Exciting Times for Gold Bugs as the Eurocrats Dither

Commodities / Gold and Silver 2011 Aug 22, 2011 - 03:45 AM GMTBy: Bob_Kirtley

Gold prices push higher as once again the ineptitude of our political masters fails to deliver. German Chancellor Angela Merkel and French President Nicolas Sarkozy had scheduled yet another problem solving high level meeting, out of which their followers expected a stroke of economic genius. Instead the two leaders agreed to try for closer economic integration within the euro zone. A result that adds up to sweet nothing.

Gold prices push higher as once again the ineptitude of our political masters fails to deliver. German Chancellor Angela Merkel and French President Nicolas Sarkozy had scheduled yet another problem solving high level meeting, out of which their followers expected a stroke of economic genius. Instead the two leaders agreed to try for closer economic integration within the euro zone. A result that adds up to sweet nothing.

The turmoil in Europe continues with no end in sight other than the slow disintegration of this ‘one size fits all’ lunatic ideology. We have warned you about this train wreck that is looking for somewhere to happen for some time now as the Euro struggles to maintain its value. However, the European mess serves only to take the spot light off the US dollar which is also dead in the water despite the occasional dead cat bounce. The race to the bottom continues between currencies with the only beneficiary being hard assets and as we see it gold and silver are top of that league.

Today we will take a quick look at gold and also the HUI, the gold bugs index, of mainly unhedged gold mining companies designed to give investors significant exposure to near term movements in gold prices.

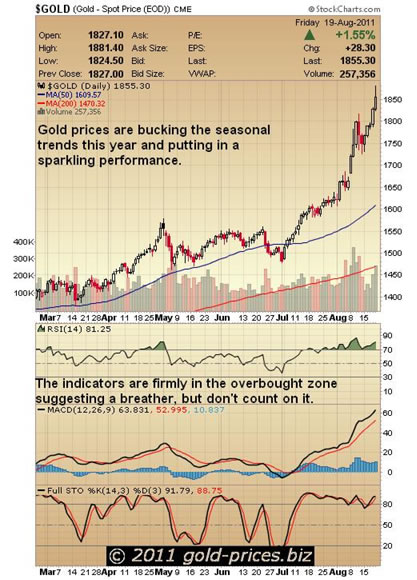

Historically the summer season in the northern hemisphere is a lackluster period for gold. The summer vacation period sees many of the traders away from their desks until around Labor Day, which is the first Monday in September, (5th) and its upon their return that normal business activity resumes. So it will be interesting to see how things pan out when they do return considering that gold and silver have been trekking north for the past two months.

A quick look at the gold chart clearly indicates that gold prices are bucking the seasonal trends this year, having moved up since early July from $1500/oz to $1855.30/oz at the close on Friday. The technical indicators are firmly in the overbought zone suggesting a breather is due, especially when we have the RSI standing at 81.25 which is well above the ‘70′ level that some traders use as a signal to lighten up. However, the fundamentals for gold remain strong and we are on track to hit $2000/oz fairly soon, in fact we could be there in the next few weeks. Golds progress will eventually pause for a rest, but for us it is difficult to see just what would be the catalyst for such a pause, other than exhaustion.

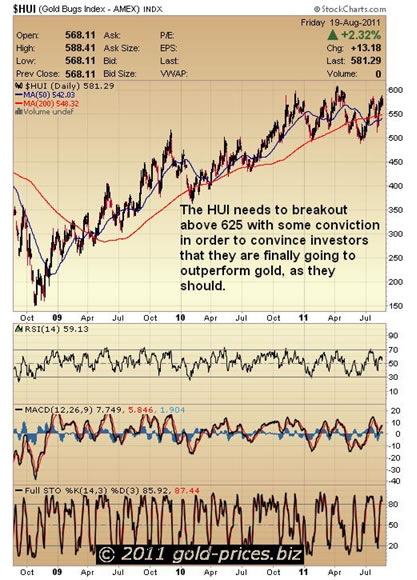

Now with gold and silver making wonderful progress one would expect the associated stocks to going gang busters to, not so. They remain in a sleepy mood right now and are not showing much appetite to reflect the progress of the precious metals. As we see it this situation cannot remain as is, because these producers will be generating handsome profits that will captivate the investment community. The question is when will they take off and in our humble opinion the HUI needs to breakout above 625 with some conviction in order to convince investors that the stocks are finally going to outperform gold. For an investor to carry the many risks associated with mining there needs to be a return that is superior to that of gold, otherwise they will buy the metal and ignore the mining sector.

Taking a quick look at the HUI chart we can see that it is standing at 581.29 as of the close on Friday. A couple of attempts have been made to breach the ‘600′ level but they haven’t been sustained, thus far. This gives you the time to prepare for a possible breakout and a rally in this sector. You need to identify and list the quality stocks that fit with your investment criteria and have a good chance of meeting your targets in terms of capital growth, etc. Our portfolio is free to view on our site and you are welcome to drop by and take a look for yourself.

Finally, in an attempt to get leverage on this bull market we have been utilizing options as our preferred vehicle for maximizing returns. This type of trading is not everyone’s cup of tea as movements can be dramatic in either direction. However, when you see your contracts go exponential, it is truly an exhilarating feeling.

As always time is of the essence, so do your due diligence now and get into position by preparing yourself for the difficulties that we are all going to have to face ready or not. Consider a layering in approach and buy on a regular basis to build your position. The oscillations will become violent at times so expect them and hold on tight, making further acquisitions throughout any weakness in this sector. And smile you’re a gold bug! So, get your head out of your day job and draw up your very own ‘acquisition’ plan and implement it as quickly as you possibly can.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

For those readers who are also interested in the silver bull market that is currently unfolding, you may want to subscribe to our Free Silver Prices Newsletter.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit. Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.