reports every sneeze that one of these elected officials makes in the name of unbiased reporting. The job of the media is to scare the masses so they will stay tuned while the media peddles their soap products and toaster ovens. The congressmen can’t get enough of it. Free advertising! Next year the amount of time they have spent in front of the camera will cost them dearly. Now they get it for free.

So now we get down to it. Like it or not The United States is “Too Big to Fail.” I have been studying the possibility of a credit downgrade and I have come to the conclusion that it simply cannot and will not happen. S&P, Moody’s and Fitch want some face time too! Ask yourself this – Are the treasuries that the FOMC have been peddling for the last two years really “AAA” grade? Absolutely not. The reality is that S&P and the rest are still the same money grubbing spineless jellyfish they were when they were stamping the garbage CDO’s “AAA” in 2007. They are still the same clowns that have been stamping our treasuries “AAA.” Now they come out with an ultimatum that unless this deal by Congress is up to their lofty standards they will downgrade our credit rating. This is sheer arrogance or worse it is part of the charade that is being foisted on an ill educated public to scare them and keep them “tuned in.”

The reality is the USA is the biggest boy on the block. There is no one to take our place. Who’s going to step in as the world’s reserve currency? While the media has done a great job selling China as the real super power in the world let’s not forget that it wasn’t that long ago that the Chinese were sowing soccer balls with their teeth for $0.10 a day and no bathroom breaks. In the timeline of history they are babies. The fact is that China is hoping no one notices that they are in a bubble right now. If there were ever a downgrade in the US, China’s bubble would burst. Human beings are human beings whether they come from The United States, Russia, India, Brazil or China. Lord Acton, expressed this opinion in a letter to Bishop Mandell Creighton in 1887: "Power tends to corrupt, and absolute power corrupts absolutely. Great men are almost always bad men." Well guess what, China is no different. China’s bubble will burst because of all the fraud, corruption and massive amounts of debts it has amassed building its infrastructure and cities. If the U.S were to have their credit rating downgraded it would have a global ripple effect and China would fall – hard! Not even their huge bank of foreign reserves would be big enough to support all of the debt that has been accumulated by the provinces and towns. Hey China, welcome to the capitalistic version of the NFL!

So in conclusion I encourage everyone to sit back and enjoy the theatrics as Congressmen shove their way to the front of the line for a fifteen second sound bite on national TV. The reality is that if it looks like a pig and oinks like a pig – it’s a pig. The papers that these “prestigious” credit ratings agencies have been stamping “AAA” are pigs. Everyone knows it. Everyone knows they are not “AAA” no matter what is stamped on them.

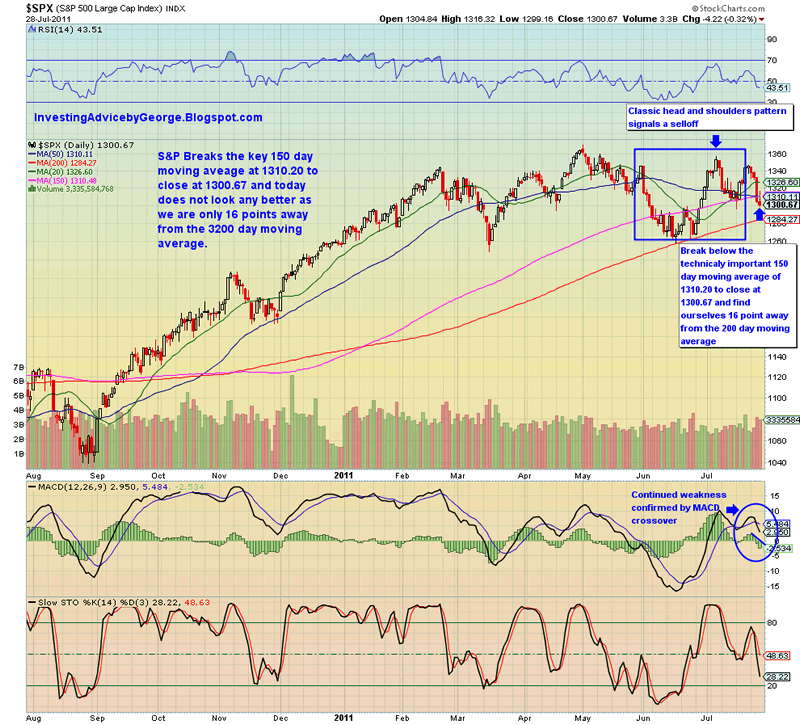

So before I take my leave, I would like to point out some pertinent facts to my regular readers. As the Chart of the S&P below shows we were unable to move above the 150 day moving average that we breached yesterday and closed 10 points under it. We are also only 17 points from breaking the 200 day moving average.

A look at the chart for the DOW below shows that we are only 27 points from breaking the 150 day moving average and 268 points from breaking the 200 day moving average.

Tomorrow should prove to be an interesting day. While all technical indicators point for an opening lower I think every trader knows that the bickering in Congress is nothing more than a ruse. We may well see a strong opening. In uncertain times like these micro calls confound all investors.

However, I will stick with my macro thesis. I want my readers well positioned in physical Gold and Silver and positioned in the Silver ETF (SLV), the Gold ETF (GLD) and the gold miners ETF (GDX).

No matter how this plays out in Congress – “You ain’t seen nothing yet, folks!”

By George Maniere

http://investingadvicebygeorge.blogspot.com/

In 2004, after retiring from a very successful building career, I became determined to learn all I could about the stock market. In 2009, I knew the market was seriously oversold and committed a serious amount of capital to the market. Needless to say things went quite nicely but I always remebered 2 important things. Hubris equals failure and the market can remain illogical longer than you can remain solvent. Please post all comments and questions. Please feel free to email me at maniereg@gmail.com. I will respond.

© 2011 Copyright George Maniere - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.