If you Debase the U.S. Dollar, you Debase them all…

Currencies / Fiat Currency Sep 02, 2011 - 02:45 AM GMTBy: Aftab_Singh

Praise the deposit. If only one thing in this world is to be guaranteed, let it be the holy financial instrument that is the commercial bank deposit. — Prayer 3:23, The Book of State-Banking

Praise the deposit. If only one thing in this world is to be guaranteed, let it be the holy financial instrument that is the commercial bank deposit. — Prayer 3:23, The Book of State-Banking

In recent years, the above prayer has been answered by the oh-so-benevolent monetary authorities of the West — we were ‘saved’ by the self-sacrificial debauchery of Western central banks. Alas, the commercial banker that owed what wasn’t his’n, wasn’t faced with the unappetizing prospect of buying it back or going to pris’n! Consequently, the question that repeatedly presents itself is: ‘Who got stiffed then?’

Who Got Stiffed Then?

The scenario where you would have gone to the bank to find that; ‘Poof! It’s gone…‘ was averted by the actions of the monetary authorities of the West. Resultantly, in the spirit of recognizing that one cannot have one’s cake and eat it too, one is compelled to ask; ‘Who got stiffed then?’. Indeed, what price was paid for the supposedly noble ideal of preserving the status quo of the banking system?

The distress that was not felt between the depositor and the writer of the deposit (i.e. the commercial bank), has been transferred to the realm of the central bank note owner and the central bank note issuer. So, in particular, the price of preserving the status quo in ownership titles relating to the US banking system was to disrupt the lives of all owners of Federal Reserve notes. Given that Federal Reserve notes are held throughout the world and that they are held against many fiat currencies, this price includes disruption to virtually all currencies.

It was the central bankers with significant dollar reserves that faced (and face) the unpalatable circumstance depicted in the above cartoon from South Park. The archetypal, grade-A central banker who had built up a small pile of gold and a big pile of dollars (just as he was ‘supposed to’) is now facing that sickening scenario where; ‘Poof, it’s gone…’.

And yet, for engineering this transfer (of troubles in the US banking system to the collapse of the entire structure of global currencies), the monetary authorities have been praised. Wow! Aren’t people smart!?

Debase the Dollar, Debase the World…

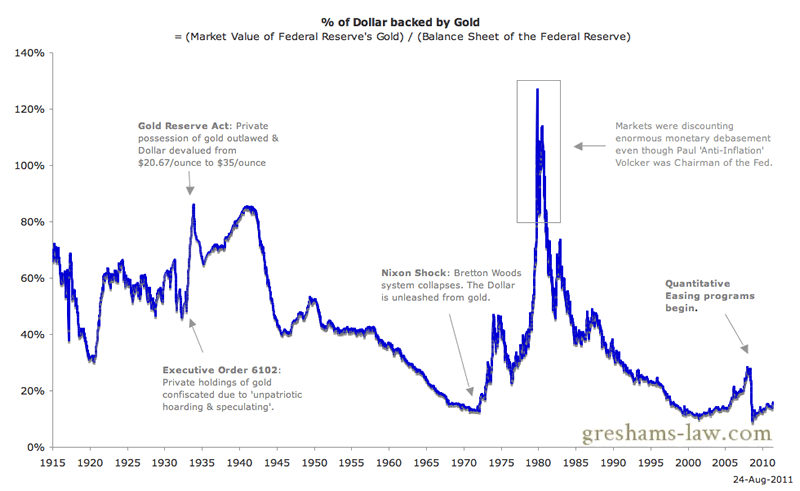

Our regular readers will recognize the following chart:

Gold Covering the Dollar - Click to enlarge. Source: St Louis Fed, World Gold Council

It shows an estimate of the degree to which the dollar is ‘backed’ by gold at market prices. It is calculated by dividing the market value of the Federal Reserve’s gold by the total size of the Federal Reserve’s balance sheet. This chart is updated every week on the ‘Long-Term Charts’ Page.

Increases in the size of the Fed’s balance sheet imply that a greater dollar price of gold is required for the dollar to maintain (or increase) the degree to which it is ‘backed’ by gold at market prices. The large balance sheet expansions that begun in 2007/2008 represented a profound debasement of the dollar — meaning, amongst other things, that the dollar price of gold would have to increase dramatically to get back to the previous ‘backing by gold’ (at market prices). But here’s where it gets really interesting; global central banks have lots and lots of dollars (and promises for dollars in the future). Hence, this balance sheet expansion-spree represented a big fat ‘POOF!’ for many of the world’s central bankers (and thus their respective currencies).

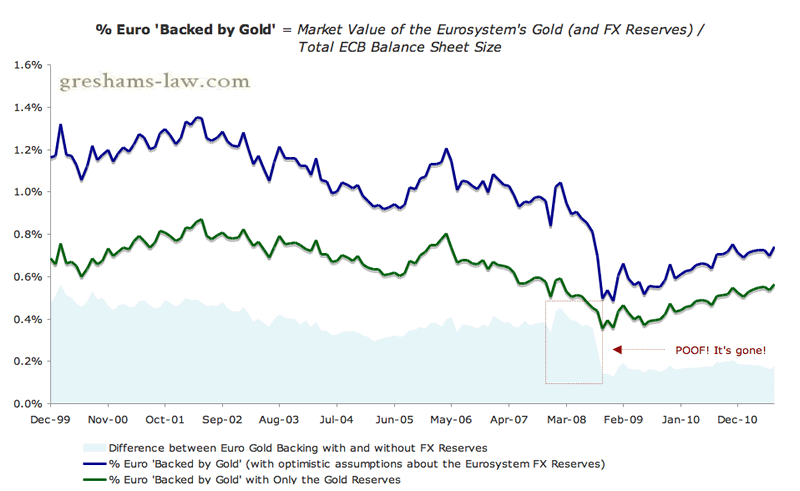

Let’s look to the ECB for a benign example: The ECB had (and has) a reserve of gold that is wholly inadequate relative to its colossal balance sheet. However, they also have foreign exchange reserves; which we might optimistically assume to be mostly dollars. (This is an optimistic assumption because other currencies are also backed by piddly amounts of gold and mostly dollars — which would make things worse.)

Prior to 2008/2009, the market price of gold and the size of the Fed’s balance sheet implied that the ECB’s foreign exchange reserves represented an important backing to the Euro. However, the debauched policies of 2007-2009 meant that — all of a sudden — the Euro price of gold would need to (basically) double just to get back to the former ‘degree to which it was backed by gold‘!

The Degree to which the Euro is backed by gold. You can see that the ECB's reserves are converging to their gold holdings. - Click to enlarge. Sources: ECB, World Gold Council, St Louis Fed

In fact, the ECB represents a relatively benign example of this evaporation of the ‘gold backing’ in dollar reserves. We present it here because we happen to have the data ready (as its part of our usual analysis). We intend to make lots of charts like this for many more central banks over the months and years ahead. Many emerging market central banks would undoubtedly display even more horrifying collapses in ‘the degrees to which they were backed by gold’. Analogously speaking, other central banks (in particular, emerging market central banks) had larger stocks of reserves that went ‘POOF!’:

Ironic, ain’t it?

The investment implications of the above may seem rather ironic. In this world where central bankers had been convinced of the merits of keeping dollars on their balance sheets, they have become — in a sense — levered to the dollar. Counterintuitively then, a super profligate Federal Reserve can bring about a rising dollar! The destruction involved with profligate Federal Reserve policies is doubly bad for currencies that maintain large dollar reserves. Hence, it becomes necessary for such currencies to depreciate against gold to greater degrees than the degree to which the dollar must depreciate against gold. The mechanism of reconciliation — if you will — is an appreciation of the dollar against those currencies! Therefore, insofar as this monstrous dollar reserve standard lingers on, we should be wary of periodic short-term appreciations in the dollar. In fact, we have reason to believe that they may continue to arrive at bizarrely paradoxical points in time!

Aftab Singh is an independent analyst. He writes about markets & political economy at http://greshams-law.com .

© 2011 Copyright Aftab Singh - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.