Gold Price Could Go to Infinity on Eurozone Debt Crisis Contagion

Commodities / Gold and Silver 2011 Nov 09, 2011 - 08:12 AM GMTBy: GoldCore

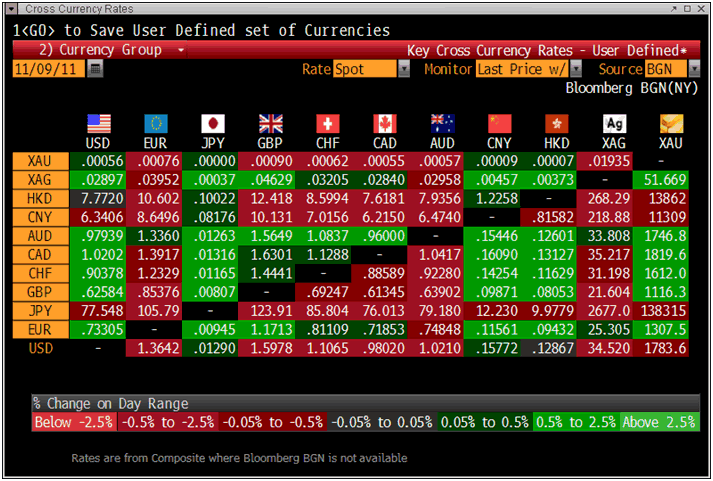

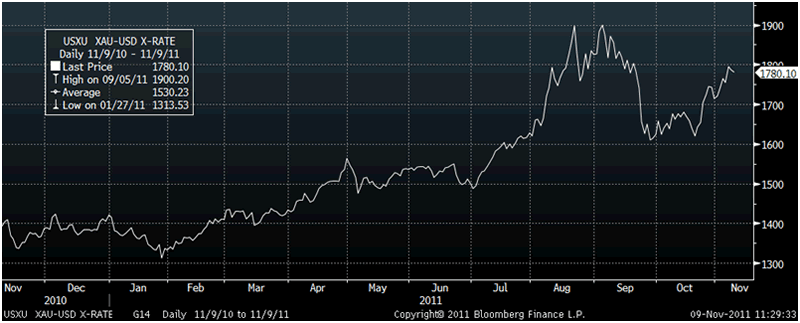

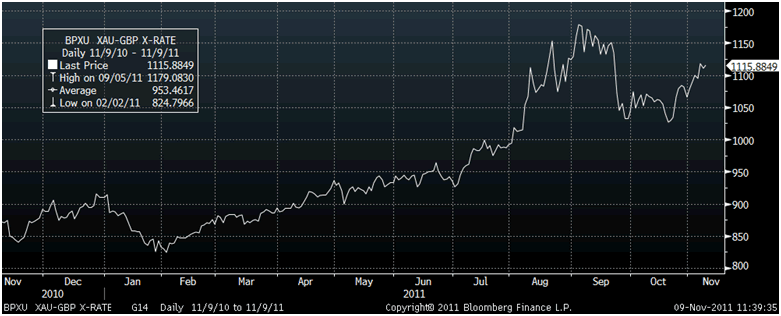

Gold is trading at USD 1,783.10, EUR 1,307.50, GBP 1,116.30, CHF 1,612.20, JPY 138,315 and CNY 11,309 per ounce.

Gold is trading at USD 1,783.10, EUR 1,307.50, GBP 1,116.30, CHF 1,612.20, JPY 138,315 and CNY 11,309 per ounce.

Gold’s London AM fix this morning was USD 1,780.00, GBP 1,112.50, and EUR 1,300.41 per ounce.

Yesterday's AM fix was USD 1,794.00, GBP 1,114.49, and EUR 1,301.51 per ounce.

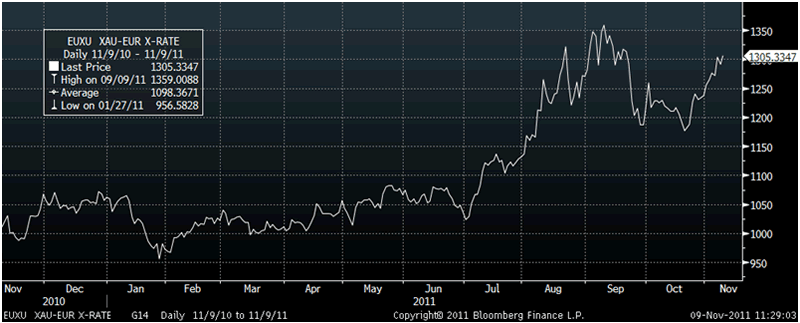

Risk has returned with a vengeance as Italian debt markets have gone into meltdown leading to falls in European equity indices. Gold remains near a seven week high and has risen to above EUR 1,305/oz due to the deepening Eurozone crisis and contagion risk.

Cross Currency Rates

Deepening geopolitical tensions regarding Iran, Israel and the western world has led to oil rising for six days in a row now and this is also supporting gold. The International Atomic Energy Agency said Iran was developing nuclear-weapons capabilities that gave it "serious concern" about possible military aspects to Iran’s nuclear programme.

Italy’s bond markets are heading the way of Ireland, Greece and Portugal with their 10 year bond yield surging to over 7.45% and the yield curve inverting with the 2 year yield rising above the 10 year.

China's gold consumption continues to surprise even bullish analysts. China's gold consumption is expected to jump nearly 50% to reach 400 tonnes this year. Thus exceeding the country's forecast of more than 350 tonnes. 400 tonnes compares to just 270 tonnes in 2010 which was itself a record month.

Official Chinese annual consumer inflation numbers showed an easing to 5.5% from September's 6.1%. The savings rate (1 year) is at 3.5% meaning steep negative real interest rates continue in China which is bullish for continuing Chinese gold demand.

So far, gold has not managed to rise above the psychologically important $1,800 level. However, the real risk of contagion in the eurozone and the breakup of the European monetary union means that gold’s safe haven properties will be increasingly appreciated in the coming months.

While much of the media attention has been on the political ‘punch and judy’ show in Athens, Rome, and in the European Union there continues to be a failure to soberly analyse the ramifications of the crisis for consumers, investors and savers.

The unprecedented scale of the debt crisis means that inflation and currency devaluations will almost certainly result from the crisis. Savers and those on fixed incomes will be very vulnerable as they were in the stagflation of the 1970s and in the economic meltdowns seen in Argentina, Russia, and in Belarus as we speak.

All the focus has shifted from Greece to Italy recently and markets and media have focused on the Eurozone debt crisis.

However, the US is itself facing a debt crisis which is also of a monumental scale. It is so large that it cannot be resolved by the usual kneejerk resorting to the printing presses and today’s equivalent panacea - computer credit creation.

The US National Debt will likely reach $15 trillion by the end of this week. Some estimates of unfunded liabilities are over $116 trillion. The US has similar issues to the many debt stricken countries of the Eurozone.

One of the few sane voices for many years regarding the dangers of excessive private and public debt has been Presidential candidate Ron Paul.

Gold Could Go to ‘Infinity’ Says Presidential Candidate Ron Paul

Ron Paul gave another perceptive interview to CNBC yesterday and warned of hyperinflation and the possibility that the dollar could become worthless. The CNBC interview can be watched here.

When asked how high the gold price would go and why, he responded:

“well, the question is how much lower is the dollar going to go in purchasing power? and i said to infinity unless we change our ways. because if you look at the gold/dollar in 1913 when the fed started, we've lost about 98% of its value. so if we continue to do what we're doing, it could go to infinity. it's the best measurement of the value of the currency. there's no advantage to anybody to have a weak currency. the gold tells us that we have a weakening dollar and a weakening currency, but the whole world does, so it's hard to sort out. so it's going to go up a lot more, which is virtually saying the dollar has a long way to go down on purchasing power. that's why the middle class gets wiped out and that is why the standard of living is going. down for the people, they already know it, and that's why there's people very unhappy in this country and they'd like to blame a few people. for all of the problems rather than looking at the philosophy of government, the monetary system, and the spending. because that's where you can find the answers to our problems.”

We do not make price predictions but given the scale of the current global debt crisis it would be naïve to completely discount the possibility of sharp devaluations of the euro, the dollar and the pound and gold surging well above the inflation adjusted high of $2,500/oz in dollar and pound terms and equivalent prices in euros.

It is not too late to diversify and never has it been more important to be prudent.

SILVER

Silver is trading at $34.77/oz, €25.49/oz and £21.78/oz

PLATINUM GROUP METALS

Platinum is trading at $1,645.70/oz, palladium at $660.80/oz and rhodium at $1,525/oz

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.