Stock Market Money Printing Thrill Gone Already?

Stock-Markets / Financial Markets 2011 Dec 01, 2011 - 04:13 PM GMTBy: PhilStockWorld

David Fry summed up yesterday’s action perfectly, saying "Wednesday’s massive rally was prompted by sudden global central bank intervention adding (printing money) liquidity (reducing the lending rate overseas to zero basically) to shore up sovereign debt in the eurozone. They basically set up a swap facility to do the job in the future. Is it a cure or a bailout? No, this is a handout. And it doesn’t solve the problems the eurozone is facing."

David Fry summed up yesterday’s action perfectly, saying "Wednesday’s massive rally was prompted by sudden global central bank intervention adding (printing money) liquidity (reducing the lending rate overseas to zero basically) to shore up sovereign debt in the eurozone. They basically set up a swap facility to do the job in the future. Is it a cure or a bailout? No, this is a handout. And it doesn’t solve the problems the eurozone is facing."

"But, it must be said that the European leaders must have hit a dead end in talks and a potential financial panic must have seemed likely. Mind you, Mr. Bernanke is perfectly comfortable with reflation and money printing. He’s been at it for a long time. It will take years for the Freedom of Information Act to discover how much money and to whom the U.S. has given free money. Americans and others will see price increases in all products and services as a result of a weaker dollar negatively affecting purchasing power. Beyond Moral Hazard issues this is the cost you’ll see and perhaps even wonder why."

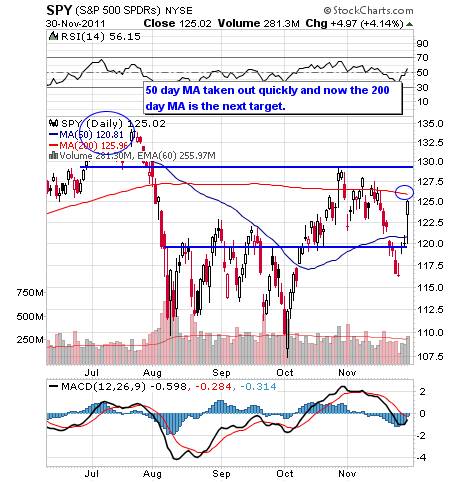

It’s the classic "stick save" that was clearly (to us) telegraphed by the very low-volume blow-off bottom last week and now, in retrospect, it is also clear that the market manipulators and their media hounds were pulling out all the stops to get retail investors to SELLSELLSELL.

As I mentioned yesterday, I’ve been railing against the market manipulation and the media nonsense that had been going on each month and today we learn that Wall Street execs did, in fact, meet privately with top Fed officials in September, according to Fed documents, and they "recommended" Central Banks make a joint effort to address the Eurozone debt crisis. Don’t forget that our Fed works for the Banksters, not vice versa! In addition to knowing well in advance this move was coming, their suggestions included boosting the global economy by buying securities, a move that may yet happen as many investors believe yesterday’s swap announcement was a prelude to additional coordinated action.

You see, it’s not enough for Lloyd Blanfein (allegedly and for example, of course, a fine man like Lloyd would never do this) to know that the Fed is going to make a massive move like yesterday – there’s much more money to be made if he (allegedly) calls a Goldman alumni like Jim Cramer (another fine man who would never do something so sleazy – other than the sleazeball stuff he already proudly admits to, of course) and has him talk down the markets to chase the Retailers out and give him cheap entries on all the stocks he KNOWS are only down because his trained media jackals are pushing it down.

Of course, it’s not JUST Lloyd (allegedly) – it takes a village full of shysters to screw over the American investing publish and, fortunately, we have an entire section of New York City filled with just such people! They don’t HAVE to make is a conspiracy – all the "Wall Street Executives" who met with the Fed KNEW that action was coming and it was in ALL of their interest to lower the price of stocks before it happened. All they have to do is spin their analyst’s outlook more negative and drop a rumor here and a rumor there….

I guess if they REALLY wanted to terrify investors they could call on an ex-Goldman CEO to crash a fund in a scandalous manner to chase investors completely out of the Financials again – even though our entire Government has made it EXTREMELY clear that the big banks are, in fact, too big to fail. So, just like we did in 2009, we loaded up on XLF and FAS as stupid low levels.

I guess if they REALLY wanted to terrify investors they could call on an ex-Goldman CEO to crash a fund in a scandalous manner to chase investors completely out of the Financials again – even though our entire Government has made it EXTREMELY clear that the big banks are, in fact, too big to fail. So, just like we did in 2009, we loaded up on XLF and FAS as stupid low levels.

The news was so scary that even we were scared to buy individual bank stocks (I missed that Fed meeting so we couldn’t be sure they’d take action) – but, as noted yesterday, we were able to make 66% on a 3-day FAS trade and, of course, Monday’s Dec $48/55 bull call spread with the $40 puts sold short for net .60 is already in the money for a $3,200 gain in our WCP (1,066% in 3 weeks) along with the other 4 trade ideas from that morning (long FXE, JPM, AA and VLO).

We should have been brave and bought JEF but, as we saw in 2008, these bastards can wreck perfectly good institutions if they want to so we stuck with our ETFs and, of course, JPM – who are slightly less evil than GS and my favorite bank to buy whenever they trade down and last week we hit the bottom of a range that hasn’t been broken to the downside since 2008. If you are not going to buy good stocks when they are cheap – when are you going to buy them?

You should always have about a dozen stocks you know very well – that you KNOW the value of, that you understand the business of (so you are not fooled by rumors or swayed by idiot analyst opinions or retail panics) and that you follow every day until you get the feel for the top and the bottom of the range. I would stick to a couple of sectors you know very well to start – ones that you A) understand and B) ENJOY reading about because you need to do A LOT of reading to really follow stocks. If you do this simple thing, you will become a better trader – rather than chasing after whatever random thing someone on TV (or in a Newsletter!) tells you to buy.

Now, this is NOT a BUYBUYBUY call. If you weren’t in at the bottom, you may have missed the whole move already. The point I want to make is that you have to learn to play these ranges because buying stocks on sale, like we did with the 5 on Monday as well as dozens last week – is MUCH BETTER than chasing things after you miss these huge pre-market moves. In fact, we pretty much sat on our hands yesterday – too late to chase long – too early to get short.

Now, this is NOT a BUYBUYBUY call. If you weren’t in at the bottom, you may have missed the whole move already. The point I want to make is that you have to learn to play these ranges because buying stocks on sale, like we did with the 5 on Monday as well as dozens last week – is MUCH BETTER than chasing things after you miss these huge pre-market moves. In fact, we pretty much sat on our hands yesterday – too late to chase long – too early to get short.

We did add a LONG-TERM trade idea on BRK.B, because we’re worried that one will get away, but it’s still hedged VERY conservatively for a possible 33% drop – not exactly uber-bullish but we feel good about the S&P holding 800 (Dow 8,000) at this point so I don’t think it’s too much of a stretch.

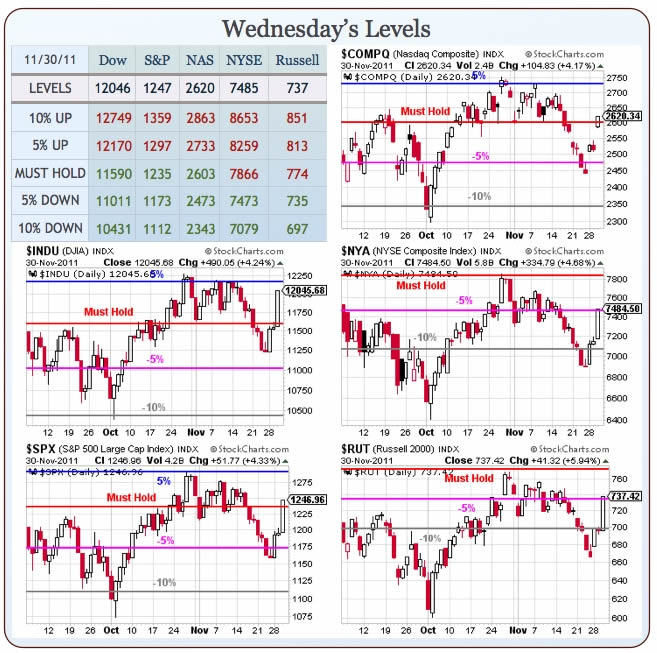

HOPEfully, we’re just taking the pause that refreshes as ALL 5 of our indexes test the levels we expected them to test on a chart we’ve been using since the Great Crash. This is what I mean by trading a range, folks – it’s not that complicated – we buy when we hit on of those low lines AND we have data that suggests we’re oversold (we don’t mindlessly follow TA, of course) and we sell when we hit the the top of our range AND we have data that suggests we are overbought.

Last week was a classic, with the McClennan Oscillator flashing a huge oversold signal after both the RUT and the NYSE overshot the bottom of our range (-10% lines). Seeing the NYSE and the RUT stop dead at our -5% lines is a GREAT thing for the 5% Rule, as it means our charts are still right on the money and the S&P tagged along 1,235 for most of yesterday before finishing strongly above it so there’s nothing to be bearish about until/unless we now blow 2 of our 3 Must Hold lines on the majors.

Of course we’re going to have a bit of consolidation at our lines and that’s good and healthy. I will be more inclined to remain bullish if we do take a few days to consolidate before racing back over +5% on the Dow (12,170). As you can see from David’s NYMO chart on the right, we’re no long clearly oversold – we’re back to dead neutral on the oscillator and the faster we move up, the more overbought we will become (see, not complicated) – it’s slow and steady that wins the race in building a better market value.

We lost the usual 400,000 jobs last week and Chain Store Sales Reports are coming in mixed for November, not as bullish as Black Friday reports would have us believe. So far, I see misses by CATO, FRED, JCP, GPS, KSS, TGT and SMRT and that’s being generous as we’re calling WTSLA, for example, a beat because sales are down 3.1% and not the down 6.8% expected. KSS is a huge miss, down 6.2% vs up 2% expected. We’ll keep an eye on RTH today and see if they can hold $110 but, if not, I’d be a bit more cautious.

We get ISM and Construction Spending at 10 today and a peak at the Fed Balance Sheet this afternoon but it’s all about tomorrow’s Non-Farm Payroll report now and the ADP report (+200,000) has everyone expecting a big number – anything under 150,000 is going to be a disappointment now. Oil was already disappointing yesterday with a huge build in inventory and barely a pop over $100, despite Basic Materials going up 6.6% on the day. So, of course we’re still shorting the futures (/CL) below the $100 line, with tight stops – and we’re also going to make oil our primary hedge against a failure at our levels.

SCO Jan $34/40 bull call spread is $2.80 and is currently $4.24 in the money so that, by itself is a nice bet on oil staying below $100 through Jan expirations in 50 days. If we assume oil doesn’t go up 10% to $110, then we can sell the 20% lower (as SCO is an ultra) $32 puts for $1.45 as an offset and that makes the $6 spread net $1.35 with a 337% upside potential if SCO is at $40 or higher at Jan expiration day. That’s a hedge I like, even if the markets are moving higher.

- Phil

Click here for a free trial to Stock World Weekly.

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2011 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.