Brazil, India, China and Eurozone Economic Headwinds to Heed in 2012

Economics / Global Economy Dec 07, 2011 - 02:34 AM GMTBy: Asha_Bangalore

There has been a string of positive news about the U.S. economy in the past few days – auto sales rose, jobless rate fell, the ISM manufacturing survey points to an increase in new orders and production, private sector construction outlays advanced. But, news from abroad is disappointing and could translate into more than a temporary dip in exports. The important question is if the tailwinds can offset the headwinds blowing through the United States.

There has been a string of positive news about the U.S. economy in the past few days – auto sales rose, jobless rate fell, the ISM manufacturing survey points to an increase in new orders and production, private sector construction outlays advanced. But, news from abroad is disappointing and could translate into more than a temporary dip in exports. The important question is if the tailwinds can offset the headwinds blowing through the United States.

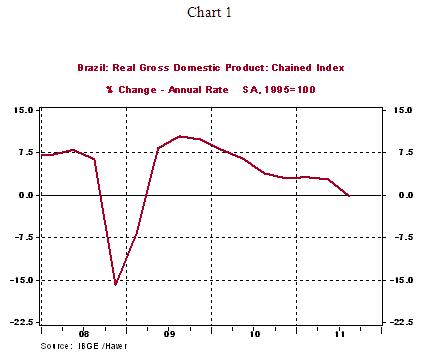

Real GDP of Brazil contracted in third quarter (-0.2%, see Chart 1), a stunning drop which is bothersome on several fronts. The Purchasing Managers’ Index stood at 48.7 in November denoting a contraction in factory activity.

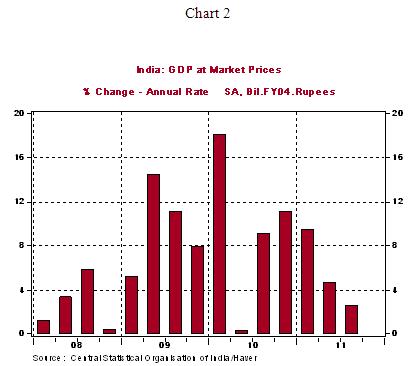

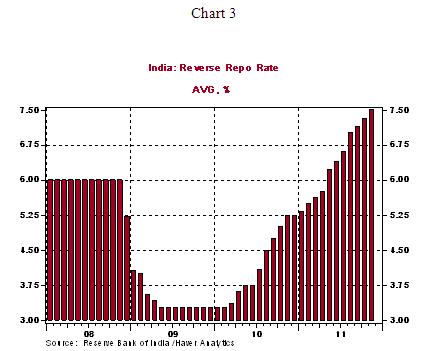

On the Asian front, India’s real GDP growth slowed in the third quarter to a paltry 2.5% after recording 10% growth in 2010 (see Chart 2). The specter of inflation has led the central bank to raise the policy rate rapidly in 2010 and 2011 (see Chart 3), which bodes poorly for economic growth in the near term. The Purchasing Managers’ Index of November dipped to 51.0 in November from 52.0 in the prior month.

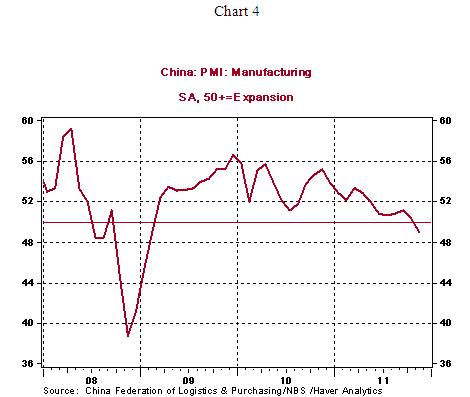

The Purchasing Managers’ Index of China fell to 49.0 in November, the first below 50.0 reading since February 2009 (see Chart 4), suggesting weakening factory conditions. China’s policy makers have stepped in and eased reserve requirements in response to signs of business deceleration.

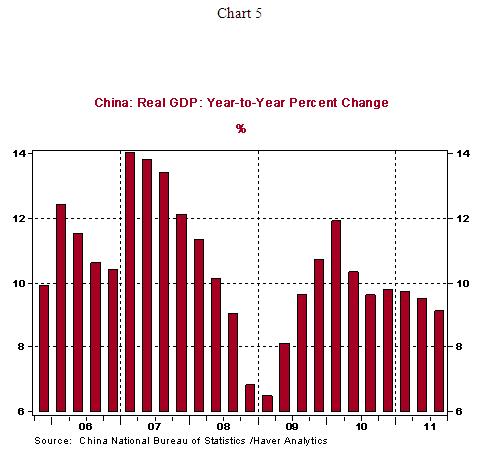

China’s GDP growth is holding slightly above 9.0 in the third quarter, but the pace of growth is showing a small slowing trend since the early part of 2010 (see Chart 5).

Pulling these strands of information about Brazil, India, China together, the key message is that as their respective economies experience a slowing of business conditions, it should translate into a smaller gain in US exports to these countries in the months ahead. Exports of the U.S to Brazil, India, and China averaged 11% during 2009-10 (see Chart 6).

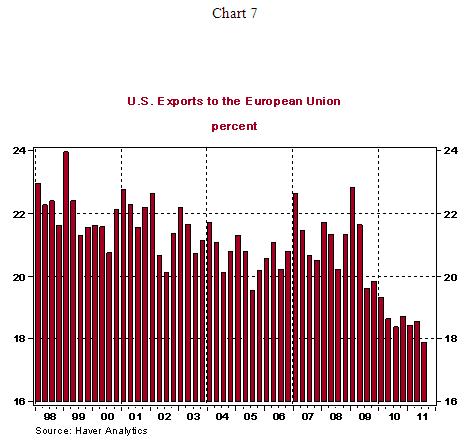

At the same time, the eurozone is nearly certain to experience a recession, given the current status of the sovereign debt crisis. Exports to the European Union (EU) account for roughly 20% of exports of the U.S; this share already shows a decline (Chart 7), with a further drop in 2012. In sum, the global economy will ring in the new year with strains of all sorts across most of the emerging and advanced nations. The BIC bloc (Brazil, India, and China) may not be the strong engines of growth and a decoupling of the emerging markets from the advanced nations looks unrealistic in 2012.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.