Germany to G20: German Gold “Must Remain Off Limits”, Instead Sell Italian Gold

Commodities / Gold and Silver 2011 Nov 07, 2011 - 08:14 AM GMTBy: GoldCore

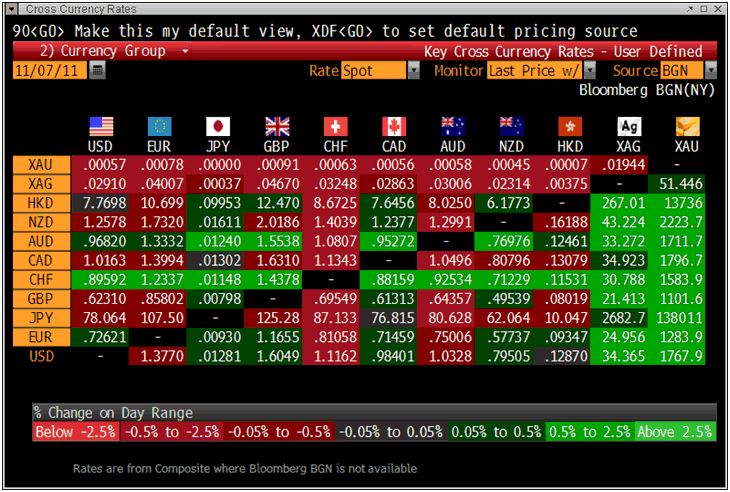

Gold is trading at USD 1,767.90, EUR 1,283.90, GBP 1,101.60, JPY 138,011, CHF 1,583.90, and AUD 1,711.70 per ounce.

Gold is trading at USD 1,767.90, EUR 1,283.90, GBP 1,101.60, JPY 138,011, CHF 1,583.90, and AUD 1,711.70 per ounce.

Gold’s London AM fix this morning was USD 1,764.00, GBP 1,102.78, and EUR 1,286.65 per ounce.

Friday's AM fix was USD 1,756.00, GBP 1,096.47, and EUR 1,269.61 per ounce.

Cross Currency Table

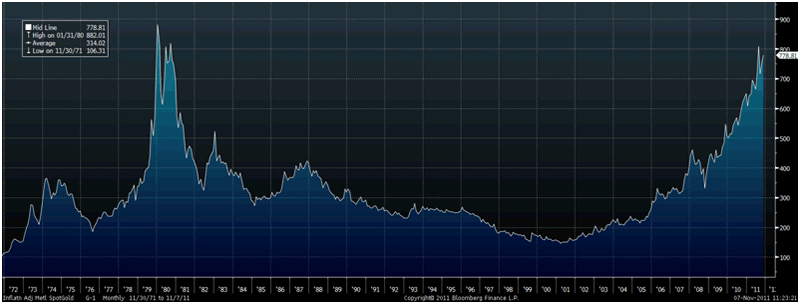

Gold prices have risen in all major currencies due to safe haven demand for bullion on concerns that the debt crisis in Greece, Italy and much of the Eurozone may lead to contagion in markets.

Italian 10 yr government bond yields have surged to 6.61% and saw an inter day high of 6.676% which has contributed to sell offs in European stock indices which followed their Asian counterparts lower.

The ‘safe haven’ Swiss franc has fallen sharply against all currencies including the euro and especially against gold. Gold in Swiss francs has surged 2.4% - from CHF 1,556 to 1,590.

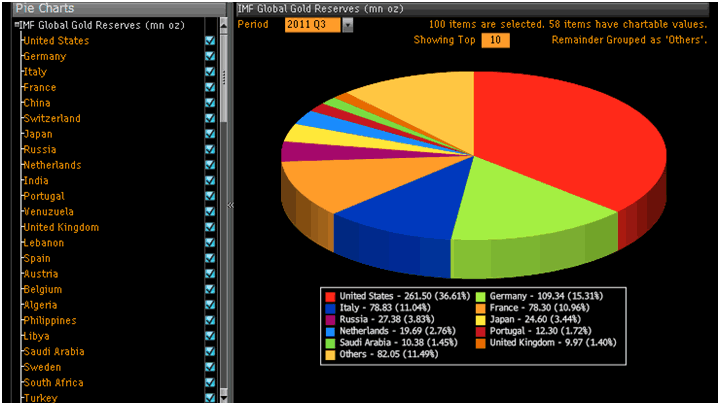

IMF Global Gold Reserves (Million Ounces)

Germany has rejected proposals by France, Britain and the US to have German gold reserves used as collateral for the Eurozone bailout fund.

Germany Economy Minister Philipp Roesler said on Monday that the German people's gold reserves cannot be touched and “must remain off limits."

"German gold reserves must remain untouchable," said Roesler, who is head of the Free Democrats (FDP), a partner in Chancellor Angela Merkel's coalition.

Roesler added his voice to opposition to an idea proposed at the G20 summit of using reserves including gold as collateral for the euro zone bailout funds.

The Bundesbank and Mr. Seibert, spokesman for Merkel, said Sunday that they too ruled out the idea discussed at the summit of Group of 20 leading economies last week.

Mr. Seibert dismissed media reports yesterday that the plan to boost bailout funds, to aid Italy or another large euro zone country, would require Germany to sell off part of its gold and foreign exchange reserves.

“Germany’s gold and foreign exchange reserves, administered by the Bundesbank, were not at any point up for discussion at the G20 summit in Cannes,” he said.

Mr. Seibert was responding to proposals to sell about €15 billion of Germany’s gold reserves of over 3,000 metric tonnes, worth a reported €139 billion.

A Bundesbank spokesperson said it was aware of the plan and said the institution “rejected” plans to touch federal reserves.

The Sunday Frankfurter Allgemeine newspaper said the initiative marked a fresh round in an ongoing struggle between the Bundesbank and the Merkel administration over reserves the bank manages on behalf of the German people.

The Irish Times reports that today’s finance ministers’ discussion is part of a wider strategy by the ECB to sound out the possibility of gaining control over the gold reserves of the euro zone’s central banks.

Bloomberg Composite Gold Inflation Adjusted Spot Price – 1971 -2011 (Monthly)

Italian Gold Sale Again Proposed in Germany

Senior German politician, Gunther Krichbaum, a lawmaker in German Chancellor Angela Merkel’s governing coalition and Chairman of the Committee on the Affairs of the European Union of the German Bundestag has proposed that Italy sell its sizeable gold reserves in order to lower its debt.

Krichbaum, who chairs the German parliament’s European Affairs Committee, was quoted as saying in the Rheinische Post that Italy’s gold reserves are relatively high and could be used to pay off their sizeable debt.

Using periphery nations’ gold reserves as collateral has been on the agenda in Germany for some months with many influential German politicians calling for debtor Eurozone nations to sell their gold reserves.

Angela Merkel’s budget speaker and his opposition counterpart urged Portugal to consider selling their gold in May of this year.

Senior Minister and rival to Merkel, Ursula von der Leyen, demanded that the debtor ‘PIIGS’ countries offer Germany more reliable guarantees and allow it access to their gold reserves and industrial facilities as payment for loans.

Gold’s value as money and as a strategically important monetary asset is being slowly realized again.

SILVER

Silver is trading at $34.45/oz, €25.05/oz and £21.46/oz

PLATINUM GROUP METALS

Platinum is trading at $1,630.25/oz, palladium at $654.75/oz and rhodium at $1,525/oz.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.