Europe and Asia Stock Markets Labor Day Sell Off

Stock-Markets / Stock Markets 2011 Sep 06, 2011 - 02:03 AM GMTBy: George_Maniere

For years, Labor Day weekend was a time to take a break from work and celebrate the fruits of our labor. Sadly last weekend was a time when millions of Americans wished they had a job to take a break from. If you were awake or remotely paying attention last Friday September 2nd The U.S. Bureau of Labor Statistics released the August 2001 jobs report and in a word - it was abysmal. The report showed that no jobs had been created in August. If this statistic was not so sad it would be laughable. What is even more telling then this report was that the prior two months had been revised down and I expect next month for the same thing to play out. The report will be revised down from zero to a negative number. There is no fudging the numbers. The jobs market is getting worse and fast.

Meanwhile, the partisan politics continue. Later this week, President Obama will address a joint session of Congress to speak about the jobs issue. Whatever your political beliefs are the Republicans are already grilling President Obama on the Labor Day barbecue pit. The man has not even opened his mouth and the Republicans are saying that real problem is President Obama’s failure of leadership. Zero leadership from the White House has equaled zero jobs. As I have often written I refuse to use this post as a “bully pulpit” to espouse my political beliefs but I will leave it at this – This White House seems to have no clue how the private sector works.

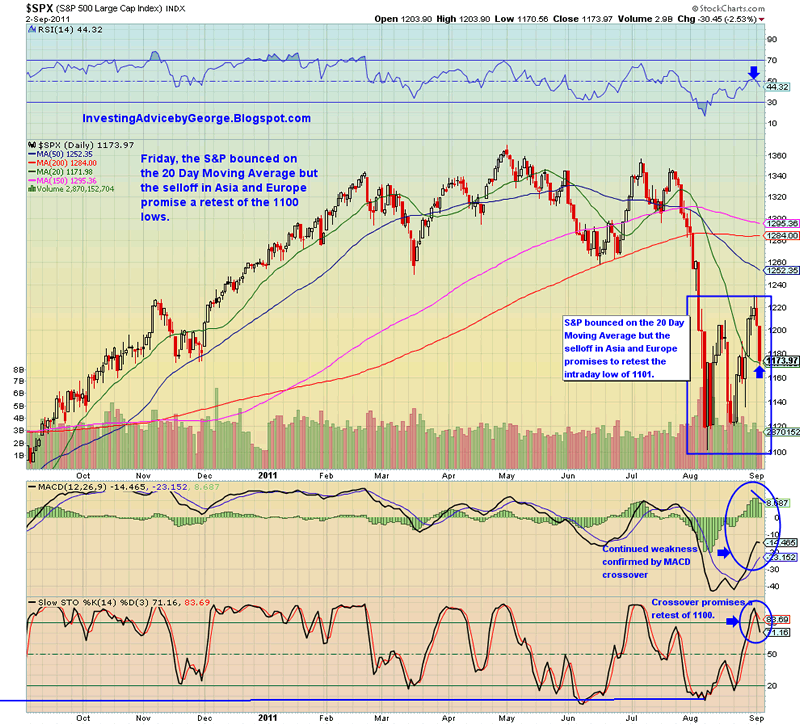

I have often written that I see this post as a chance to help people navigate these perilous economic waters we find ourselves in. In that light I will share what I see coming in the next months ahead. While most people tried to enjoy the weekend and forget that the abysmal jobs reports by the BLS, it just portends a global economic slowdown which normal people call a recession (if you are one of the people without a job go ahead and call it what it really is – a depression). A look at the chart of the S&P below will show that we are getting set up to retest the 1101 lows.

At the close of trading in Europe, yesterday, the S&P futures were down 23 points. If we fail to hold the 1101 level of August 9th we will certainly break towards the psychologically important 1000 level.

There are two things that I am sure will happen. 1) The global markets will continue to sell off for the simple reason that there is no catalyst to grow. 2) At some point, Dr. Bernanke will have to step in with another round of quantitative easing. Until that day, however, we need to protect our capital. We need to protect both our monetary and emotional capital.

I feel the best way to do this is to stay long precious metals. Yesterday, Gold closed up $17.00 at $1903.00 and silver closed up marginally at $43.30. The futures are predicted to open down over 200 points on the Dow and 25 points on the S&P so I will be maintaining my long positions in gold and silver. Both silver and gold are well within their trading ranges and still have room to run to the upside. While I don’t want to drone on about gold and silver for now I believe precious metals are the safe haven in this most uncertain economic storm.

I will remain long GLD, PHYS, IAU, UGL, CEF, SLV, PSLV, AGQ.

By George Maniere

http://investingadvicebygeorge.blogspot.com/

In 2004, after retiring from a very successful building career, I became determined to learn all I could about the stock market. In 2009, I knew the market was seriously oversold and committed a serious amount of capital to the market. Needless to say things went quite nicely but I always remebered 2 important things. Hubris equals failure and the market can remain illogical longer than you can remain solvent. Please post all comments and questions. Please feel free to email me at maniereg@gmail.com. I will respond.

© 2011 Copyright George Maniere - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.