Strong Silver Price in 2012 as Strengthening Investment and Industrial Demand

Commodities / Gold and Silver 2012 Mar 09, 2012 - 09:32 AM GMTBy: GoldCore

Gold’s London AM fix this morning was USD 1,699.50, EUR 1,285.36, and GBP 1,078.30 per ounce.

Gold’s London AM fix this morning was USD 1,699.50, EUR 1,285.36, and GBP 1,078.30 per ounce.

Yesterday's AM fix was USD 1,701.50, EUR 1,287.26 and GBP 1,076.70 per ounce.

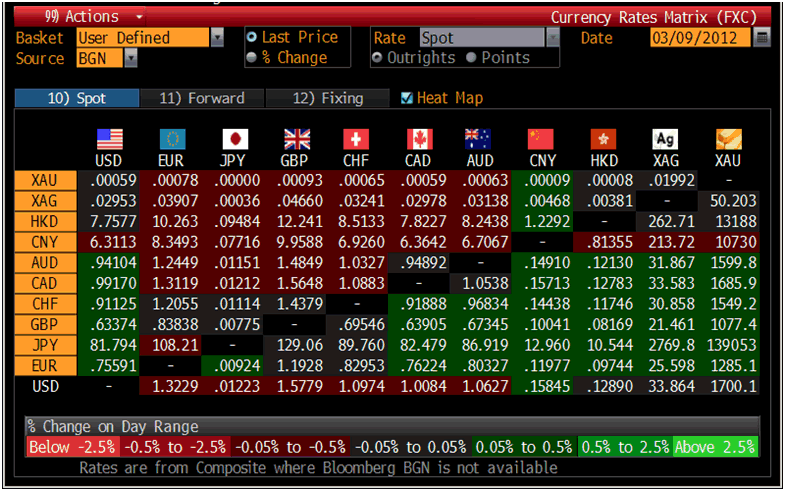

Cross Currency Table – (Bloomberg)

Gold climbed 0.4% or $15 in New York yesterday and closed at $1,700.40/oz. Gold rose slightly in Asia touching $1,707/oz prior to price falls in trading in Europe which has gold now trading at $1,700.80/oz.

Gold appears to be consolidating above the 200 day moving average - now at $1,679/oz and a weekly close above the 200 day moving average and above $1,700/oz will embolden buyers again.

Gold analysts are the most bullish in four months after investors accumulated more gold than ever and hedge funds raised bets on gains to a five-month high (see news below).

Sixteen of 23 analysts surveyed by Bloomberg expect prices to gain next week and one was neutral, the highest proportion since Nov. 11. Investors increased their holdings in gold ETFs for seven consecutive weeks and now hold 2,407 metric tons valued at $131 billion.

China’s factory output, retail sales and investment data all slowed in February while its inflation rate dropped to a twenty month low. This increases the risk that China’s policy makers will further loosen their money supply and further debase the yuan.

Poor economic data was also seen in the US and Japan. In the US, a new all time record monthly budget deficit was recorded - $229 billion in February, the highest monthly figure ever.

Japan logged a record monthly current account deficit and a record trade deficit in January. Japan's trade deficit widened in January to 1.382 trillion yen ($17.0 billion), up 245.9% compared to the year-ago.

This strongly suggests that the “global recovery” is on very shaky grounds and a serious recession remains a real risk.

In spite of a relief rally in equity and bond markets, markets show investors continue to attach a high chance of Greece not being able to meet its debt commitments in the future. The new bonds that will be issued by Athens on Monday are already trading in the grey market at just 20% of their face value.

Although Greek’s bond swap offer to private creditors warded off a default, most investors feel the Greek financial tragedy is nowhere near its end.

This deal is yet another short term panacea and just another band aid on a bullet wound that may bleed out over Europe in financial contagion.

"That's still showing that the market doesn't have faith that Greece is able to pay its debts, even if you defer it for 20 or 30 years," one trader told Reuter’s Fixed Income reporters.

Physical demand in Asia was strong below $1,700/oz this week - showing strong support for gold at these levels.

Reuter’s reporters in Asia say that buying petered out when gold reclaimed the $1,700/oz level overnight.

In recent days and weeks, Thailand and Indonesia have been good sources of demand while premiums for physical delivery loco Hong Kong and Singapore have edged up.

Hong Kong premiums are around $1.00-1.50/oz from $0.70-1.00 earlier in the week, while Singapore premiums are up to $1.00/oz, from around $0.70.

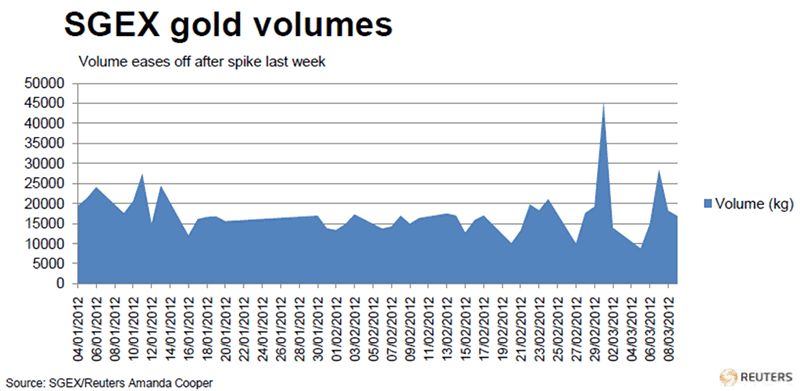

Volumes on the Shanghai Gold Exchange remain robust (see chart).

The People's Bank of China is likely to be again buying this dip and emerging market central banks will continue to diversify out of dollars and euros and into gold.

As pointed out yesterday, Asia is buying today, while much of the west is selling. Buyers were hesitant in recent weeks and this hesitancy was exacerbated by last Wednesday’s volatile sell off.

Despite urging clients to buy on this latest correction, we have a record amount of funds in client accounts but many have instructed us to wait further instructions and are delaying their purchase until there is a more definitive price trend.

We have seen both a decline in purchases in recent weeks but also an increase in selling. Indeed, we have seen a degree of selling of bullion in the last 2 weeks which we have not experienced in recent years.

We may need an 'event', financial or geopolitical, or prices over $1,800 and rising prior to buyers become emboldened again.

“Strong Silver Price” in 2012 As “Strengthening” Investment and Industrial Demand

Silver prices have been boosted by investment and industrial demand this year, the Silver Institute have reported. They say that this is contributing to a “strong silver price over the course of this year”.

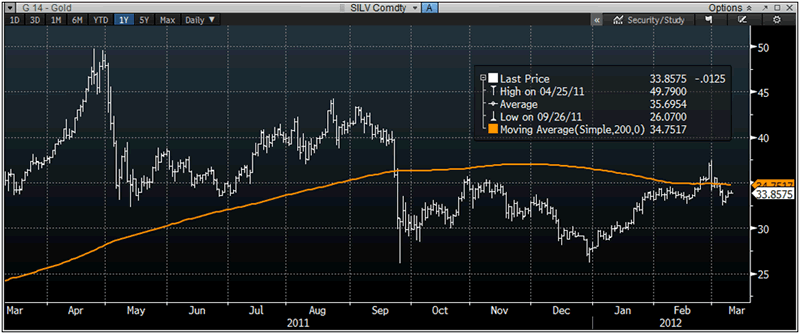

Sturdy investment demand has pushed the silver price up 20% in the first ten weeks of 2012, outperforming platinum, palladium and gold during the period.

Silver 1 Year – (Bloomberg)

Investors are increasingly acquiring silver in many forms. Globally, silver-based exchange-traded-funds (ETFs) account for 586 million ounces (Moz) of silver, up from 576 Moz at the end of 2011. Demand for physical silver bars is also strong.

The Silver Institute say that precious metals dealers are seeing brisk silver bar sales continue.

Moreover, investor demand on the Commodity Mercantile Exchange (a division of the CME Group) has been strong this year.

As of February 28, net long silver positions, which are the difference between total long positions and total short positions, had increased by more than two-fold from end-2011. If investors are net long they are bullish on prices and expect further price strength. Total net long positions on February 28 were at their highest level since September 13, 2011.

Also contributing to a strong silver price over the course of this year will be strengthening global silver industrial demand after a record 2011.

According to The Future of Silver Industrial Demand, a report commissioned by the Silver Institute and released last March, silver industrial demand is forecast to grow by 36% to 666 Moz from 2010 through 2015.

Silver industrial demand remains positive primarily because of the lack of substitution and the very wide range of established and ever growing new uses of silver that are critical to industry.

Silver remains very undervalued from a historical perspective and the nominal high near $50/oz from 1980 and again in April 2011 remains a viable price target in 2012. Longer term, the inflation adjusted high of $150/oz remains viable.

Silver deserves an allocation in a portfolio or as a way of diversifying savings and should be owned in order to protect from systemic, macroeconomic, geopolitical and the monetary risk of currency devaluation.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.