War and Inflation in US History, Not Worth a Continental

Economics / Inflation Oct 05, 2011 - 04:48 AM GMTBy: Richard_Mills

Inflation is caused by an increase in the money supply - the rate of inflation is determined by the quantity of goods vs. the money supply - more money chasing the same amount of, or fewer goods, causes price increases. The higher the price increases the higher the rate of inflation is said to be.

Inflation is caused by an increase in the money supply - the rate of inflation is determined by the quantity of goods vs. the money supply - more money chasing the same amount of, or fewer goods, causes price increases. The higher the price increases the higher the rate of inflation is said to be.

Wars cause inflation - war affects everything from international trading to labor costs to quantity of available consumer goods to product demand because governments:

- Conscript labor

- Bid up prices in markets for natural resources and industrial goods

- Divert capital and technology from civilian to military applications

War always causes a rise in prices.

"In World War I, the American people were characteristically unwilling to finance the total war effort out of increased taxes. This had been true in the Civil War and would also be so in World War II and the Vietnam War. Much of the expenditures in World War I, were financed out of the inflationary increases in the money supply." ~ David Hackett Fischer, Author, The Great Wave, Price Revolutions and the Rhythm of History

"Every major war in the past century brought inflation to some degree. And so did two upheavals in the Middle East, the Yom Kippur War of 1973 and the Iranian Revolution of 1979, which did not directly involve the United States, except through their effect on the price of oil. Why is this so? The big reason is that wars must be paid for, somehow. They require resources that civilians would otherwise use. Those resources must be diverted to the war effort. Usually, inflation is the easiest way. World War I was largely financed by inflation, and so were the Revolutionary and Civil Wars before that. So, though on a smaller scale, was Vietnam.

"Inflation applies the law of the jungle to war finance. Prices and profits rise, wages and their purchasing power fall. Thugs, profiteers and the well connected get rich. Working people and the poor make out as they can. Savings erode, through the unseen mechanism of the "inflation tax" -- meaning that the government runs a big deficit in nominal terms, but a smaller one when inflation is factored in." ~ Economist James Galbraith

"War has a profound effect on the economy, our government and its fiscal and monetary policies. These effects have consistently led to high inflation." ~ Blanchard Economic Research

"War is inflationary. It is always wasteful no matter how just the cause. It is cost without income, destruction financed (more often than not) by credit creation. It is the essence of inflation." ~ James Grant, Grant's Interest Rate Observer

"This country's first two experiences with high inflation were during the American War of Independence (1775-83) and during the Civil War. There was also high inflation associated with the First World War; the unifying theme running through inflation episodes are the occurrence of bad times, often as a result of war or its aftermath. After the Second World War, inflation became the norm everywhere in the industrial world. There was another surge of inflation during the Korean War, which took inflation in the U.S. above 9% in 1951 (and wholesale price inflation into double digits). The inflation that accompanied the Vietnam War and the Yom Kippur War, and oil price shocks in the 1970s, led people to increase their inflationary expectations, which aggravated inflation itself." ~ Roger Bootle, Author, The Death of Inflation

War and Inflation in US History

The United States has experienced two currency collapses due to inflation:

- Continental Currency during the Revolutionary War

- Confederation notes during the Civil War

"One can say without exaggeration that inflation is an indispensable means of militarism." Ludwig von Mises

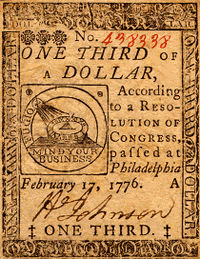

The American Colonies lacked the necessary finances to rebel against Britain - instead of raising money through taxation they decided to print a "Continental Currency".

Unfortunately for the Colonies their new currency was easily counterfeited. And Britain did so, counterfeiting large amounts and giving it away to destroy its value.

Between the combination of counterfeits and increased continental printing the value of the colonies paper currency became worth 1/1,000th of its original face value by the end of the war. The saying "not worth a continental" was a result of this massive devaluation.

The Civil War's direct cost was $6.7 billion in 1860 money - over $140 billion in today's.

"At the beginning of the war on January 1, 1861 one Confederate dollar would purchase one gold dollar. By May it took $1.05 Confederate dollars to purchase one Gold Dollar or 5% inflation in four months. By February of 1861 it took $1.25 Confederate Dollars to buy one Gold Dollar or 25% inflation. By February 1863 it took $3.00 Confederate Dollars to buy one Gold Dollar or 200% inflation since 1861 but because inflation is generally measured Annually we have to compare the price to the price a year earlier. So from $1.25 to $3.00 is 140% inflation. From October of 1861 to March of 1864 the commodity price index rose an average rate of 10 percent per month. When the Civil War ended in April 1865 the cost of living in the South was 92 times what it was before the war started." ~ Inflationdata.com

http://www.globalresearch.ca

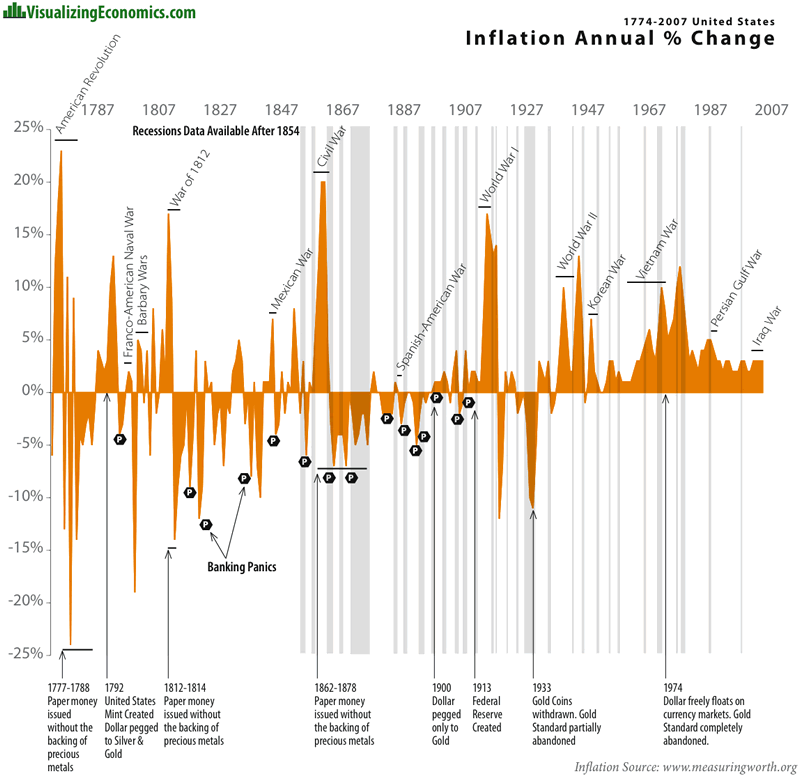

The top four inflationary periods in the US are:

- American Revolution - 23%

- Civil War - 20%

- War of 1812 - 17%

- World war One - 17%

Military Spending Today

Worldwide military spending edged up in 2010, to a record $1.6 trillion, the Stockholm International Peace Research Institute said in April 2011.

Spending in Europe shrank 2.8 percent to $382 billion, the biggest cuts were in small economies in central and eastern Europe, and in countries such as crisis stricken Greece.

United States Military Spending

The Unites States increased spending, in 2010, by 2.8 percent to $698 billion - six times as much as China spent for defense spending. Not included in US numbers are nuclear weapons spending, black ops, interest on the defense portion of the debt and ongoing military obligations to veterans.

The budget for nuclear weapons falls under the Department of Energy, other military expenses - care for veterans, health care, military training, aid and secret operations - are put under other departments or are accounted for separately.

The US numbers are already eye opening - they amount to more than half of all government discretionary spending and represent, at the very least, an astounding 43% of total military spending on the planet.

US Defense spending in 2011 is slated to increase, by a reported $5 billion over 2010 levels.

"The United States has increased its military spending by 81 percent since 2001. At 4.8 percent of gross domestic product, U.S. military spending in 2010 represents the largest economic burden outside the Middle East." SIPRI Military Expenditure Project chief Sam Perlo-Freeman.

"Of all the enemies to public liberty war is, perhaps, the most to be dreaded because it comprises and develops the germ of every other. War is the parent of armies; from these proceed debts and taxes ... known instruments for bringing the many under the domination of the few.... No nation could preserve its freedom in the midst of continual warfare." ~ James Madison, Political Observations, 1795

Conclusion

Wars are:

- Expensive in money and other resources

- Destructive of capital and human capital

- Disruptive of trade, resource availability and labor management

"Congress and the Federal Reserve Bank have a cozy, unspoken arrangement that makes war easier to finance. Congress has an insatiable appetite for new spending, but raising taxes is politically unpopular. The Federal Reserve, however, is happy to accommodate deficit spending by creating new money through the Treasury Department. In exchange, Congress leaves the Fed alone to operate free of pesky oversight and free of political scrutiny. Monetary policy is utterly ignored in Washington, even though the Federal Reserve system is a creation of Congress.

The result of this arrangement is inflation. And inflation finances war." ~ Congressman Ron Paul

Sun Tzu said to keep your wars short and have the money in hand before assembling an army.

Inflation acts as an indirect tax on an economy. Perhaps the US Congress should consider Sun Tzu's advice? At any rate, inflation should be on every investors radar screen. Is it on yours?

If not, maybe it should be.

By Richard (Rick) Mills

If you're interested in learning more about specific lithium juniors and the junior resource market in general please come and visit us at www.aheadoftheherd.com. Membership is free, no credit card or personal information is asked for.

Copyright © 2011 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.